EFAV

iShares MSCI EAFE Min Vol Factor ETF

-

Fees as stated in the prospectus

Expense Ratio: 0.20%

Overview

Performance

Performance

Growth of Hypothetical $10,000

Distributions

| Record Date | Ex-Date | Payable Date |

|---|

Premium/Discount

-

Returns

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

| Total Return (%) | 26.16 | 14.15 | 6.29 | 5.96 | 6.99 |

| Market Price (%) | 26.01 | 14.31 | 6.33 | 6.00 | 6.99 |

| Benchmark (%) | 25.79 | 14.03 | 6.20 | 5.92 | 6.99 |

| After Tax Pre-Liq. (%) | 25.11 | 13.31 | 5.64 | 5.25 | 6.31 |

| After Tax Post-Liq. (%) | 16.06 | 11.00 | 4.88 | 4.66 | 5.63 |

| MSCI EAFE Index (Net) | 31.22 | 17.22 | 8.92 | 8.18 | 7.89 |

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) | 26.16 | 1.47 | 2.87 | 3.96 | 26.16 | 48.73 | 35.68 | 78.42 | 161.07 |

| Market Price (%) | 26.01 | 1.40 | 3.07 | 4.01 | 26.01 | 49.35 | 35.95 | 79.01 | 160.72 |

| Benchmark (%) | 25.79 | 1.54 | 3.09 | 4.37 | 25.79 | 48.27 | 35.07 | 77.81 | 161.13 |

| After Tax Pre-Liq. (%) | 25.11 | 1.11 | 2.51 | 3.59 | 25.11 | 45.46 | 31.55 | 66.88 | 138.38 |

| MSCI EAFE Index (Net) | 31.22 | 3.00 | 4.86 | 9.86 | 31.22 | 61.08 | 53.33 | 119.59 | 194.05 |

| After Tax Post-Liq. (%) | 16.06 | 1.07 | 1.90 | 2.55 | 16.06 | 36.75 | 26.89 | 57.66 | 117.62 |

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Total Return (%) | 7.02 | -14.76 | 11.98 | 5.28 | 26.16 |

| Market Price (%) | 7.20 | -15.09 | 12.54 | 5.32 | 26.01 |

| Benchmark (%) | 7.14 | -14.97 | 11.81 | 5.42 | 25.79 |

| MSCI EAFE Index (Net) | 11.26 | -14.45 | 18.24 | 3.82 | 31.22 |

The ETF total return may appear to diverge from the return of its benchmark. This may be due to the use of systematic fair value. Click here for more information

Key Facts

Key Facts

Portfolio Characteristics

Portfolio Characteristics

Fees

Fees

| Management Fee | 0.20% |

| Acquired Fund Fees and Expenses | 0.00% |

| Other Expenses | 0.00% |

| Expense Ratio | 0.20% |

The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year. Amounts are rounded to the nearest basis point, which in some cases may be "0.00".

Ratings

Ratings

Holdings

Holdings

| Ticker | Name | Sector | Asset Class | Market Value | Weight (%) | Notional Value | Quantity | CUSIP | ISIN | SEDOL | Price | Location | Exchange | Currency | FX Rate | Accrual Date |

|---|

The values shown for “market value,” “weight,” and “notional value” (the “calculated values”) are based off of a price provided by a third-party pricing vendor for the portfolio holding and do not reflect the impact of systematic fair valuation (“the vendor price”). The vendor price is not necessarily the price at which the Fund values the portfolio holding for the purposes of determining its net asset value (the “valuation price”). Holdings data shown reflects the investment book of record, which may differ from the accounting book of record used for the purposes of determining the Net Assets of the Fund. Notional value represents the portfolio's exposures based on the economic value of investments and options are delta-adjusted. Additionally, where applicable, foreign currency exchange rates with respect to the portfolio holdings denominated in non-U.S. currencies for the valuation price will be generally determined as of the close of business on the New York Stock Exchange, whereas for the vendor price will be generally determined as of 4 p.m. London. The calculated values may have been different if the valuation price were to have been used to calculate such values. The vendor price is as of the most recent date for which a price is available and may not necessarily be as of the date shown above.

Please see the “Determination of Net Asset Value” section of each Fund’s prospectus for additional information on the Fund’s valuation policies and procedures.

“Quantity” represents the number of shares, units or contracts of the corresponding security, as applicable per security type.

Exposure Breakdowns

Exposure Breakdowns

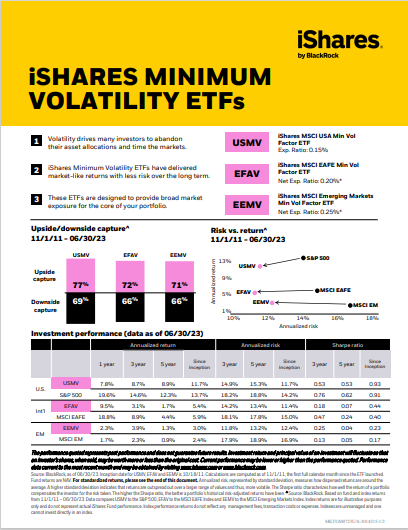

iSHARES MINIMUM VOLATILITY ETFs

READY TO INVEST?

READY TO INVEST?

There are many ways to access iShares ETFs. Learn how you can add them to your portfolio.

This fund does not seek to follow a sustainable, impact or ESG investment strategy. For more information regarding the fund's investment strategy, please see the fund's prospectus or, as applicable, shareholder report.