Updated: February 9, 2026

Got diversification? Access the 20 biggest U.S. stocks

Oct 24, 2024 Equity

Key takeaways

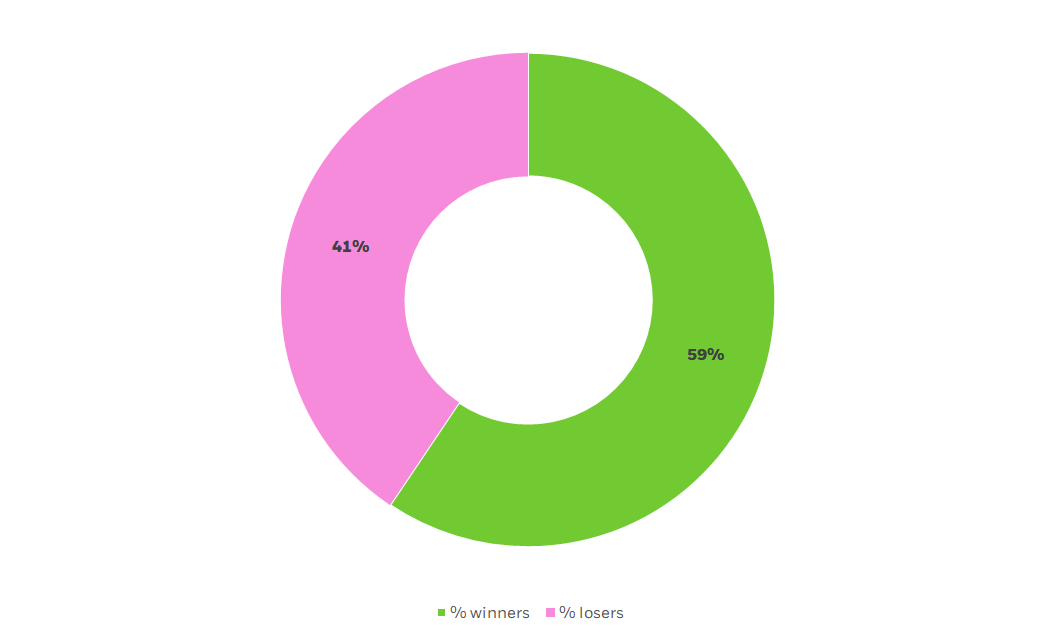

- The U.S. stock market has performed very well overall in the past five years. But nearly 41% of individual stocks are down in the same timeframe, with an average decline of 55.7%.1

- Diversification is a key tool investors may use to manage the risk of owning the “wrong” stocks in a rising market.

- The iShares Top 20 U.S. Stocks ETF (TOPT) gives investors access to 20 of the biggest companies in the U.S. in a low-cost, tax-efficient wrapper, taking the guesswork out of picking individual stocks.

Why is diversification an important investment strategy?

It's been a good time to own stocks. Major indexes like the Dow Jones Industrial Average and S&P 500 have produced a string of record closes this year, and a broad measure of U.S. equities has more than doubled in the past five years.2 But picking stocks isn’t easy and the harsh reality is nearly 41% of publicly traded companies in the S&P U.S. Total Market Index are down in the past five years, with an average decline of 55.7%.

Don’t be a loser in a winning market

5 -year returns as of 6/20/2025

Source: Morningstar as of 6/20/2025. Market return is represented by the S&P US Total Market Index, using cumulative total return which assumes the reinvestment of dividends. Past performance is not indicative of future results. Indexes are unmanaged and one cannot invest directly in an index.

Chart description: Doughnut chart showing the percentage of U.S. stocks that have gone up vs. down in value over the last five years (through 6/20/2025).

So equity investors have done great but only if they were in the right stocks. In other words, it’s been very possible to experience meaningful losses in a winning market, which shows the importance of diversification in investing.

And while past performance doesn’t guarantee future returns, shares of the 20 largest publicly traded U.S. companies contributed 59% of the S&P 500’s total return over the last five-years.3 The iShares Top 20 U.S. Stocks ETF (TOPT), which launched on Oct. 24, 2024, empowers investors to access 20 of the biggest and some of the most successful companies in the U.S. with a single trade, via the convenience of the low-cost and tax-efficient ETF wrapper.

The iShares Top 20 U.S. Stocks ETF seeks to track the investment results of an index comprised of the 20 largest U.S. companies by market capitalization within the S&P 500 Index. Market cap is the dollar value of a company’s total outstanding shares of public stock. If, for example, a company has 100 million shares of stock outstanding and it trades at $100 per share, its market cap would be $1 trillion.

Market capitalization is often used as a way to measure the size of a company, and as a way to differentiate between companies. For instance, companies are typically categorized as being large-, mid- or small-cap based on their market capitalization.

Brands currently in the top 20 by market cap include Apple, Amazon, Meta, Johnson & Johnson and JP Morgan Chase. The 20 largest publicly traded U.S. stocks collectively represent $34.6 trillion in market cap, almost equal to the size of the U.S. economy, which produced approximately $30 trillion of GDP in 2025.4

These companies operate in more than 160 countries around the world and currently employ about 4.4 million Americans.5

See what's inside your investment

Access multiple sectors with the largest, and some of the most recognizable, companies by market capitalization in the U.S.

