Interviewer:

Alright Gargi, we all know the market can be moody (Gargi laughs at camera). Let’s do a temperature check. What’s the market mood right now?

Gargi:

Cautiously optimistic. The U.S. economy is holding up — unemployment ticked down to 4.3%, and 130,000 jobs were added in January, the biggest gain in over a year. That said, markets are still volatile.

Interviewer:

Gold and silver have made headlines...

Gargi:

They hit record highs to start 2026 but saw double-digit selloffsafter the Fed chair nominee announcement and a stronger U.S. dollar.

Interviewer:

And stocks?

Gargi:

This earnings season is all about AI differentiation. Investors are favoring hardware — memory and chips — over software.

Interviewer:

So what’s the takeaway?

Gargi:

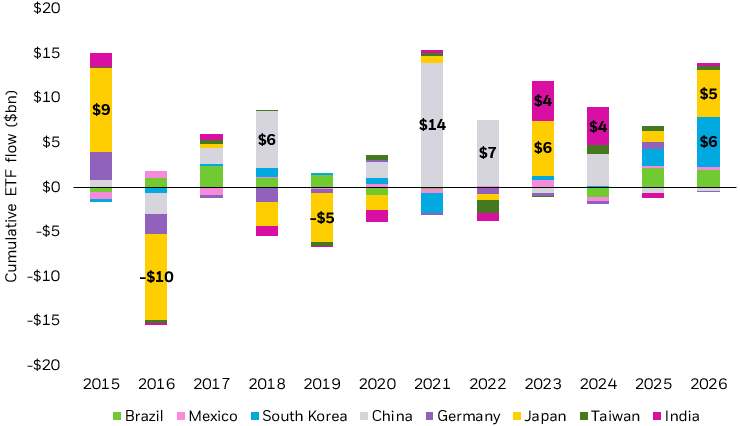

We saw a record start in January – over. But this isn’t a “buy everything” market. It rewards selectivity — particularly in AI — and investors are increasingly looking beyond the U.S.

Interviewer (smiling):

Love it! Last question: what’s your personal mood this weekend?

Gargi:

I’ll be writing - with actual pen and paper! It helps me foster more creativity and focus... and cuts down on my scrolling.

Interviewer:

And that’s the market mood.

Sources:

- ● Bureau of Labor Statistics, as of February 11, 2026.

- ● Gold represented by the Gold Dollar Spot Index.

- ● Bloomberg, as of January 31, 2026.

Disclosures:

Past performance does not guarantee future results.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this material is at the sole discretion of the viewer.

This material contains general information only and does not take into account an individual's financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

This material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice.

Prepared by BlackRock Investments, LLC, member FINRA.

© 2026 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and iSHARES are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

MKTG0226-5242542-EXP0227