Updated: August 15, 2025

The rebirth of American manufacturing: Growth and innovation

Jul 18, 2024 EQUITY

KEY TAKEAWAYS

- While U.S. manufacturing activity has largely been in decline since the late 1970s, the makings of a manufacturing renaissance could be emerging.

- Geopolitical fragmentation and shifting political and economic priorities are reshaping supply chains and driving renewed investment in domestic production.

- Potential investment opportunities exist across the entire U.S. manufacturing value chain supported by legislation designed to incentivize more domestic manufacturing.

-

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892

U.S. MANUFACTURING: THEN & NOW

In 1979, U.S. manufacturing employment peaked at nearly 20 million workers.1 Over the next 45 years, manufacturing declined as the U.S. transitioned towards a more service-oriented economy. This shift has been pervasive, impacting national output, household consumption, and employment. By 2020, the service sector dominated the U.S. economy, contributing a staggering 79% to GDP (up from 52% in 1950) and employing 80% of workforce.2 At the same time, production of goods moved offshore, attracted by lower labor costs. However, geopolitical events such as Brexit, COVID-19, and the war in Eastern Europe revealed vulnerabilities in global supply chains, exposing governments, businesses, and consumers to risk.

SHORTER & STRONGER SUPPLY CHAINS

Supply chains are being re-engineered for resilience and emerging technologies like artificial intelligence and advanced automation may change production economics, enabling reshoring strategies that once seemed costly. As a result, there has been a renewed focus on reshoring — the process of bringing production back to the country of origin — as a core strategy for building resilience. (Learn more about reshoring in our Thematic Mid-Year Update.)

The pandemic highlighted how impactful supply chain risks can be. Take semiconductors, for example, one of the most globally integrated supply chains. Eighty-eight percent of semiconductor production occurs overseas,3 often crossing as many as 70 international borders before reaching the end-user.4 Pre-COVID-19, chip lead times averaged three to four months. During the pandemic, they ballooned to a year or more,5 halting production across industries from automobiles to kitchen appliances.

U.S. POLICY REMAINS SUPPORTIVE

Beyond attempting to de-risk supply chains, revitalizing U.S. manufacturing may be a favorite among politicians across the political spectrum. Today, the sector contributes approximately $2.9 trillion to the U.S. economy, representing 10% of GDP,6 and carries the highest multiplier effect of any sector. Each dollar spent on manufacturing triggers a chain reaction of increased material purchases, job creation, and further economic expansion.7

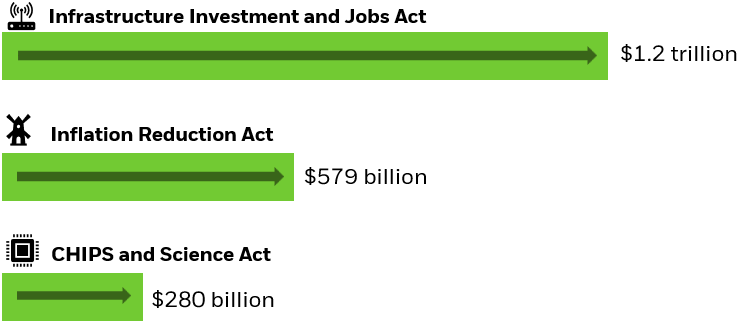

More than $2.1 trillion has been allocated to pro-manufacturing initiatives through the Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA), and CHIPS and Science Act.8 These policies aim to accelerate the buildout of domestic infrastructure and manufacturing capabilities in critical industries and incentivize greater private-sector investment. As of October 2024, over 700,000 manufacturing jobs have been created and $910 billion in private manufacturing investments have been announced.9

Government investment in U.S. manufacturing

Source: Deloitte, "Executing on the $2 trillion investment to boost American competitiveness," 03/16/2023. Legislative policy may influence these figures, but it is too early to assess their potential impact.

Chart description: Bar chart showing the $USD amount invested in different manufacturing initiatives including the Infrastructure Investment and Jobs Act, Inflation Reduction Act, CHIPS and Science Act.

Over the past eight years, the government has sharply ramped up tariffs and imposed import and export restrictions on technologies such as semiconductors and electric vehicles to strengthen its competitiveness. These measures are designed to raise trade barriers and protect U.S. economic interests. By mid-2025, the average U.S. import tariff had climbed from 1.5% in 201510 to roughly 17%, the highest level in nearly 90 years.11 Together, this carrot-and-stick strategy could give a significant boost to U.S. manufacturing and position it as a potential beneficiary of these policies.

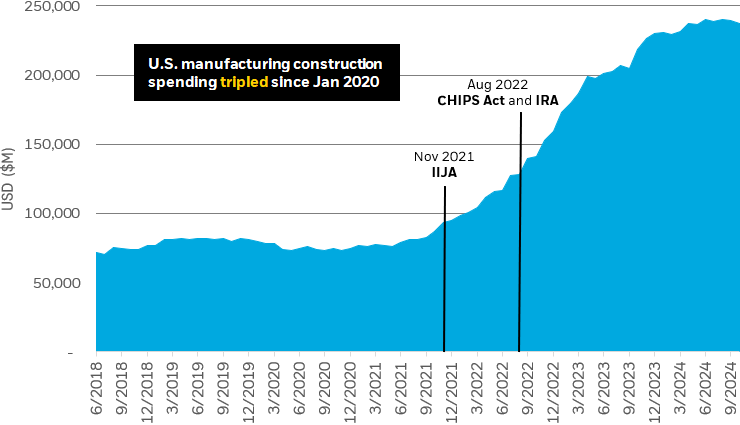

Total construction spending: manufacturing in the U.S.

Source: Federal Reserve Bank of St. Louis, “Total Construction Spending: Manufacturing in the U.S.".

Chart description: Shaded line chart depicting U.S. manufacturing spending from 2018 to 2024, highlighting that spending has tripled since January of 2020.

U.S. MANUFACTURING IS GAINING STEAM

Early signs of a manufacturing revival are emerging, from surging construction activity to increased hiring and corporate investment.

As of October 2024, annual construction spending in manufacturing soared to $237 billion, triple its January 2020 level.12

The job market may be following this construction boom. Due to evolving demand, the industry is projected to create 3.8 million new job openings by 2033.13

Top executives at corporations have been focused on reshoring as well. In the first quarter of 2025, mentions of reshoring in S&P 500 earnings calls increased 58% compared to the previous year.14 Altogether, rising manufacturing, hiring, and corporate focus on reshoring highlight a shift underway across U.S. manufacturing.

CONCLUSION

After nearly four-decades of decline, U.S. manufacturing is showing signs of a resurgence, fueled by geopolitical shifts and a renewed focus on supply chain resilience. Reshoring initiatives, supportive policies, and corporate investments are contributing to this turnaround, leaving U.S. manufacturing poised for possible expansion in the years ahead.