Updated: September 16, 2025

Investing in AI: It’s about how, not if

Aug 15, 2024 Equity

Key takeaways

- AI’s long-term impact could extend beyond the “Magnificent 7”— Apple, Microsoft, Amazon, Google (Alphabet), Meta, NVIDIA, and Tesla — to nearly all global industries.

- AI is still at the early stages of one of the most powerful technological revolutions since the internet.

- Investing in the full AI value chain — such as through an AI-focused ETF — could offer a broader approach compared to traditional tech sector investments.

AI is just getting started

Artificial Intelligence (AI) is showing up everywhere you turn, from self-driving vehicles to summarized product reviews. AI thrives on data, and we live in an increasingly digital world. In fact, AI market size is expected to reach over $4 trillion by 2033, representing a 25x increase vs a market size of $189 billion in 20231, and BlackRock believes AI could disrupt the global economy over the next decade. (Learn more about digital disruption and AI).

Although the concept of AI has been around for decades, recent trends of advancements in semiconductor breakthroughs, data proliferation, and software design have converged to bring the field to an inflection point. AI has transcended its “buzzword status,” with businesses across sectors looking to integrate the technology to grow new revenue streams or improve efficiencies.

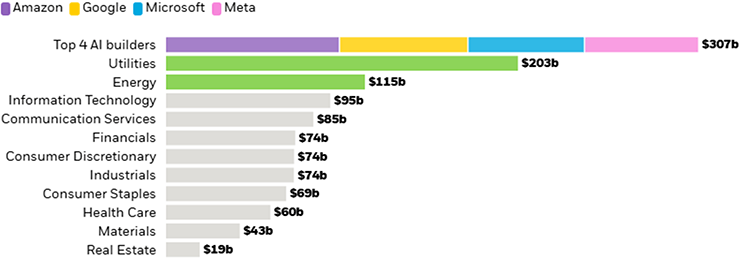

This has all culminated in historic capital expenditures (capex) across the full AI value chain. As the AI buildout accelerates across big tech and energy infrastructure, the top 4 AI builders, alongside utilities and energy companies, have capex that is roughly equaling the rest of the S&P 500 combined.

AI could bring new efficiencies and revenue opportunities to virtually all segments of the economy

Share of industry employment exposed to automation in the U.S.

Source: BlackRock as of April 7, 2025 using Refinitiv, mean analyst estimate sector grouping of the S&P 500 index determined by MSCI GICS Level 1 groupings.

Specific companies or issuers are mentioned for educational purposes only and should not be deemed as a recommendation to buy or sell any securities. Any companies mentioned do not necessarily represent current or future holdings of any BlackRock products. For holdings information on the iShares funds, please visit www.iShares.com or click the fund card below.

Chart description: Bar chart showing capex spending across different sectors, showcasing that the top 4 AI builders, utilities and energy combined is nearly equal to the rest of the S&P 500.

Yet despite the recent attention to AI, we believe the AI theme is still in its early stages, presenting investment opportunities for long-term investors.

Looking beyond the “Mag 7”

Certain areas of the AI space continue to attract more headline attention than others, like the select group of mega-cap tech companies known as the "Magnificent 7”

Focusing on the Mag 7 illustrates the potential emphasis on “picking a winner now” when investing in AI. The S&P Technology Select Sector Index has exhibited notable disparities between top and bottom performers. The difference between top-decile and bottom-decile technology stocks year-to-date is about 74.6%.2 Long-term thematic AI investing is not just about investing in today’s largest tech stocks it is about identifying underappreciated areas within AI that are well-positioned for long-term growth and understanding what could come next for AI.

How to capture the full AI value chain

The AI value chain includes companies and industries directly contributing to AI’s growth, including software, hardware, and infrastructure. A few key examples include:

- Core AI models designed to generate new and original content

- Specialized chips essential for training and running AI models

Did you know?

Worldwide AI chip revenue is projected to increase to $92 billion in 2025 a 29% increase from 2024.³

- Operators of AI workloads & data centers, providing the infrastructure needed for generative AI

- Chips that support broader AI applications

- Infrastructure for data centers, crucial for storing and processing vast amounts of data

Did you know?

North American inventory across the four largest data center markets has increased 43% YOY in Q1 2025.⁴

- Databases & related software tools that facilitate data management & AI deployment

- Enterprise software enhanced with AI capabilities to improve business processes

- Consumer software integrated with AI features, enhancing user experiences and functionality

Did you know?

The global AI software market is predicted to grow from $175 billion in 2024 to approximately $467 billion by 2030.⁵

- IT consulting or service firms that specialize in the implementation and management of AI technologies

Did you know?

It is estimated that over 80% of enterprises will have used generative AI by 2026, up from less than 5% in 2023 – creating demand for AI-as-a-service providers.⁶

These categories represent the diverse and evolving landscape of AI. By owning the full value chain of AI industries, investors can seek to capture a broader spectrum of companies and reduce the risk of overreliance on a few dominant players. This approach may allow for exposure to both established and emerging innovators and enablers. A thematic ETF focused on these areas can offer a streamlined approach to AI.

- For investors looking to explore the full breadth of the AI value chain, the iShares Future AI & Tech ETF (ARTY) offers targeted exposure to companies driving innovation across artificial intelligence and adjacent technologies. This ETF provides a diversified lens into the future of AI, from foundational infrastructure to real-world applications.

- For those seeking a more hands-on approach, the iShares A.I. Innovation and Tech Active ETF (BAI) is an actively managed strategy that aims to maximize total return by investing in high-conviction opportunities across the AI tech stack. Leveraging active insights, BAI dynamically navigates the evolving AI landscape to capture emerging growth potential.

Conclusion

AI is still at the early stages of one of the potentially most powerful technological revolutions since the birth of the Internet. AI may introduce new efficiencies and revenue streams across sectors of the economy. As this technology matures, investors can turn to AI to complement the core exposure of their portfolios or to replace their traditional tech exposure. AI-focused ETFs can offer a streamlined way to tap into potential diverse opportunities with a single trade.