What were 2025’s ETF & ETP market trends?

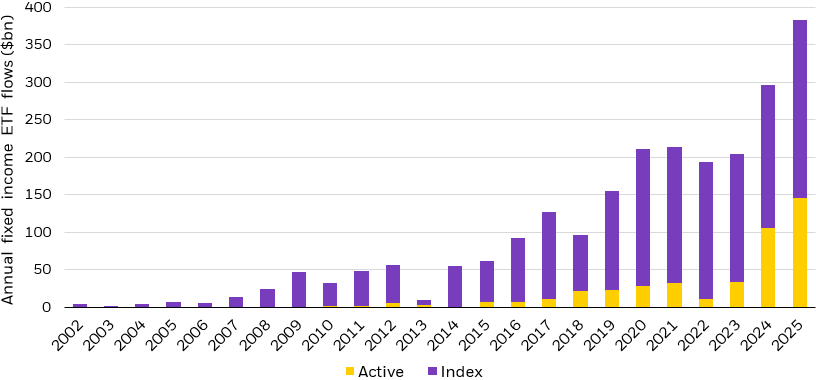

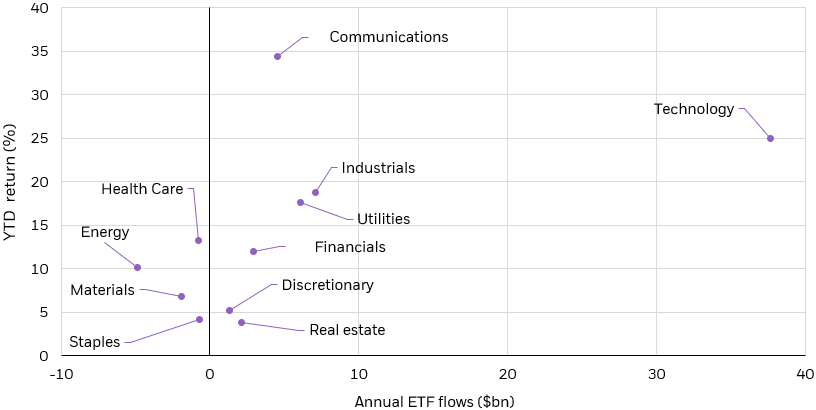

ETF and ETP flows set records in 2025, a year when markets delivered robust, broad-based returns despite sweeping tariff announcements, persistent policy uncertainty, and the longest U.S. federal government shutdown on record. Heading into December, the S&P 500 was up 18% for the year (after notching 36 fresh all-time highs), developed markets gained 27%, and emerging markets topped the leaderboard at 30%.1 Fixed income posted strong performance, while correlations to equities dipped lower.

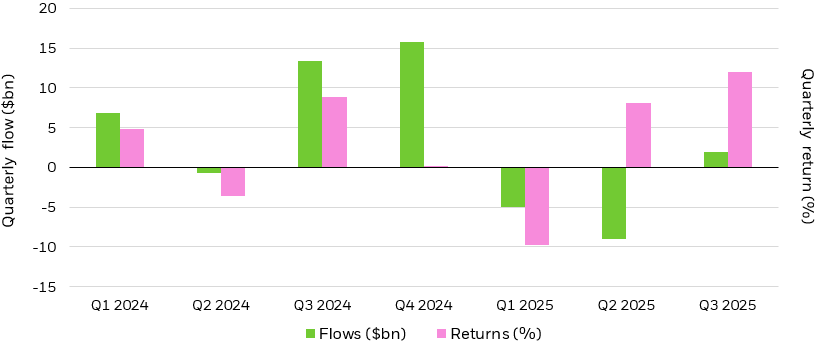

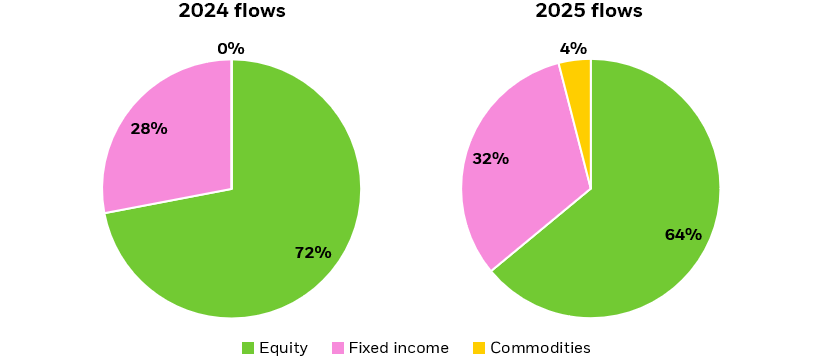

U.S.-listed ETFs added over $1.3 trillion in inflows in 2025 through early December, already surpassing 2024’s record with four weeks to go. Q4 kept up the record quarterly inflows pace for the year, adding $341 billion, with gains across all asset classes.

This is nearly double the average quarterly flow since 2020.

To recap 2025’s ETP & ETF market trends, we’ve identified 10 key themes that defined the year.