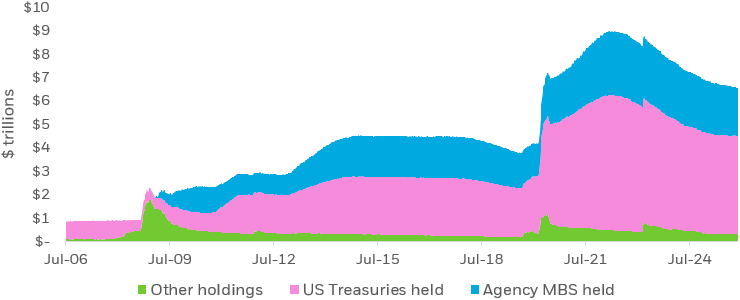

Since the Global Financial Crisis, the Fed has increased its use of its balance sheet — the ability to hold U.S. Treasury, agency debt and mortgage-backed securities (MBS) — as a means of governing the supply and demand for longer-term interest rates, which generally fall outside the scope of its fed funds rate.

By buying bonds, the Fed aims to lower long-term interest rates, making borrowing cheaper and stimulating economic activity. Conversely, reducing its holdings through bonds sales or letting bonds mature can exert upward pressure on interest rates, tightening monetary conditions.

The Fed’s balance sheet was increased through bond purchases during the COVID-19 pandemic.

- In May 2022, the FOMC announced that it would begin reducing the size of the balance sheet.

- In May 2024, the committee announced that it was slowing the pace of the reduction from $60 billion to $25 billion for U.S. Treasuries while maintaining the MBS reduction at $35 billion per month. The Fed is accomplishing this by letting bonds mature and not selling them into the market. From May 2022 to December 2025, the Fed’s balance sheet declined by $2.4 trillion, from $8.9 trillion to $6.5 trillion.

- Beginning in December 2025, the Fed will reinvest maturing U.S. Treasury principal payments into Treasuries and maturing agency MBS into Treasury bills.

At the December 2025 meeting, the Fed approved new purchases of Treasury bills and coupon bonds out to three years at the pace of up to $40 billion per month for reserve management, not quantitative easing. This pace will serve to increase the balance sheet and provide the central bank with an ample supply of reserves. This operation is expected to be used until April 2026.