When it comes time to start spending your retirement savings, most investors are looking for steady income. Remember, you’re not just investing for retirement but through it.

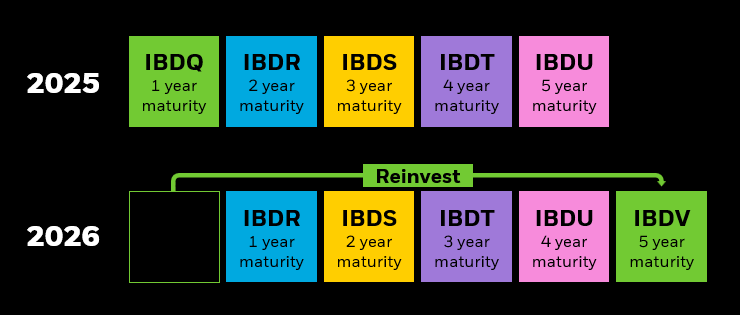

IShares iBonds ETFs are term maturity ETFs that hold a diversified portfolio of bonds with similar maturity dates. iBonds are designed to mature like a bond, trade like a stock and diversify your portfolio like a fund. They can provide a simple solution for those looking to put their spending needs on autopilot.

You can build a bond ladder with the amount of money that you need for the following calendar year. For example, if you need $50,000 in retirement each year and have saved $1.25 million, you can invest about $500,000 ($50,000 each year for 10 years) in a series of iBonds ETFs that will mature in 2025 to 2035 to help meet your spending needs. The rest of your savings can then remain invested for potential long-term growth. Offered in U.S. Treasuries, U.S. TIPS, municipals, investment grade and high yield corporates, iBonds ETFs can help address spending needs.