Want to kick it up a notch or two? The concept of compounding applies to investing too.

Investing involves buying assets that you believe will become more valuable in the future. Your money can grow not just from interest earned on bonds, but from reinvested dividends and capital gains, and appreciation of the investments themselves. (Learn about how to get started investing.)

But investing is not without risk- there’s always the chance you could lose some or all the money you started with. By contrast, there’s very low risk of losing your principal with traditional savings accounts, which have FDIC insurance, a government program that protects up to $250,000 per person for each account at an FDIC-insured bank.

While there’s no way to know for sure what your investments will earn because the markets are not predictable and past performance doesn’t guarantee future results, that $1,000 could have become more than $1,600 if you had invested it.

Just for illustrative purposes, if you had invested $1,000 in an S&P 500 index fund 10 years ago, your money could have grown to nearly $4,000 today, depending on exactly when you invested and what fund you invested in.1

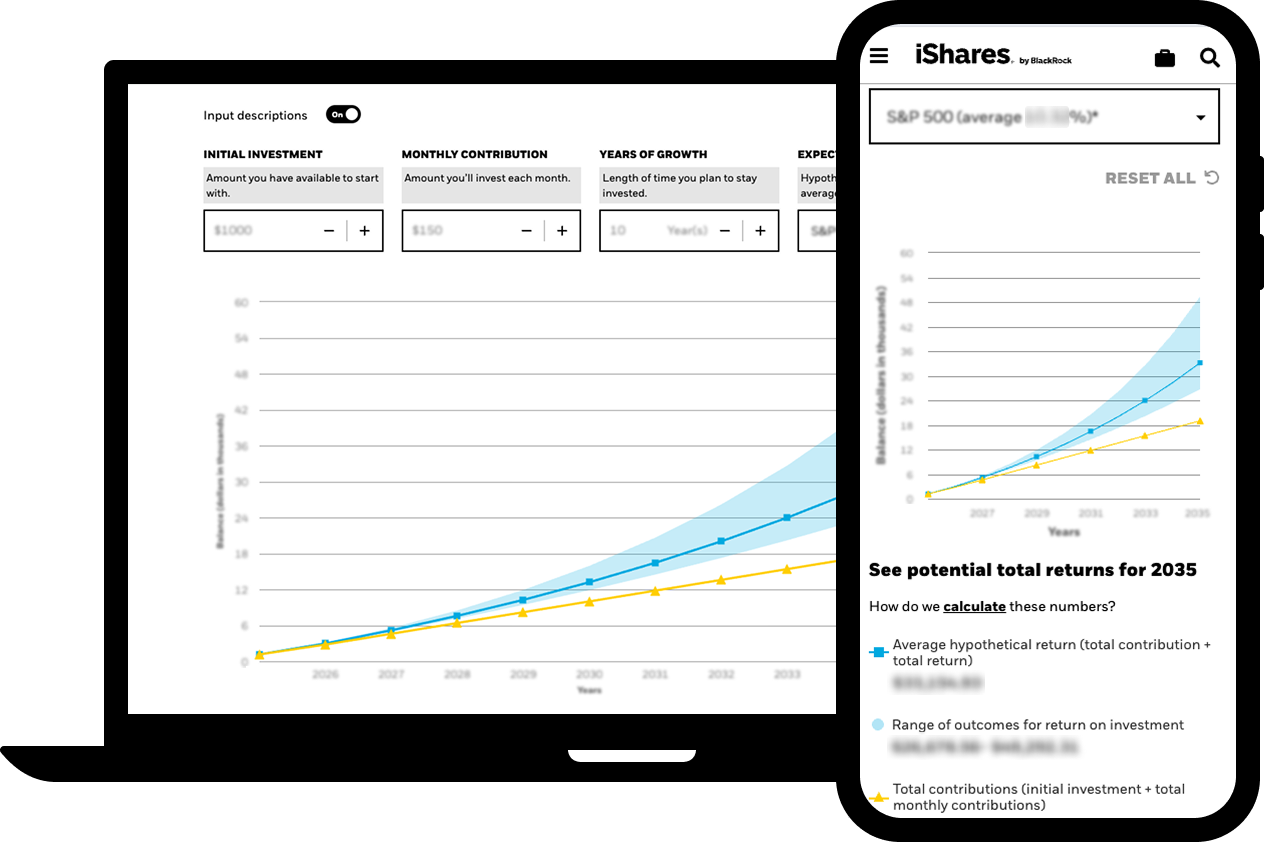

Explore how investing can help your money grow

The potential for higher returns is one of the main advantages of investing. The iShares Investment Growth Calculator demonstrates what you could potentially earn from recurring investing in just a few steps.

The calculator allows you to visualize how your money could grow in different scenarios.

You can play around with the contribution amount and years you plan to stay invested until you find the combination that works best for you and your financial goals.