Updated: October 7, 2025

Bond duration demystified: A guide for fixed-income investors

Jun 20, 2024 Fixed Income

How to play the Fed cutting cycle

Key takeaways

- Duration is a way to measure the interest rate risk of a bond and is a critical factor in fixed income investing.

- Investors can manage their portfolio's duration through their selection of bonds or bond funds.

- iShares offers investors a wide range of fixed income ETFs to navigate various potential interest rate scenarios.

iShares Flexible Income Active ETF

Seek to maximize income with an active fixed income approach.

iShares Short Duration Bond Active ETF

Got short-term financial goals? Consider NEAR

iShares 0-3 Month Treasury Bond ETF

Seek stability and monthly income with short-term Treasuries.

What is duration?

Duration is a way to measure the interest rate risk of a bond and is a critical factor in fixed income investing. Duration is defined as the change in value of a bond for a 1% change in interest rates. For example, if interest rates decrease by 1% and you own a 10-year bond with a duration of 5, then the price of that security is expected to increase by 5%. (Bond prices and bond yields generally are inversely related, meaning when yields increase, bond prices drop and vice versa.)

Why bond duration matters to investors

In balanced investment portfolios, stocks and bonds traditionally make up the basic building blocks. A classic “60 – 40” portfolio is comprised of 60% stocks and 40% bonds, which historically have served three key roles in portfolios: capital preservation, income generation, and diversification.

Bonds have the potential to deliver income via cash flows from coupon payments. These typically occur on a set schedule, which is why bonds are often referred to as “fixed income.” However, one of the biggest risks for bond investors comes from changes in interest rates. That’s why managing duration risk is so important to investors — especially in an environment like the one we’re in now.

Managing duration risk in the current cycle

From March 2022 to July 2023, the Federal Reserve increased short-term interest rates (known as the fed funds rate) by 0.25% to a range of 5.25 – 5.50%. During that period, the broad U.S. bond market, as measured by the Bloomberg US Aggregate Bond Index, decreased by 8.8% — contributing to one of the worst 18-month periods in the history of the index.1

The Fed was then on pause for 14 months and then cut 50 basis points (bps) in September 2024, followed by two 25 bps cuts at the October and December 2024 meetings.2

After holding rates steady for the first nine months of 2025, the Fed cut the fed funds rates by 25 basis points to a range of 4% – 4.25% at its policy meeting on September 17, 2025.3

Market consensus is anticipating additional rate cuts in the final months of 2025. Based on the FOMC’s June 2025 Summary of Economic Projections, the Fed expects overnight interest rates to decline to 3% by 2027.4

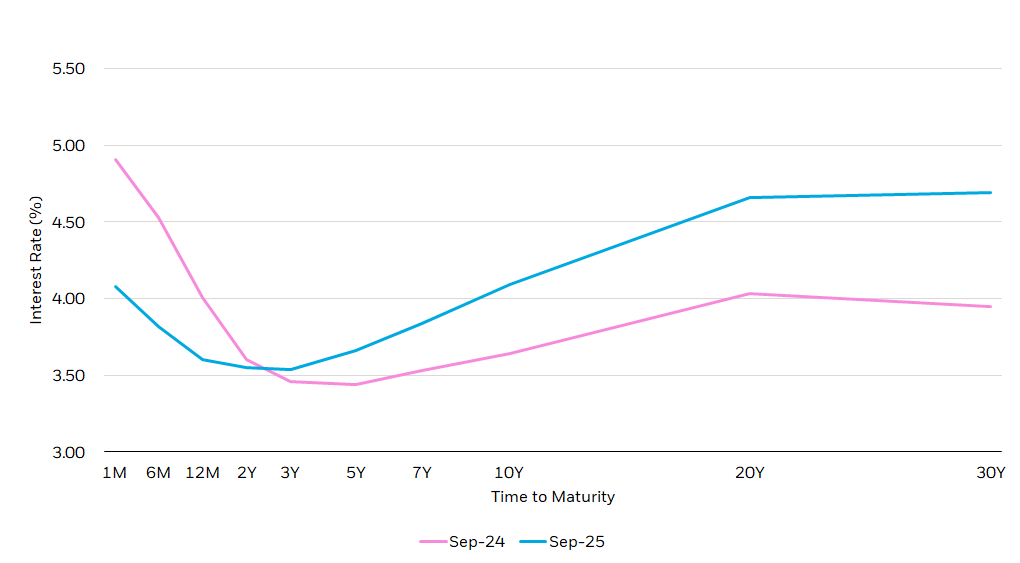

Since the September 2024 rate cuts, front-end yields have declined by 100 bps from 5.50% to 4.50%, but remain higher than other Treasuries maturing in 10 years or less.5 Historically, longer-term yields have been higher than those of bonds with shorter maturities. This compensates investors for the risk of holding bonds for a longer period, as more time equals more uncertainty about the future path of inflation and interest rates.

We anticipate that the yield curve will revert to short-term rates being lower than longer-term rates, known as a normalization of term structure, eventually resulting in an upward sloping yield curve. While short rates could eventually decline with expected Fed cuts, long-term rates will likely be driven by inflation expectations, economic growth, bond issuance and government deficit. A parallel rate shift is unlikely, and investors should be aware of where (which maturities) they hold to achieve portfolio duration.

