Updated: September 12, 2025

2025 Spring Investment Directions: Exposures for volatile markets

Apr 28, 2025 Equity

Key takeaways

- We expect volatility to remain elevated as slower growth and shifting trade policy generate complex macro signals. With the Fed constrained by a tight labor market and the potential for tariff-induced inflation, rate cuts may be limited. We prefer low volatility strategies and defensive equities for the near term.

- Amid macro crosscurrents, there remain attractive opportunities with long-term potential. Artificial intelligence (AI) remains a durable theme supported by structural capital expenditures (capex) and falling compute costs, while Latin America may stand to benefit from shifting global supply chains.

- Diversification today requires looking beyond duration. Investors should consider inflation-linked bonds, gold, infrastructure, and short dated-bonds to seek to reduce correlation risk and enhance resiliency across asset classes.

With the arrival of spring, it's time to refresh our perspective on the market. We’re currently in a period of policy change, which often brings uncertainty, leading to market volatility.

As with any period of volatility and uncertainty, it’s understandable for investors to feel unsettled. But volatile markets can also be a great time to be proactive and seek out potential areas of opportunity.

Hi, I’m Kristy Akullian, head of iShares Investment Strategy, here with four takeaways from our 2025 Spring Investment Directions that we think investors should be aware of.

● We expect slower growth and higher inflation for the remainder of 2025.

● Economic data have proven resilient and corporate earnings growth remains healthy, for now.

● Despite resilient economic data, a whiff of recession has crept into measures of consumer sentiment.

● We think it makes sense for investors to consider low volatility strategies for the near term, while looking for attractive entry points to longer term themes. Our full outlook lays out the macro backdrop and explores the potential opportunities across US & international equities, fixed income, and ways to potentially protect against volatility.

Thanks for watching. Check out the full report for our outlook and specific product ideas designed to help you navigate this period of heightened market volatility.

Disclosures:

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Past performance does not guarantee future results.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers. employees or agents. This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this material is at the sole discretion of the viewer.

This material contains general information only and does not take into account an individual's financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. This material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/developing markets and in concentrations of single countries. Fixed income risks include interest-rate and credit risk.

Typically, when interest rates rise, there is a corresponding decline in the value of debt securities. Credit risk refers to the possibility that the debt issuer will not be able to make principal and interest payments.

Diversification and asset allocation may not protect against market risk or loss of principal.

Prepared by BlackRock Investments, LLC, member FINRA.

©2025 BlackRock, Inc or its affiliates. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock. Inc. or its affiliates. All other marks are the property of their respective owners.

iCRMH0425U/S-4422550

With the arrival of spring, it's time to refresh our perspective on the market. We’re currently in a period of policy change, which often brings uncertainty, leading to market volatility.

As with any period of volatility and uncertainty, it’s understandable for investors to feel unsettled. But volatile markets can also be a great time to be proactive and seek out potential areas of opportunity.

Hi, I’m Kristy Akullian, head of iShares Investment Strategy, here with four takeaways from our 2025 Spring Investment Directions that we think investors should be aware of.

● We expect slower growth and higher inflation for the remainder of 2025.

● Economic data have proven resilient and corporate earnings growth remains healthy, for now.

● Despite resilient economic data, a whiff of recession has crept into measures of consumer sentiment.

● We think it makes sense for investors to consider low volatility strategies for the near term, while looking for attractive entry points to longer term themes. Our full outlook lays out the macro backdrop and explores the potential opportunities across US & international equities, fixed income, and ways to potentially protect against volatility.

Thanks for watching. Check out the full report for our outlook and specific product ideas designed to help you navigate this period of heightened market volatility.

Disclosures:

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Past performance does not guarantee future results.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers. employees or agents. This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this material is at the sole discretion of the viewer.

This material contains general information only and does not take into account an individual's financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. This material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/developing markets and in concentrations of single countries. Fixed income risks include interest-rate and credit risk.

Typically, when interest rates rise, there is a corresponding decline in the value of debt securities. Credit risk refers to the possibility that the debt issuer will not be able to make principal and interest payments.

Diversification and asset allocation may not protect against market risk or loss of principal.

Prepared by BlackRock Investments, LLC, member FINRA.

