Hi, I am Kristy Akullian and I am excited to introduce our 2026 Year Ahead Investment Guide.

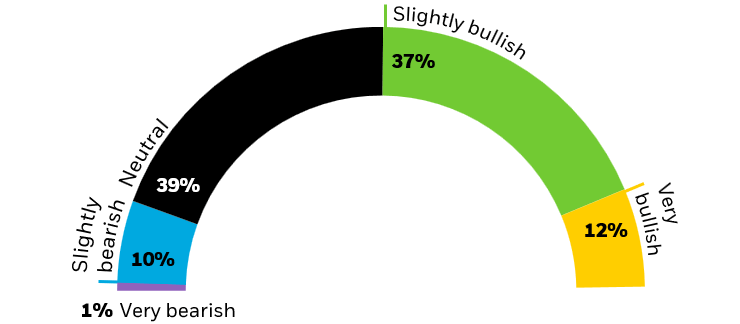

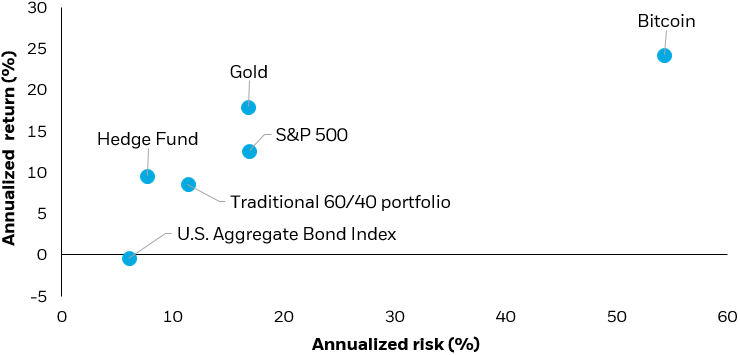

The new year brings a market characterized by above-trend growth, easing policy, and accelerating productivity. We believe this backdrop favors risk taking, but weakness in the labor market, rich valuations, and an uncertain forward path for interest rates remain risks, arguing for greater selectivity.

Let’s dive in...

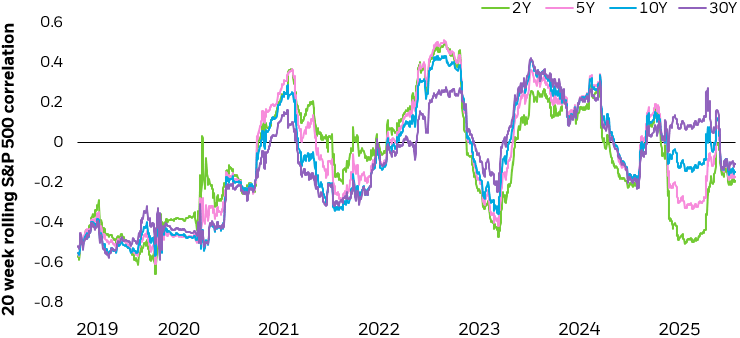

Bonds reemerged in their traditional role as “ballast” in portfolios in 2025, though the relationship between stocks and bonds remains less stable than in prior decades. We believe the intermediate portion of the yield curve, or the “belly”, provides an appealing mix of ballast and income. We also see emerging market bonds presenting a compelling source of income, supported by a weaker U.S. dollar, easier global financial conditions, and improving sovereign balance sheets.

