Target_Date_Fund

Life has many twists and turns and picking the right investments to get you through decades of life changes and onto retirement can seem intimidating. Fortunately, iShares LifePath Target Date ETFs make it easy, by automatically adjusting your investments on your journey to retirement.

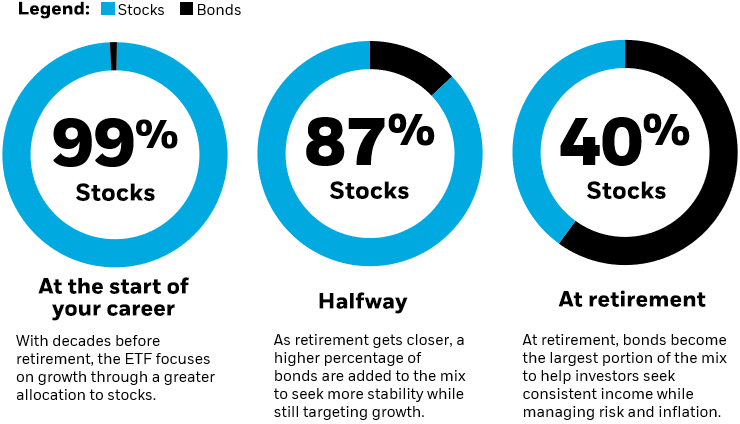

Let's say you want to retire in 2058 when you turn 65. To select the ETF closest to your 'target date' - the year you plan to retire - you might consider the iShares LifePath Target Date 2060 ETF. For each Target Date ETF, the BlackRock LifePath team of experienced investment professionals selects and manages a mix of globally diversified stocks, bonds, and other investments based on each fund's particular time horizon and adjusts over time to help investors stay on the path to their target retirement date.

When the target retirement date approaches, the ETF is designed to merge into the iShares LifePath Retirement ETF. This ETF is specifically designed for investors in retirement and seeks to help investors maintain consistent income. So, you can spend less time focusing on your investments and more time focusing on what's next.

iShares LifePath Target Date ETFs make it easy to start planning for retirement today. Learn more at iShares.com/TDF. Visit www.ishares.com to view a prospectus, which includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. Investing involves risk, including possible loss of principal.

Disclosures:

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Each target date fund has a number (a target date) at the end of the name that designates an approximate year when an investor plans to start withdrawing their money. The asset allocation of the fund will become progressively more conservative as the specified target date approaches. An investment in the fund is not guaranteed, and an investor may experience losses, including near, at, or after the target date. Investment in a fund of funds is subject to the risks and expenses of the underlying funds.

Diversification and asset allocation may not protect against market risk or loss of principal.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

Prepared by BlackRock Investments, LLC, member FINRA.

© 2025 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK, LIFEPATH and iSHARES are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1225U/S-4915919