U.S. Treasury Bond yield curve: change since September 2024

Source: Bloomberg using the Fed Funds target rate and 30-year US Treasury yields from September 18, 2024 to September 17, 2025.

Chart description: Line chart illustrating the U.S. Treasury Bond yield curve since September 2024.

A review of the past four rate cutting cycles (1995 – 2020) reveals a lower Fed funds target rate when there is a recession or economic shock (2001, 2007 and 2019/2020) versus a higher rate when the Fed is seeking a normalization of policy (1995 cut). See the table below for more details.

Rate changes over previous Fed cutting cycles

| Start of first rate cut | Length of cuts | Rate change over cycle | Market context |

|---|---|---|---|

| 7/6/95 | 41 months | 6.00% to 4.75% | Mid-cycle adjustment |

| 1/3/01 | 30 months | 6.50% to 1.00% | Tech Bubble |

| 9/18/07 | 15 months | 5.25% to 0.25% | Global Financial Crisis |

| 7/31/19 | 8 months | 2.50% to 0.25% | Economic slowdown then COVID |

| 9/18/24 | 12 months and counting | 5.50% to 4.25% (in progress) | Inflation decreases, then tariff policy change |

Source: BlackRock, Bloomberg and US Federal Reserve as of 8/25/2025

Navigating different duration scenarios

While daily changes in interest rates at different points are hard to predict, bond portfolios can be adjusted to take into account potential longer-term trends. Many investors use the broad US bond indices as the benchmark when determining how much interest rate risk to hold. The Bloomberg US Aggregate Bond Index has a duration of about 6 years.6 Investors can add or reduce duration relative to this commonly used bond index. Bond investors can reduce duration — or interest rate risk — by selecting bonds or bond ETFs with short-term maturities, and they can increase their interest rate risk by selecting bonds or bond ETFs with longer maturities.

However, equity heavy portfolios may want to hold more interest rate risk, which can add diversification to stock portfolios. Very bond heavy portfolios (over 60%) may want to hold less duration if they are focused on capital preservation and do not want to add risk that rising long-term interest rates may pose. Additionally, interest rates do not always move in parallel, so different interest rate environments could call for adjustments to holdings.

Bond ETF ideas for the potential continuation of this rate cutting cycle

- Core bonds: Investors could aim to get ahead of the rate cuts and move toward strategic asset allocation goals, especially if they are overweight cash, which historically have underperformed bonds during an interest rate cut. Intermediate duration bonds could help provide more income and equity market diversification during rate cuts.

Core bonds may be accessed via the iShares Core U.S. Aggregate Bond ETF (AGG), the iShares Core Universal USD Bond ETF (IUSB) and the iShares 5-10 Year Investment Grade Corporate Bond ETF (IGIB).

- Step out of cash — With over $7 trillion in money market funds7, Americans have stockpiled cash. Cash yields historically have declined when the Fed lowers the overnight rate. Putting the cash to work with 1-to-5 year bonds can help maintain yield and diversify holdings or consider diversifying cash holdings with Treasury bills, which may be accessed via the iShares 0-3 Month Treasury Bond ETF (SGOV).

Investors seeking access to short-term bonds may consider the iShares Short Duration Bond Active ETF (NEAR) and the iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB). - Seek income: Investors can seek income to boost return potential.

Credit risky assets, such as high yield bonds, have tended to underperform investment grade bonds when the Fed has cut due to a recession (2001, 2007, 2019 cuts). However, when the Fed has cut as inflation has decreased (1995 and 2024 cuts), then these bonds have tended to be driven by their income potential. A starting point of 6-8% yields can help drive performance in the current environment.

Investors seeking income may consider the iShares Flexible Income Active ETF (BINC) and the iShares Broad USD High Yield Corporate Bond ETF (USHY).

- Build a Bond Ladder with iBonds: Seek income yields with a bond ladder built with ETFs. Check out the iBonds Ladder tool to build a custom ladder over your time horizon.

In addition to these ideas, here is a summary of five interest rate scenarios and potential strategies for managing bond portfolios with iShares bond ETFs.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

Using iShares to navigate changing interest rate environments

| Interest rate scenario | Potential strategy | iShares bond ETFs | |

|---|---|---|---|

| rates | Longer term rates rise |

| IGSB iShares 1-5 Year Investment Grade Corporate Bond ETF STIP iShares 0-5 Year TIPS Bond ETF HYGH iShares Interest Rate Hedged High Yield Bond ETF |

| Rising | Rate hikes |

| SGOV iShares 0-3 Month Treasury Bond ETF ICSH iShares Ultra Short Duration Bond Active ETF CLOA iShares AAA CLO Active ETF |

| Flat rates | Fed on hold |

| BINC iShares Flexible Income Active ETF USHY iShares Broad USD High Yield Corporate Bond ETF TLTW iShares 20+ Year Treasury Bond BuyWrite Strategy ETF |

| rates | Rate cuts |

| NEAR iShares Short Duration Bond Active ETF IUSB iShares Core Universal USD Bond ETF IGIB iShares 5-10 Year Investment Grade Corporate Bond ETF |

| Falling | Longer term rates fall |

| TLT iShares 20+ Year Treasury Bond ETF IGLB iShares 10+ Year Investment Grade Corporate Bond ETF QLTA iShares Aaa – A Rated Corporate Bond ETF |

For illustrative purposes only.