©2025 BlackRock, Inc or its affiliates. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock. Inc. or its affiliates. All other marks are the property of their respective owners.

iCRMH0425U/S-4422550

Macro

We expect slower growth and higher inflation for the remainder of 2025. Instability in U.S. trade policy — even after the temporary reprieve granted to most countries — has increased the risk of a material slowdown in growth beyond the moderation we expected at the start of the year. Tariffs are likely to weigh on growth and boost near-term inflation, the extent of which will be determined by their size and stability. As BlackRock Investment Institute (BII) has laid out, “while persistent uncertainty can cause economic damage, we are seeing hard economic rules binding U.S. trade policy changes. The administration’s responsiveness to market moves and a recent de-escalation in rhetoric should bolster sentiment, but we believe a resolution will be needed to curb volatility. Looking further ahead, proposed tax cuts and a deregulatory agenda could prove stimulative to growth but are likely to further increase the budget deficit.

Given current data, we see the Fed on hold at least through the June meeting and likely beyond. Policy crosscurrents complicate the outlook. While trade policy risks curbing growth, immigration policy has the potential to reduce labor supply. In our view, the resulting wage pressure from a tighter labor market, combined with price pressure from ongoing tariffs could combine to delay or deter the cuts to the policy rate that slower growth would otherwise imply. The Fed may be able to reduce rates in the second half of the year — so long as longer-term inflation expectations remain contained. However, with possible tension between the two sides of their dual mandate, it may be that only a sharp slowdown would prompt the Fed to act.

So far, economic data has proven resilient and broadly consistent with our year-ahead outlook. Durable goods, retail sales, factory orders, nonfarm payrolls all have continued to exhibit the same strong-but-gradually-moderating trend as they have over the past year.1 Corporate earnings growth likewise entered Q2 from a position of strength. So far, the Q1 earnings season is on track to beat consensus earnings expectations, though forward earnings forecasts have consistently been revised lower since tariffs were announced.2

Still, a whiff of recession has crept into ‘soft data’. Even before the global tariffs rollout, consumer sentiment readings from the University of Michigan survey and the Conference Board both showed consumer sentiment hitting multi-year lows.3 The NFIB and AAII sentiment readings showed a similar decline in confidence for small business owners and investors, respectively.4 Our own proprietary sentiment indicator — based on cash holdings, flows, leverage, credit spreads and breadth — was also steadily declining before diving in the week of the tariff announcements.5 Further instability of policy measures may continue to chip away at sentiment.

Figure 1: Sentiment declined before the global tariff announcement and plummeted after

Source: BlackRock. Sentiment index equally weighted standardized scores of cash holdings, ETF flows, hedge fund leverage, high yield credit spreads, and equity market breadth. As of April 14, 2025.

Chart description: Line chart looking at investor sentiment from January 2007 to April 2025.

Overall, we see merit in defending against ongoing equity volatility while finding attractive entry points for enduring themes. We prioritize diversification in a structurally higher volatility environment in which U.S. Treasuries may not be the reliable diversifier they once were.

U.S. equities

Our pre-tariff estimates point towards S&P 500 earnings growth of 8-10% for the full-year 2025, alongside a broadening out of earnings expectations away from the top of the index.6 However, we acknowledge that many earnings forecasts have yet to reflect the reality of a world newly defined by shifting trade policies. Our expectation for slower gross domestic product (GDP) growth could also translate to slower earnings growth, potentially exacerbated by price pressures on household real income. This could put further pressure on revenue expectations and corporate margins if businesses struggle to pass on costs in a slowing growth environment.

The near-term equity outlook remains unclear. Top-down analysis is complicated by high macro uncertainty, while bottom-up estimates are hampered by companies withdrawing forward guidance. Instead of specific price targets, we consider a range of earnings growth estimates against the backdrop of historically supported multiples. The wide range of earnings per share (EPS) forecasts makes an exact approximation of the current forward price to earnings ratio (P/E) difficult, though we feel that the current multiple is likely modestly above the long-term average. Above average index multiples, combined with slower growth expectations warrant a precise approach to equity allocations. However, we caution against extrapolating too much from valuations, as we find they are often a poor predictor of near-term returns. Rather than focus on a specific valuation, we feel investors should consider dynamic, systematic strategies that seek to respond quickly to changes in earnings expectations.

