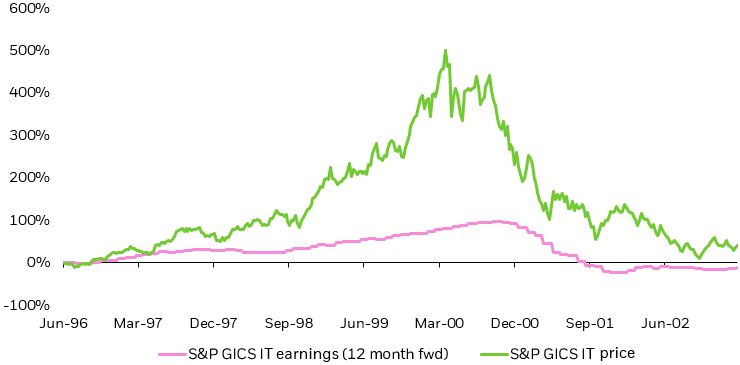

Recent reports of deals where a supplier helps finance a customer who then spends money back with that supplier (either directly or via a partner) have raised concerns about the dot.com-era practice known as circular financing. Circular financing can be risky when it hides weak end‑demand. During the dot-com boom, equipment vendors boosted sales to mask a demand gap that later imploded.6

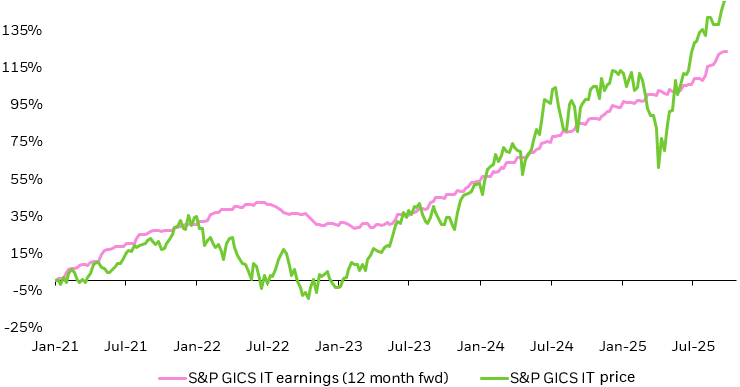

In our opinion, though, that’s not the case today. AI usage is already large and growing very quickly. OpenAI’s revenue is running around $13 billion a year7, and Anthropic is targeting $9B in 2025 run‑rate with a plan to more than double again in 2026.8

Notably, industries with big, long‑lived assets have tended to blend sales and financing. Boeing, for example, has long provided asset‑backed financing so airlines can take delivery of new planes. Energy and heavy‑equipment vendors typically arrange leases or loans so customers can afford multi‑year projects, with the asset and future revenue as collateral.9

The same logic has been showing up in AI: an AI lab needs compute for years, a cloud provider needs to lock in supply, and a chip vendor wants reliable end‑demand. In our view, it’s a classic way to line up customers, financing, and capacity.

AI datacenter capacity is constrained, driving multi-year, prepaid commitments to lock in scarce AI chip and datacenter supply. The demand curve has no clear cap: every leap in capability has been creating appetite for more compute.10