Why use automation for investing?

Making investment decisions can be difficult since there’s so much to consider. In fact, that’s one reason why some people never start investing. But automating your contributions eliminates the stress of constant decision-making, turns investing into a habit, and helps set you up for the future.

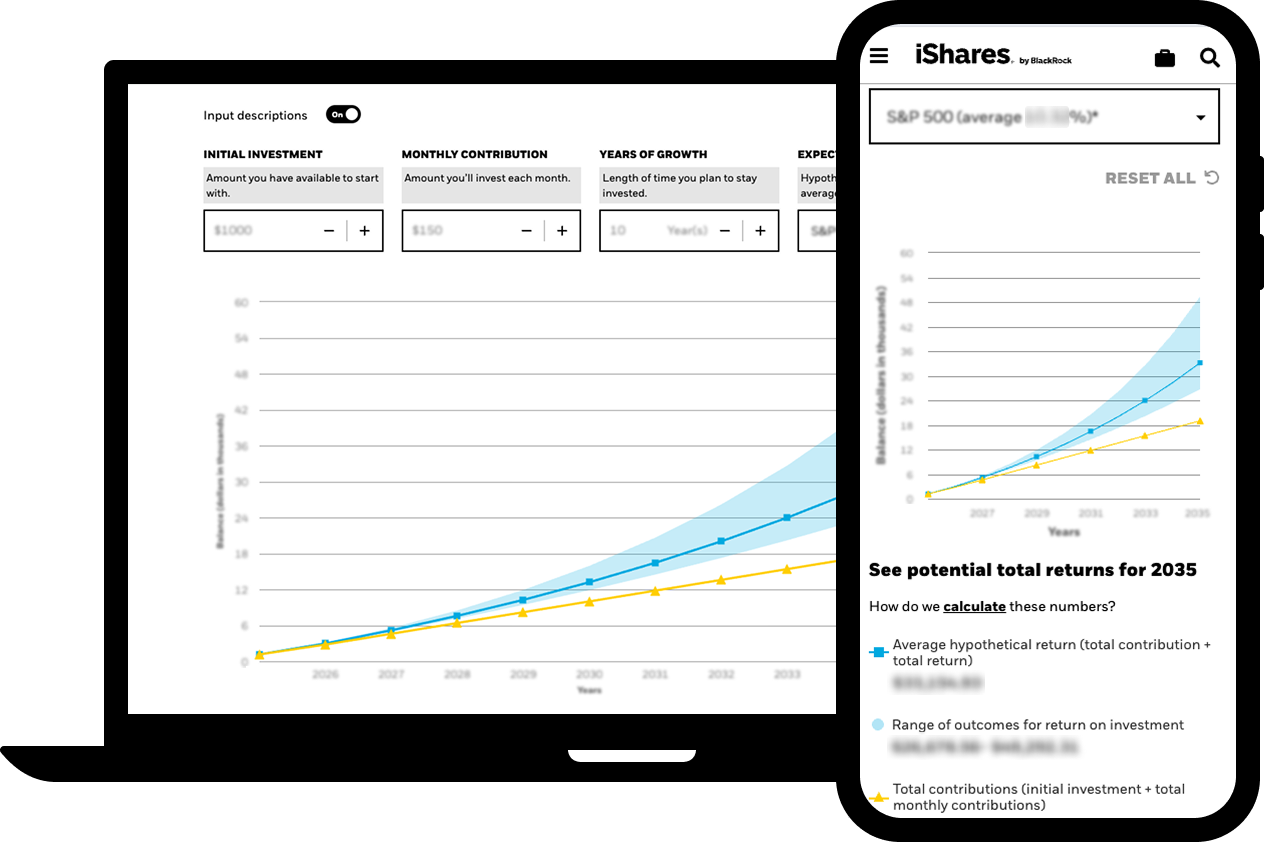

Grow exponentially

Regular contributions allow your returns to compound, helping to build your wealth slowly and steadily over time.

Stay disciplined

Recurring investments can help remove the impulse to time the markets or react to market swings, helping you stay invested.

Stay on track

Automating your investments is simple and convenient, helping you stay on track towards pursuing your investment goals.

Set your goals on autopilot

A recurring investment plan allows you to buy fractional shares (or slices) of an investment, including ETFs, on a regular basis, starting from just $1 per month. It’s that simple.