Figure 2: Earnings estimates and multiples remain near 10yr averages

Source: BlackRock, Refinitiv. EPS range based on IBES 12-month forward EPS growth estimates for the S&P 500, with +/-1 standard deviation band defining the “Typical Earnings Growth” range based on 10-year earnings growth history. “Bearish” and “bullish” earnings growth estimates defined by less than (greater than) -1 standard deviation (+1sd). “Typical Market Multiple” range based on +/-1 standard deviation of 10-year market multiples. “Bear market” and “bull market” multiple defined by less than (greater than) -1 standard deviation (+1sd). As of April 14, 2025.

Chart description: Chart showcasing earnings estimates organized by recessionary multiples, typical market multiples, and bullish multiples.

Given the uncertainty and volatility of this backdrop we believe investors may be well served to modestly add to defensive exposures and look for attractive entry points to enduring themes.

Playing defense: Winning more by losing less

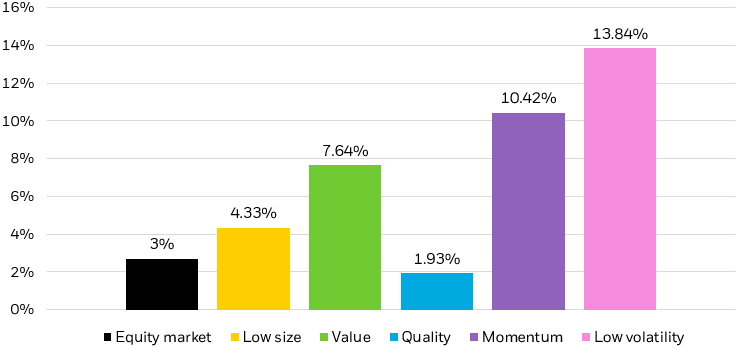

The policy driven sell-off in April saw volatility spike dramatically. Although equities have partially recovered on subsequent policy changes, we don’t see volatility dissipating in a headline driven market. Regardless of the near-term direction of U.S. equities, structurally higher equity volatility has tended to make for lower risk-adjusted returns. For this reason, we believe investors — particularly those with shorter time horizons or lower risk tolerances — may be best suited looking to the low volatility factor to help filter out market turmoil. Because the factor offers an asymmetric up/down capture — participating to a greater degree on the upside than on the downside — it has historically, and over time, been able to deliver performance similar to the broad market with lower overall risk.7 In previous periods of low growth and higher inflation, the low volatility factor was able to meaningfully outperform other equity factors as well as the broad market.

Figure 3: The low volatility factor outperformed during the stagflationary period of the 1970-80s

Source: Fama and French data libraries, the equity market is a value-weighted portfolio of all U.S. stocks from NYSE, AMEX, and NASDAQ used to calculate the market excess return over the risk-free rate. Size represented by SMB, Value by HML, Quality by RMW and Momentum by MOM in the Fama and French data set. Low Volatility represented by BAB in the AQR data set. SMB represents small minus big companies. HML represents high book-to-market minus low book-to-market companies, RMW represents robust operating profitability minus weak operating profitability companies. MOM represents high price momentum minus low price momentum companies. As of March 31, 2025. Performance does not reflect any management fees, transaction costs or expenses. Past performance does not guarantee future results.

Chart description: Bar chart depicting factor performance including equity, size, value, quality, momentum, and low volatility.

Alongside the low volatility factor, we evaluate historical correlations across both economic growth and inflation to find defensive industries that may help position equity portfolios from these shocks. We find that utilities and consumer staples have provided the least sensitivity to changes in both variables, while energy and technology were more exposed.8

Figure 4: Historical sensitivity to growth and inflation

Source: BlackRock, Morningstar. Historical correlations based on daily correlations over the last 1-year period ending March 31, 2025. Inflation proxied by CPI, growth proxied by S&P 500 forward growth. Sector groupings determined by MSCI GICS Levels 1 groupings, Russell Smal & Mid-Cap, and Rusell 1000 Value & Growth indexes. As of March 31, 2025. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Scatterplot displaying the growth and inflation sensitivities of various equity styles (value, growth, S&P 500, small & mid-caps) and sectors.

