3. Even though companies beat expectations, share prices didn't necessarily rally.

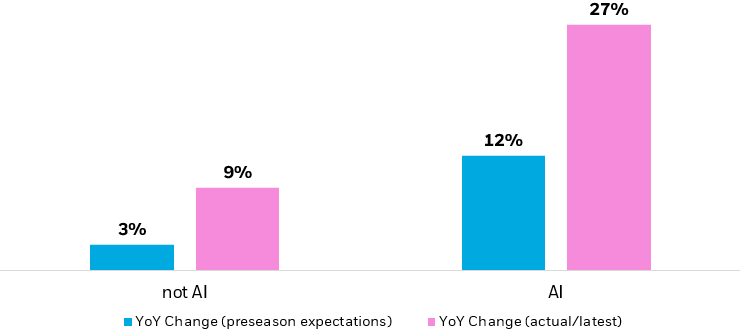

Companies that fell short of Q3 expectations tended to see sharper declines than normal, while those that reported strong earnings were less likely to see a pop in share price during the week of earnings compared to previous quarters.7 We feel this may suggest signs of investor AI fatigue. Concerns surrounding risks in private credit, a hawkish Fed pivot, and AI bubbles all emerged over the course of earnings season, likely spurring a bout of profit taking in select companies.

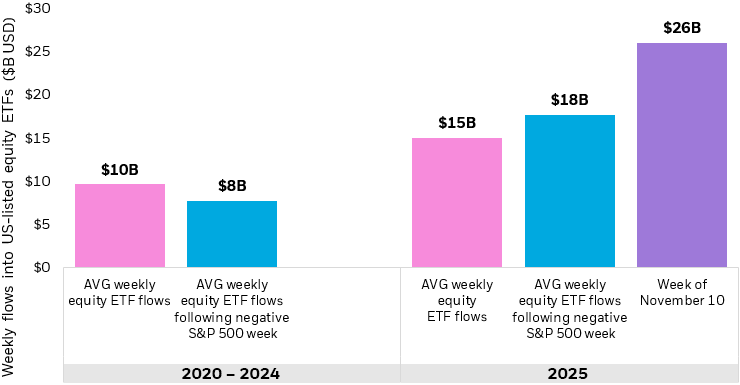

But profit taking appears to be selective, as that runs counter to the trend in ETF flows, where we’ve seen a clear preference to buy the dip. Weekly U.S. equity ETF flows after a week where the S&P 500 was negative have been 17% higher this year than the average flow week. This trend persisted in the most recent bout of uncertainty: the week of November 10, U.S.-listed ETFs saw $26B of net inflows, which is 2x the average weekly flow in 2025.