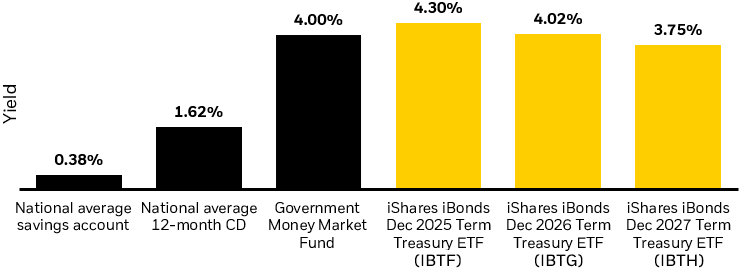

Stepping out of cash could have potential benefits as markets are increasingly convinced short-term interest rates may decline in the near-to-intermediate term. Fed members project the fed funds rate will fall to 3% in 2007 from the current range of 4.25-4.50%.4

One way to step out of cash is to build a bond ladder. A bond ladder is a series of bonds that mature in consecutive calendar years. When the shortest-duration bonds mature, you can either spend the proceeds or reinvest them in new bonds that mature in the latest year of your bond ladder. For example, to set up a 5-year bond ladder with $1,000 to invest, you would buy five bonds for $200 each that mature in 2026 to 2030. Once the 2026 bonds mature, you can stay invested by buying a 2031 bond with the proceeds.

iBonds can be used in place of individual bonds to quickly build a bond ladder. Each iBond ETF holds many individual bonds and can help add diversification. For example, a 5-year (2026-2030) corporate iBonds ladder provides exposure to 3,200 corporate bonds.5 And a 5-Year municipal iBonds ladder (2026-2030) would provide exposure to over 6,000 municipal bonds.6

In addition to putting cash to work and building bond ladders, here are additional ways you can use iBonds ETFs:

- Save for a future purchase: Let’s say you want to buy a home in three years or pay for a child’s college tuition over the next four years. This money could be invested in iBonds ETFs. The fund will then mature and your investment will be made available in the year indicated in the fund’s name.

- Protect Purchasing Power: Inflation is still hovering above 2.7%.7 If you are not at least earning this yield on your savings, then you are likely losing purchasing power over time. TIPS iBonds offer exposure to US Treasury securities whose principal adjusts with monthly changes in the Consumer Price Index. If inflation continues to increase, the bond’s principal payment will rise to account for this change.

5-year corporate bond ladder

How to build a bond ladder