We extend this analysis beyond historical correlations by overlaying current valuations. While consumer staples have historically served as a defensive exposure, we find that the sector is currently trading at 21x earnings, above the broad market and its historical average, a more demanding setup that may represent already crowded positioning.9 Healthcare, another traditionally defensive sector, similarly trades at a premium to history.10 However, drilling beyond the sectoral level, we find defensive opportunities in Healthcare Providers, which trade at 13x forward earnings estimates, below the industry’s long-term average of 14x.11 Utilities also have screened relatively well and represent a sector overweight in many minimum volatility factor strategies.12

Playing offense: What to do about AI?

- The administration’s evolving trade policy continues to inject volatility into markets. While tariff uncertainty may persist, we see selective opportunities for investors positioned to navigate near-term risk. Highly profitable companies with strong balance sheets and stable earnings are well positioned to weather near-term volatility. Most importantly, we believe the long-term secular growth proposition of the AI theme, responsible for driving equity market leadership in 2023 and 2024, remains intact.

- AI equities were hit hard during recent selloffs, largely due to their reliance on a globally integrated chip and hardware supply chain. The U.S. administration is focused on maintaining its AI lead, and will take a range of steps, including export controls and additional trade measures, in an effort to protect and extend that lead.

- Meanwhile, physical-economy sectors remain vulnerable. U.S. companies in Textiles, Apparel & Luxury Goods, for instance, source 87% of their cost of goods sold from abroad — nearly half from China alone.13 In a trade-fragmented world, these firms may face significant input cost risk, which could compress margins. At the same time, falling AI compute costs are creating a margin tailwind for software companies, as we think that lower infrastructure expenses translate to higher profitability.

In our view, software’s structural AI advantage, combined with its resilience to potential tariffs, makes it one of the more compelling areas of the equity market.

Will AI capex slow?

A small handful of mega-cap companies have fueled the early stages of the AI buildout through the construction of large-scale AI datacenters. The primary beneficiaries of the buildout are the designers and manufacturers of AI chips & hardware.

Source: Refinitiv, mean analyst estimate. Sector groupings determined by MSCI GICS Level 1 groupings. Specific companies or issuers are mentioned for educational purposes only and should not be deemed as a recommendation to buy or sell any securities. Any companies mentioned do not necessarily represent current or future holdings of any BlackRock products. For actual fund holdings, please visit the respective fund product pages. As of April 7, 2025.

Chart description: Bar graph demonstrating the top capex spenders of various sectors and Top 4 AI builders.

- This year, the top four U.S. spenders (Amazon, Microsoft, Google, and Meta) have plans to deploy over $315 billion of capex, most of which is slated for expanding AI infrastructure.14 Investors should closely monitor any shifts in those plans: commentary from any of these mega-cap companies may solidify (or question) the dominance of AI equities. We believe this wave of capex is likely to continue, supported by structural demand for AI compute even amid trade tensions or macroeconomic uncertainty. Still, a slowdown or plateau in spending would present a near-term risk to parts of the AI trade.

- In this environment, we believe a bottom-up fundamental active management approach from technology specialist investors is critical. Active managers with AI investment experience can take intentional bets across different layers of the AI stack, from AI hardware to AI software. As the theme matures, the opportunity set will evolve, and a flexible, research-driven framework can help identify the beneficiaries of each new phase of adoption.

-

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892

International equities

As U.S. equities declined amid Q1’s growth scare, international equities sharply outperformed, with the largest relative performance difference between European and U.S. indexes in two decades.15 International investments benefited from both strong local returns and a declining dollar, amplifying the returns realized by a U.S. investor.

While we still believe in the U.S.’s centrality in global capital markets and its track record of creating strong, innovative companies, developed markets ex-U.S. have shown a renewed focus on their own growth trajectories. From Europe’s push towards meaningful infrastructure and defense spending or Japan’s focus on creating shareholder value, the geopolitical fragmentation of today is accelerating this trend. BII stays positive on developed market (DM) stocks yet see more near-term volatility.

We believe increased uncertainty in the U.S. will continue to drive regional asset allocation decisions for foreign investors. The first months of 2025 brought some evidence that foreign investors had begun to repatriate investments away from the U.S. and back to home equity markets, a trend that could be a further tailwind to international performance should it continue.16 For many U.S. investors, looking abroad can offer the twin benefits of lower valuations and increased diversification. A weaker or rangebound U.S. dollar further adds to the favorable backdrop.