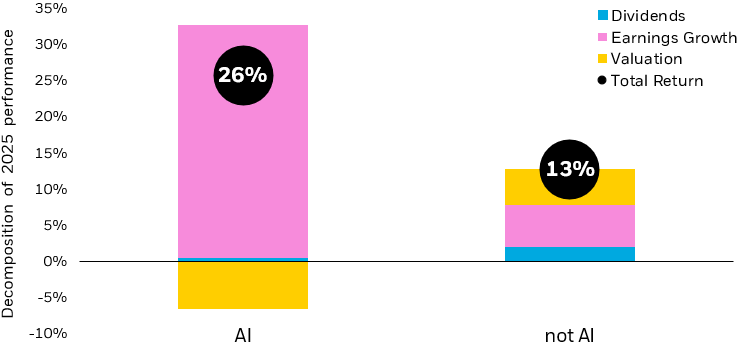

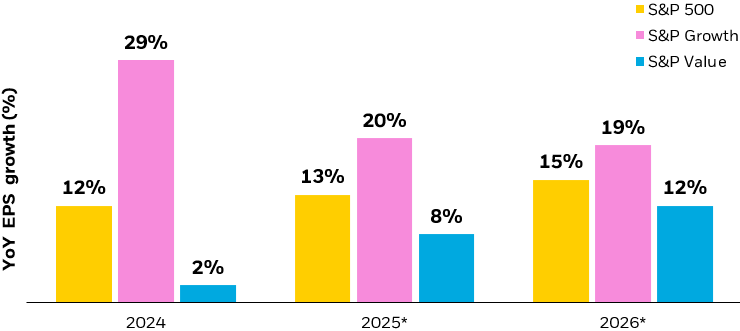

Across asset classes, AI remains the dominant theme for investors, as it catalyzes a capital-intensive expansion, boosting productivity and sustaining earnings strength. In U.S. equities, we also see fundamentals improving in non-AI portions of the market as earnings growth across the S&P 500 strengthened meaningfully in 2025.

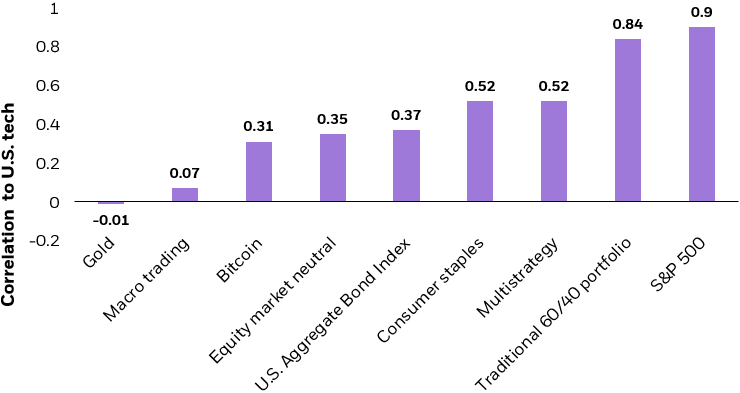

Still, the prevalence of the AI theme within investor portfolios, whether they’ve intentionally allocated to it or not, introduces risks of higher concentration and correlations. We see a variety of ways to seek diversification:

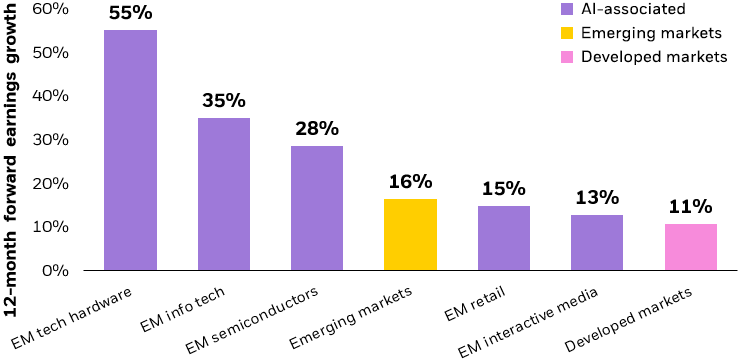

International equities, specifically emerging markets in Asia, can help investors diversify within the AI theme, while those wanting to diversify outside of the AI trade may also consider developed market strategies, which tend to have a tilt towards value and lower earnings volatility, or pay out dividends.

Additionally, to address concentration risk and reduced hedged reliability of traditional assets, consider what we call a “diversified diversifier” using alternative strategies and asset classes that have a low correlation to stocks.

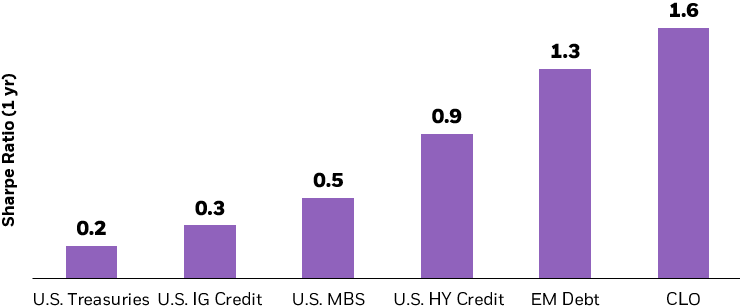

Finally, while easing policy rates should prove a boon to risk assets broadly, this can present challenges for income-oriented investors. We believe investors should take a whole portfolio approach to income, with a range of solutions from bonds to options income or dividend strategies.

For a deeper dive into our outlook and relevant product ideas, head over to iShares.com or BlackRock’s Advisor Center to read the full Year Ahead Investment Directions.

Disclosures:

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular. The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective. This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

Prepared by BlackRock Investments, LLC, member FINRA.

© 2025 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1225U/S-5081891