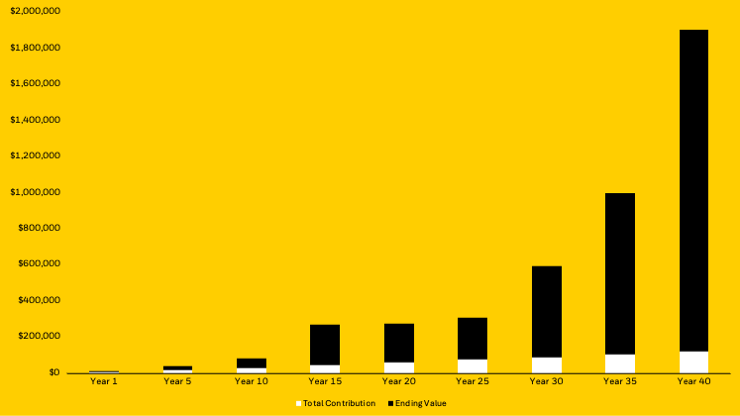

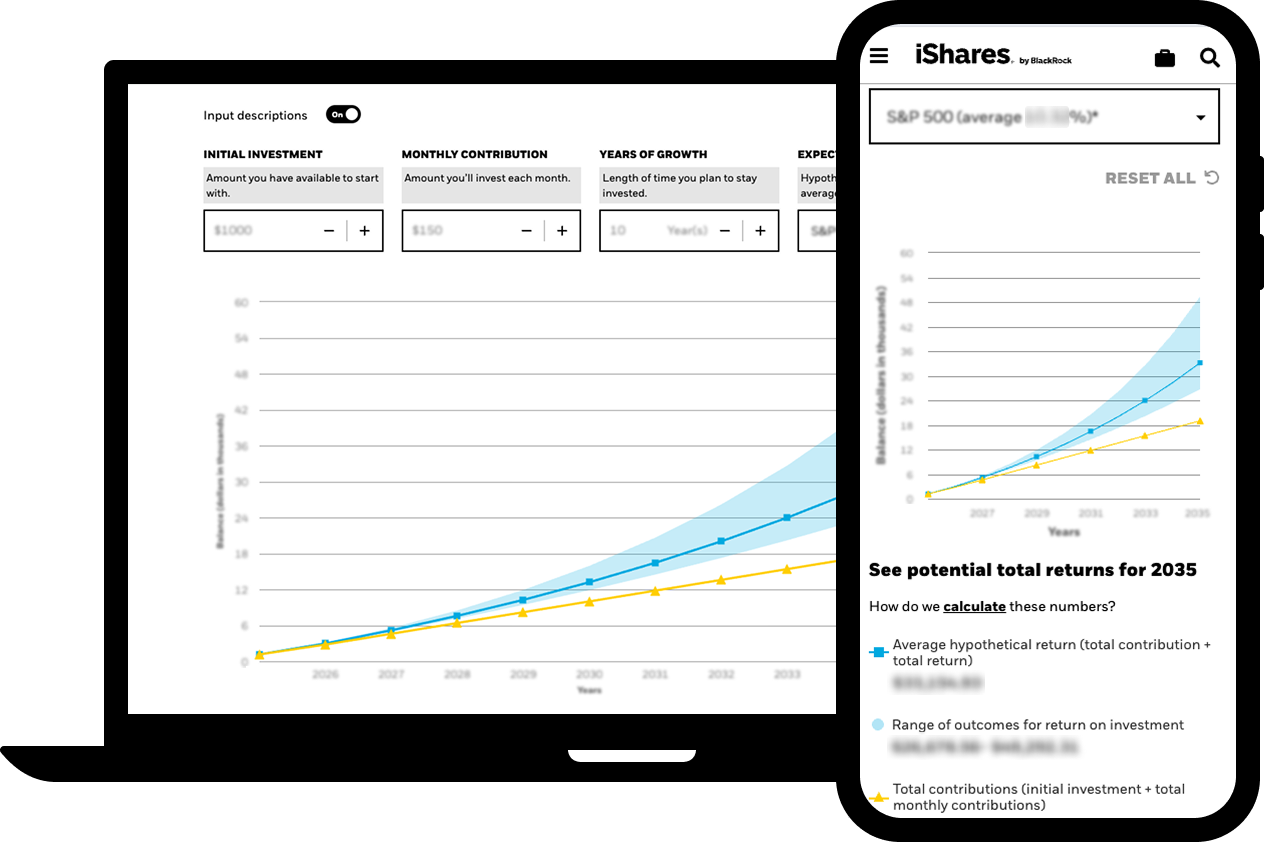

The Potential Benefits of Automated Investing: If you are looking at this chart and thinking "that's awesome — but investing each month sounds daunting and time consuming," I have good news: automated investing may make it easier to stay invested, stay disciplined, and work toward your goals. Automated investing can help remove the guesswork and emotions that can get in the way of good decision making, and may alleviate concern that you need to constantly watch the markets.

Automation can also make investing more accessible. Many platforms have low minimums, and simple setup processes so you can establish recurring investments into various assets, including ETFs, and you can start with as little as $1 when you buy fractional shares.

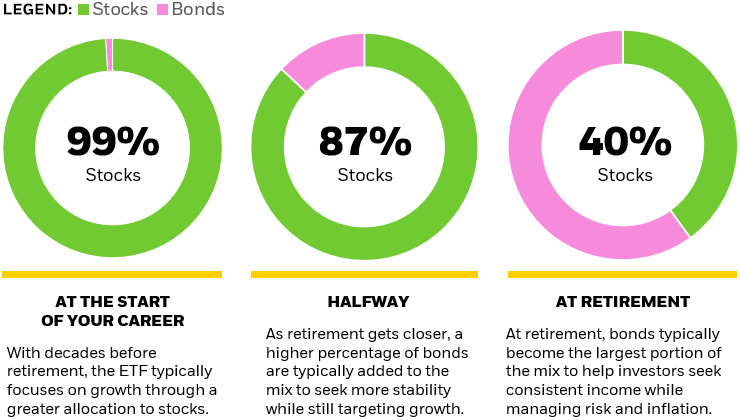

With automated investing, you can spread investments across a mix of asset classes — such as stocks, bonds, and cash — based on your risk tolerance and time horizon. Diversification may not protect your portfolio against market risk or loss of principal, but it can help investors navigate fast-changing markets and stay the course to pursue their financial goals. (Learn more about the benefits of diversification.)

Consider diversifying beyond stocks: Investing across a variety of stocks is a good start, but it may not be enough.

Over the past five years, the U.S. stock market doubled, yet 36% of individual stocks lost money.2 In contrast, less-than 1% of ETFs focused on U.S. stocks posted losses during the same period3 — highlighting the risks of picking individual stocks, even in a rising market. Diversifying can help capture more of the market’s return while reducing the risk of betting on the wrong stocks. ETFs offer a straightforward way to help diversify your portfolio — making it convenient to balance risk and reward.