Finding value (and income) in developed markets

The U.S. has long benefited from its tilt to growth, one reason why it often supports higher valuations. Developed markets outside of the U.S. often offer higher exposure to the value factor — with higher dividend and earnings yield than their U.S. counterparts.17 By incorporating international equities into a diversified portfolio, investors may benefit from structural geopolitical trends while also balancing out the inherent growth bias within their U.S. equity allocations. We also see opportunity in actively managed international developed market strategies, with diverging tariff impacts and central bank bifurcation in some cases favoring selectivity.

Figure 6: International equities offer a different factor profile than their U.S. counterparts

Source: BlackRock. Style factor chart using equity risk model. The numbers represent standardized scores on how many standard deviations away an exposure is from the estimation universe. As of April 14, 2025.

Chart description: Spider graph looking at exposures of different style factors including volatility, momentum, growth, leverage, value, profitability, earnings yield, dividend yield, and size.

Minimizing volatility in emerging markets

We maintain a neutral outlook on emerging markets broadly — we watch for tailwinds from under-owned positioning and potential stimulus but acknowledge uncertainty will be the dominant catalyst of price action ahead. We believe China will continue to face the highest risk of trade volatility as a deliberate decoupling strategy currently remains central to the administration’s stated goals. Further, Q1 equity outperformance masked potential cracks in China’s macro backdrop, even before the administration’s tariff announcements. Growth in high-frequency indicators softened in late March, including steel demand and freight volume of departing ships at major ports, while consumer confidence remained at still-depressed levels.18

Rapidly changing policy and the continuation of the trade war are likely to weigh on China’s growth: we estimate U.S. tariffs covering 70% of Chinese exports add up to an estimated 2% drag on GDP. The trade war shows few signs of abating in the near-term as details remain unclear and uncertainty continues to metastasize. We therefore lean into emerging market minimum volatility strategies, which have seen a sizably lower downside capture relative to the broad index over the last 10 years.19

The strategic importance of Latin America

We believe Latin America may continue to grow its role as a strategically important trade partner as both the U.S. and China jockey for influence in the region. Latin American countries are critical producers and exporters of raw materials and agricultural products, ranging from copper and lithium to soybeans and beef.

The strategic importance of the region is underscored by both the U.S. and China’s investment presence. Although the U.S. still dominates in terms of bilateral trade, China is now the region’s second-largest trading partner, having grown bilateral trade to over $500 billion in recent years.20 As both the U.S. and China continue to push for influence in the region — particularly through strategic investments — we believe that Latin America may stand to benefit.

Further, valuations across LatAm equity markets are trading at substantial discounts relative to historical averages:

Figure 7: LatAm equities trade at relative discounts to historical averages

| Country | Price to earnings (P/E) | Price to book (P/B) | P/E 5Y Average | Prem/Disc to 5Y |

|---|---|---|---|---|

| Brazil | 7.5 | 1.6 | 8.6 | –13% |

| Mexico | 10.8 | 1.8 | 12.7 | –15% |

| Chile | 10.5 | 1.3 | 11.0 | –4% |

Source: BlackRock, Refinitiv. P/E and P/B country data from MSCI country indexes: MSCI Brazil, MSCI Mexico, and MSCI Chile. As of April 14, 2025.

