Updated: December 9, 2025

Navigate ‟higher for longer” with floating rate bond ETFs

Aug 06, 2024 Fixed Income

Key takeaways

- Floating rate bonds are a type of fixed income security where the interest rate, or coupon, can go up or down depending on market conditions.

- Bond ETFs with floating interest rates can help investors seek capital preservation, boost current income, reduce interest rate risk, and diversify short-term bond holdings.

- Floating rate ETFs may offer exposure to U.S. government bonds, corporate bonds, securitized assets and bank loans.

What is a floating rate bond?

Floating rate bonds are a type of fixed income security where the interest rate, or coupon, can go up or down depending on market conditions. While traditional bonds typically pay a fixed rate throughout the life of the bond, interest rates on floating rate bonds can periodically reset based off a short-term interest rate, known as the “reference rate”1.

Floating rate bonds may help investors:

- Preserve capital: Treasury floating rate notes have traditionally served as a way to gain exposure to government bonds with minimal credit risk.

- Boost income: Interest rates on floating rate bonds currently vary from 5% to 8%, depending on the credit risk.2 These bonds can pay a spread, or additional yield, above a short-term interest rate.

- Reduce interest rate risk: With durations currently close to zero, these bonds can be used to help reduce interest rate risk in a portfolio. Learn more about bond duration and why it’s so important to fixed income investors.

- Diversify short-term bond holdings: With over $7 trillion in money market funds,3 investors may seek to diversify the types of short-term bonds they hold ahead of expected Fed rate cuts later this year.

What happened to LIBOR?

For many years, the most commonly used reference rate in finance was LIBOR, or the London Interbank Offered Rate. LIBOR was the rate an international bank would charge another bank for a short-term loan and was quoted over various time periods (overnight, 1-, 3-, 9-, and 12-months) and in various currencies. LIBOR was once tied to $200 trillion of financial instruments, including derivatives, bonds, mortgages and student loans.4

Introducing SOFR

In May 2021, the Financial Conduct Authority (FCA) announced their intent to retire LIBOR benchmarks by June 30, 2023.5 Many U.S. dollar-based financial instruments and contracts have now transitioned to the Secured Overnight Financing Rate (SOFR), which is the new benchmark interest rate and has become the replacement for LIBOR.

SOFR is a measure of the cost of borrowing overnight funds, which are collateralized by U.S. Treasury securities. SOFR is calculated using market-based transactions in the US Treasury repurchase agreement (repo) market.

How coupon resets work

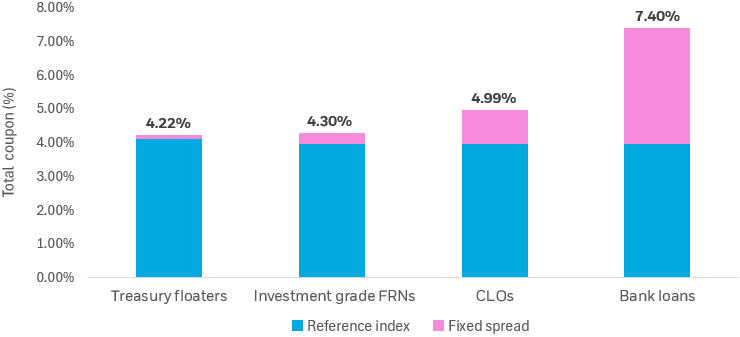

The income paid by floating rate securities is the result of the floating rate plus a fixed spread. The fixed spread is determined at the time of issuance based on demand for the security and the market’s perception of the issuer’s credit risk. Historically, the higher the credit risk, the higher the fixed spread. The coupons typically reset quarterly and are paid quarterly or semi-annually.

Coupons reset quarterly to protect investors from interest rate fluctuations. The reset allows the coupon rate to adjust to the current market conditions, ensuring that the investment yields returns are in line with the prevailing interest rates. The quarterly reset is common because it strikes a balance between providing investors with some stability in their interest payments while still allowing for regular adjustments to reflect market changes.

Coupon = reference index (SOFR ) + fixed spread

Today, investors have access to a broad spectrum of floating rate ETFs, including those that hold U.S. Treasury floating rate notes, investment grade corporate floating rate bonds, high yield floating rate bank loans, and AAA-rated collateralized loan obligations (CLOs).