Top 5 companies

The top 5 companies in TOPT represent $15 trillion in market cap, which is more than half the size of the U.S. economy.²

NVIDIA

Nvidia Corp (NVDA) 15.78% Information Technology

APPLE

Apple Inc (AAPL) 13.63%

Information Technology

MICROSOFT

Microsoft Corp (MSFT) 12.13%

Information Technology

JP MORGAN CHASE

JP Morgan Chase & Co (JPM) 4.69%

Financials

BERKSHIRE HATHAWAY

Berkshire Hathaway Inc Class B (BRK/B) 4.58%

Financials

As of January 5, 2026

Information technology & communication services

These companies are reshaping the world we live in, creating digital experiences and enabling AI, as well as producing content and the platforms for us to consume them.

NVIDIA

Nvidia Corp (NVDA) 15.78% Information Technology

APPLE

Apple Inc (AAPL) 13.63%

Information Technology

MICROSOFT

Microsoft Corp (MSFT) 12.13%

Information Technology

BROADCOM

Broadcom Inc (AVGO) 3.75%

Information Technology

PALANTIR TECHNOLOGIES INC CLASS A

Palantir Technologies Inc Class A (PLTR) 2.05%

Information Technology

META

Meta Platforms Inc Class A (META) 4.57%

Communication Services

Alphabet Inc A (GOOGL) 3.38%

Communication Services

Alphabet Inc C (GOOG) 2.71%

Communication Services

NETFLIX

Netflix Inc (NFLX) 2.00%

Communication Services

As of January 5, 2026

Financials

The finance industry is experiencing growth in several areas such as fintech and digital payments led by technological innovation, regulatory changes, and evolving consumer preferences.

JP MORGAN CHASE

JP Morgan Chase & Co (JPM) 4.69%

Financials

BERKSHIRE HATHAWAY

Berkshire Hathaway Inc Class B (BRK/B) 4.58%

Financials

VISA

Visa Inc Class A (V) 3.08%

Financials

MASTERCARD

Mastercard Inc Class A (MA) 2.40%

Financials

As of January 5, 2026

Healthcare

The healthcare industry has seen multiple paradigm shifts, including areas like biotech and wearable technologies.

ELI LILLY

Eli Lilly (LLY) 4.27%

Healthcare

JOHNSON & JOHNSON

Johnson & Johnson (JNJ) 2.54%

Healthcare

ABBVIE

AbbVie Inc (ABBV) 2.01%

Healthcare

As of January 5, 2026

Consumer discretionary & staples

The shift to e-commerce and demand for more sustainable products have upended the retail industry, but the business of providing Americans the products and services they need — and want — never goes out of style.

AMAZON

Amazon.com Inc (AMZN) 4.53%

Consumer Discretionary

TESLA

Tesla Inc (TSLA) 5.41%

Consumer Discretionary

WALMART

Walmart Inc (WLM) 2.55%

Consumer Staples

COSTCO

Costco Wholesale Corp (COST) 2.00%

Consumer Staples

As of January 5, 2026

Energy

The energy sector has seen massive technological advancements, policy changes, and shifting consumer preferences, namely in renewable energy, energy storage, electric vehicles and more.

EXXON MOBIL

Exxon Mobil Corp (XOM) 2.73%

Energy

As of January 5, 2026

20 big stocks, one easy trade

Here are three potential benefits of the iShares Top 20 U.S. Stocks ETF:

- Access: TOPT is designed to track the performance of the 20 largest U.S. stocks by market capitalization. You may be new to investing, but you’re probably familiar with these brands, which are some of the largest companies in the technology, consumer goods, communications, healthcare and financial services sectors.

- Diversification: As noted above, a rising equity tide hasn’t lifted all boats and TOPT provides the benefits of diversification vs single-stock ownership. In theory, any potential weakness in one or two of the top 20 may be partially offset by strength in other constituents.

- Convenience: Just like an appetizer sampler removes the challenge of having to choose a favorite starter, TOPT is a one-ticker solution that gives an investor exposure to a variety of large-cap U.S. stocks with no minimum investment other than the price of the ETF itself. With TOPT, investors can get exposure to the 20 largest U.S. stocks at a fraction of the capital required to purchase them individually; it could cost over $8,000 to purchase a single share of each of the top 20 stocks included in the fund.7

As with all equity index ETFs, TOPT is designed to reflect the price of a collection of stocks — in this case, the 20-largest U.S. companies by market capitalization.

Just like the Billboard Top 20 is regularly updated — based on the sales, airplay and streaming of songs — TOPT adjusts as the market changes. TOPT is professionally managed against an index that dynamically rebalances on a quarterly basis — the third Friday of March, June, September, and December — ensuring investors maintain their exposure to the 20 largest companies on a rolling basis, though it may not reflect current rankings between rebalances.

With the rebalancing done for you automatically, TOPT takes the guesswork out of keeping up to date with the latest corporate trends.

Putting TOPT

into action

Get started with the iShares Top 20 U.S. Stocks ETF to help take the guesswork out of picking individual stocks, and to gain access to 20 of the biggest and some of the most successful companies in the U.S.

- To view the TOPT ETF, visit the iShares Top 20 U.S. Stocks ETF product page.

- To learn more about TOPT, explore our investment strategy page.