-

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892

Fixed income

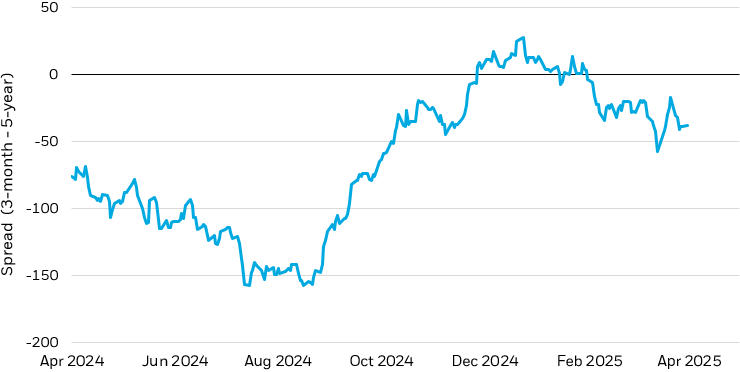

Rate volatility remains a key focus for financial markets. Rates on the long-end of the yield curve have risen steadily since the April 2nd tariff announcement, with 30-year nominal rates climbing 27 basis points and real 30-year rates popping 36 basis points.21 The dramatic move in the long-end of the curve has seen 10-year term premium push up to 10-year highs. Some of the move may be attributable to positioning and other temporary factors — the notable plunge in prime brokerage leverage data and the sharp move towards even more deeply negative swap spreads are consistent with the unwind of levered curve bets by hedge funds and other speculative actors. However, there are reasons to believe that long rates may continue to be volatile or even move higher, including a continued deterioration in the fiscal outlook. For this reason, we continue to favor exposure through the front-end and belly of the curve: maturities in the 3- to 7-year range.

Short-duration bonds remain a compelling tactical allocation. While the unwind of leveraged curve trades has sparked a sell-off on the long-end and a steepening of the yield curve, the front-end of the curve (0 to 5 years) has stayed elevated and relatively flat. We believe that income and carry look attractive on the front end of the Treasury curve as well as in select corporate credits and plus sectors. Elevated interest rate volatility often leads to pricing dislocations in the short end of the curve, which we believe can be opportunistically exploited through active management.

Figure 8: The yield curve is struggling to steepen in the front-end

Source: Bloomberg. Spread between U.S. 3-month and 5-Year U.S. Treasury indexes shown. As of April 21, 2025. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Line graph demonstrating the spread between the U.S. 3-month and 5-year Treasury index.

We believe duration may be unreliable as a traditional ballast in the case of a growth shock. Firstly, it is our view that the FOMC won’t speedily cut rates with inflation above trend and tariffs shocking prices higher. Secondly, we believe that rising term premia and funding market dynamics will continue to fuel rate volatility in longer-duration assets. Finally, the fiscal uncertainty introduced by tax cuts may call the long-term creditworthiness of the U.S. into further question.

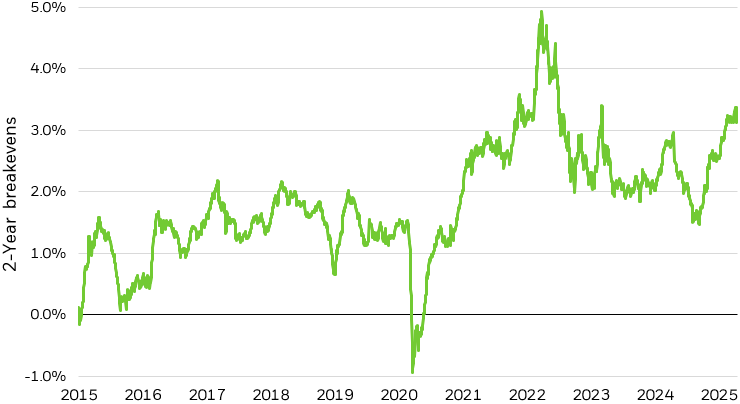

Protecting against inflation erosion

Global supply chains can evolve over time but cannot be rewired at speed without major disruption. Tariffs not only raise costs but can cut access to key inputs and potentially halt production. With the wholesale change to U.S. trade policy, inflation expectations have drifted higher. Currently, 2-year inflation breakevens (breakevens are market-implied inflation compensation over a particular period, in this case 2 years) are at some of the highest levels since the post-pandemic inflationary shock.22 Although we expect real yields to stay high, we think recent repricing higher in real rates have been overdone, and we favor inflation protection, particularly in the front-end of the curve.

Figure 9: Inflation expectations have moved higher given risk of tariffs

Source: Bloomberg. The U.S. Treasury 2-Year Breakeven Index, which reflects the market’s inflation expectations over the next two years by measuring the yield difference between 2 year Treasuries and 2 year TIPS, as of April 14, 2025.

Chart description: Line chart of the U.S. Treasury Yield 2-Year Breakeven Index from April 2015 to April 2025.

-

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892

Diversification in volatile regimes

In our 2025 Year Ahead Investment Directions, we discussed how risk factors such as broad tariff implementations, curbed immigration policy, and mounting deficit concerns could impede the trajectory of solid economic growth in the U.S. The levels of extreme uncertainty that have battered the market since have demonstrated the importance of portfolio diversification amid unpredictable market swings. Crucially, we believe investors can benefit from a more deliberate diversification strategy, where traditional asset classes may not meet the moment.