As of September 30, 2025, U.S. Treasury floating rate notes have a fixed spread of 0.11%. Meanwhile, investment grade floaters may have a spread of 0.32%, AAA-rated CLOs may have 1.01% and bank loans around 3.42% as of September 30, 2025. Figure 1 below provides a coupon breakdown for each of these instruments:

Figure 1: Average coupon breakdown on floating rate instruments

Source: BlackRock, JP Morgan, ICE and Bloomberg as of September 30, 2025. The reference index for investment grade floating rate notes, AAA CLOs and banks loans is SOFR as of 6/30/2024 and the reference index for Treasury floating rate notes is the 13-week T-bill high auction rate as of 6/30/2024. Treasury floaters represented by the Bloomberg U.S. Treasury Floating Rate Index, investment grade floating rate notes (FRNs) represented by Bloomberg U.S. Floating Rate Note < 5 Years Index, AAA CLOs represented by JP Morgan CLOIE AAA Index, and bank loans represented by Morningstar LSTA Leveraged Loan Index.

Chart description: Bar chart displaying the weighted average coupons of Treasury floating rate notes, investment grade floating rate notes, AAA collateralized loan obligations (CLOs) and bank loans. Each bar indicates the coupon difference between the reference rate and the fixed spread.

Figure 2: Types of floating rate instruments

| Treasury Floating Rate Notes | Investment Grade Floating Rate notes (FRNs) | Collateralized Loan Obligations (CLOs) | Leveraged Loans or Bank Loans | |

|---|---|---|---|---|

| Description | Short-term bonds issued by the U.S. government | Issued by corporations or quasi-sovereign issuers | Securitized bonds backed by cash flows from corporate loans | Loans to corporations arranged by bank syndicates |

| Reset Index | 3-month T-bill auction rate | SOFR | SOFR | SOFR |

| Credit Quality | U.S. Government | Typically investment grade | Ranges from investment grade (AAA to BBB) to below investment grade (BB or lower) | Typically high yield, may be secured |

| Settlement | T+1 | T+1 | T+1 | T+5 or longer |

Source: BlackRock, Bloomberg, JP Morgan and Morningstar as of 6/30/2024. The characteristics of Treasury floaters represented by the Bloomberg U.S. Treasury Floating Rate Index, investment grade floating rate notes (FRNs) represented by Bloomberg U.S. Floating Rate Note < 5 Years Index, AAA CLOs represented by JP Morgan CLOIE AAA Index, and bank loans represented by Morningstar LSTA Leveraged Loan Index.

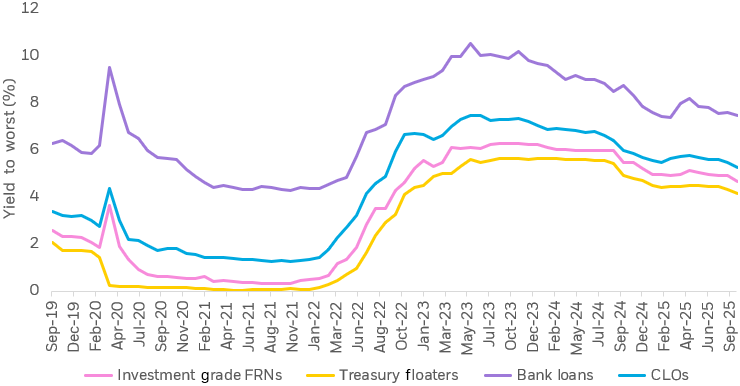

Figure 3: Floating rate instrument yields over time

Source: Bloomberg, JP Morgan and Morningstar as of September 30, 2025. The yield to worst displays the weighted average yield to worst of the securities in the following indices: Treasury floaters are represented by the Bloomberg U.S. Treasury Floating Rate Index. Investment grade floating rate notes (FRNs) are represented by Bloomberg US Floating Rate Note < 5 Years Index. AAA CLOs are represented by JP Morgan CLOIE AAA Index. Bank loans are represented by Morningstar LSTA Leveraged Loan Index. Index returns are for illustrative purposes only. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Line chart displaying yield to worst over time between Treasury floating rate notes, investment grade floating rate notes, collateralized loan obligations, and bank loans.

What’s the appeal of floating rate bonds today?

Floating rate bonds may appeal to investors even during a rate cutting cycle. Investors may be able to take advantage of a “higher for longer” interest rate environment using a full suite of floating rate bond ETFs. Since the coupons reset frequently and there can be little duration risk, floating rate bond ETFs can help investors step out of cash while aiming to manage interest rate risk, potentially boost income and diversify short-term bond holdings.

Featured funds

-

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892