Growth stocks have significantly outperformed value stocks over the past 20 years.1 Investors concerned that the trend may have gone too far, but do not want to completely abandon growth investing may want to consider a hybrid approach, known as GARP, or Growth at a Reasonable Price. GARP seeks to help investors maintain growth exposure — especially in exciting areas like AI — while aiming to not overpay for growth (hence the acronym) by considering valuation levels.

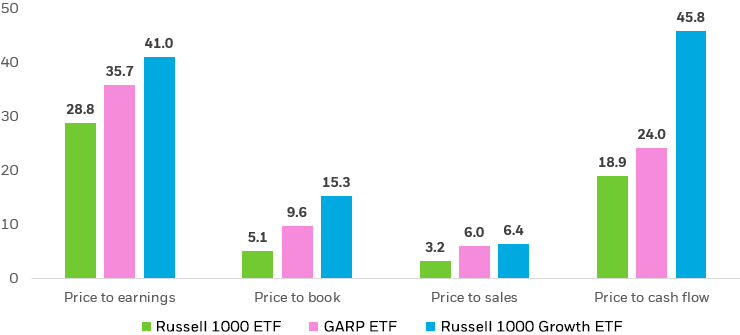

GARP is a hybrid stock-picking style combining growth and value investing. The goal is to find companies with strong earnings growth prospects that aren’t trading at excessive valuations. GARP screens first for growth stocks, then tilts the portfolio toward those with attractive value and quality characteristics.

The iShares MSCI USA Quality GARP ETF (GARP), which rose approximately 37% in 2024 and has gained over 22% year to date through October 31, 20252, seeks to help investors maintain growth exposure — while supporting thoughtful security selection that considers valuation and concentration risk.

Growth vs. Value: Outperformance and Stretched Valuations

Over the past 20 years, growth stocks have dramatically outperformed value stocks, with a cumulative performance differential of more than 730%.