In the past few years, elevated interest rates and low equity risk premiums had eroded the negative equity-bond correlation that benefited a 60-40 portfolio for decades. This challenge could linger in a world of rising macro uncertainty, reinforcing the importance of alternative sources for portfolio diversification.

Diversify a portfolio with gold and infrastructure:

In an environment of continued macro uncertainty, we believe gold could function as a viable alternative in investor portfolios. Our analysis shows that a small addition of gold in a portfolio could boost its Sharpe ratio for 1- year, 3- year, 5- year and 10- year time periods.23

Gold may also be used as a hedge against monetary debasement and fiat currency risks. Historically, government debt levels have shown a positive correlation with the price of gold.24 Rising deficit levels across many developed economies, particularly in the U.S., have raised concerns about currency stability, making safe-haven assets like gold more attractive. (Learn more about U.S. deficit dynamics)

In addition, global central banks, which own nearly 20% of all physical gold ever mined, have significant influence on gold demand.25 Rising geopolitical uncertainty has prompted these institutions to bolster reserves, with Asian countries being particularly strong net buyers.26 We expect this trend to continue given the potential for them to diversify away from the U.S. dollar given more aggressive trade policies.

Besides gold, public and private infrastructure can also potentially bring portfolios diversification benefits. Over the past 17 years, public infrastructure has offered investors stable returns and a low correlation to other traditional asset classes, with added liquidity benefits compared to private infrastructure.27 In addition, long-term mega forces such as AI datacenter and sustainable transitions speak to the attractiveness of infrastructure as a strategic allocation for investors.

Diversify a portfolio with short-term exposures:

Short-term exposures can be another alternative asset class to consider in a highly volatile environment. Short-term bonds have typically been less sensitive to changes in interest rates and equity market uncertainty — consider, short-term bonds, on average, have had a lower correlation to stocks.28

These strategies help diversify portfolios away from near-term ups and downs by seeking to preserve capital. By parking cash in a lower risk asset, investors can later deploy it in places that may be attractive when market conditions support.

Figure 10: Short-term exposures help bring down overall portfolio beta relative to the S&P 500²⁹

Source: Morningstar. Stocks as represented by S&P 500 Index; Min Vol as represented by MSCI USA Minimum Volatility Index; Buffered as represented by CBOE S&P 500 95-110 Collar Index; HY as represented by ICE BofA U.S. HY Index; IG as represented by ICE BofA U.S. Corporate Index; Gold as represented by LBMA Gold Price Index; Bonds as represented by Bloomberg US Aggregate Bond Index; Equity Market Neutral represented by the average performance across 40 funds in the U.S. Fund Equity Market Neutral Morningstar Category. From April 1, 2015 to March 31, 2025. The up/down capture ratio, which refers to beta capture, shows how much a strategy tends to rise when the market goes up and how much it tends to fall when the market goes down. Past performance does not guarantee or indicate future results. Index performance is shown for illustrative purposes only. It is not possible to invest directly in an index.

Chart description: Bar chart illustrating the up capture ratio and down capture ratio various investment strategies and asset classes.

-

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892 -

iShares ETFs are available to purchase through a brokerage account or with a financial advisor.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs and ETPs trade commission free online through Fidelity.

By clicking on the button below, you will leave BlackRock’s website.

Buy now on Fidelity Contact your advisor

Contact a financial professional to discuss how iShares ETFs and ETPs can fit in your investment portfolio.

Email your advisor Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Any links to third-party websites are provided for use at your own discretion. Each third party is solely responsible for the content presented and availability of its website. BlackRock does not control, monitor or maintain third-party websites, their content or the products/services they offer. Content may change without notice. When you leave BlackRock’s website and enter a third-party website, you will be subject to that site’s terms, policies and/or notices, including those related to privacy and security, as applicable. Please review those policies and notices on the third-party website.

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1124U/S-3985892

The iShares Trusts are not investment companies registered under the Investment Company Act of 1940, and therefore are not subject to the same regulatory requirements as mutual funds or ETFs registered under the Investment Company Act of 1940. Investments in these products are speculative and involve a high degree of risk.