Updated: November 6, 2025

Investing in companies across the AI tech stack

Apr 21, 2025 Equity

Key takeaways

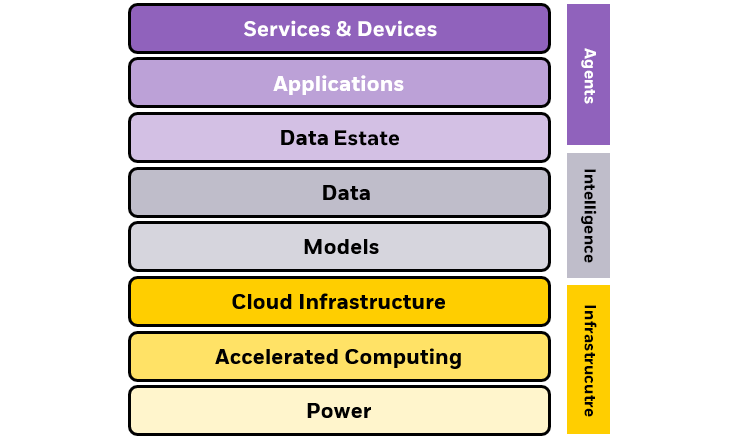

- AI’s “tech stack” is composed of infrastructure, intelligence, and agents with each layer playing a different role in the AI story.

- Different companies across these layers including Siemens Energy, Tempus AI and Shopify are reshaping the emergence of AI.

- An actively managed ETF like the iShares A.I. Innovation and Tech Active ETF (BAI), provides hand-picked exposure to companies enabling, developing, and deploying today's most advanced AI technologies.

Introduction

AI’s tech stack reflects innovation & transformation

It’s hard to believe that it has only been around 3 years since the release of ChatGPT ignited a generative AI revolution. In that time, surging AI optimism has catalyzed massive capex in AI infrastructure and remarkable advances beyond simply “text-in-text-out” to much more complex and productive capabilities. AI remains a powerful mega force still in the early innings of its adoption curve with the potential to reshape the economy on a scale comparable to the industrial revolution or rise of the internet. A range of companies are leading this transformation, hailing from various layers across the “AI tech stack” which includes infrastructure, intelligence, and agents.

Each layer of the tech stack plays an important role in AI’s emergence and presents different opportunities for investors. To delve deeper into each of these layers, we profile three companies currently held in the iShares A.I. Innovation and Tech Active ETF (BAI).

The AI stack

Source: BlackRock, as of April 2025.

Image description: Illustration showing the different layers of the AI tech stack across Infrastructure, Intelligence, and agents.

Infrastructure

Siemens Energy: a global leader in energy technology

Infrastructure is a critical component of the AI tech stack, serving as the physical foundation for AI compute used in training large language models and inference. Think, data centers, which are only continuing to grow in scale. Current estimates predict that power demand from AI data centers in the US could grow more than 30x, reaching 123 gigawatts, up from just 4 gigawatts in 2024.1

As a global energy provider focusing on energy transmission, energy generation, and renewable energy, Siemens (1.59% exposure in BAI)2, is operating across several key segments, including gas & power, grid technology, and energy services. Siemens plays a particularly crucial role in powering AI data centers through gas turbines. Natural gas’s affordability, reliability, and availability make it the fuel of choice for data centers.3 In fact, 60% of Siemens 14 gigawatts of gas turbine orders this year are linked to U.S. data centers.4 This demand is predicted to continue, especially in data center hot-spots like Texas, where 108 new gas-fired power plants are currently planned for deployment.5

Imagine: You’re listening to the weather, and a record-breaking heatwave is predicted. Your first thought may be preparing for a potential power outage, but AI-powered grids could detect disruptions to power lines in real time, re-routing electricity without human intervention to potentially spare.

Intelligence

Tempus: bringing the power of technology and AI to cancer care

The intelligence layer of the AI tech stack encompasses AI models and the unique data sets being used to train them.

As a technology platform focused on precision medicine, Tempus AI (1.02% exposure in BAI)6 leverages AI to analyze large datasets and provide insights for cancer treatment. The company has three main business segments: genomics, data & services, and AI applications. The company owns a large dataset of proprietary, de-identified clinical data, providing a competitive advantage in AI model training and insights generation. Tempus also benefits from strong relationships with oncologists and healthcare providers, with over half of US oncologists using Tempus' platform.7

Imagine: You can walk into a clinic and get a personalized cancer treatment plan within minutes — tailored to your genetic profile and medical history. AI models make this possible by turning mountains of clinical data into life-saving insights, transforming how doctors treat disease.

Agents

Shopify: leveraging AI to make commerce better for everyone

The final layer of the AI tech stack is agents. Think of this as the real-life applications of AI that have seamlessly integrated into the services and solutions you turn to daily.

As a leading global commerce company, Shopify (1.03% weight in BAI)8 is providing trusted tools to start, grow, market, and manage retail businesses of various sizes. The company offers a comprehensive e-commerce solution for small to medium-sized businesses (SMBs), enabling them to manage their businesses across multiple sales channels, including web and mobile storefronts, physical retail locations, social media storefronts, and marketplaces. Shopify's partnership with OpenAI for Instant Checkout within ChatGPT positions the company at the forefront of AI-driven commerce, giving it direct access to the 2%9 of ChatGPT’s 2.5 billion daily queries10 focused on purchasable products.

Imagine: You can chat with an AI assistant about a birthday gift idea, and within seconds, it finds the perfect item, checks inventory, and completes your purchase — all without you lifting a finger. Ecommerce integration with AI chatbots like ChatGPT is turning casual conversations into seamless transactions.

Conclusion

As AI continues to evolve and change the way we view technology, so must the way in which we invest in it. Investing dynamically across the different layers of the AI tech stack could be key to capturing the full investment opportunity in the AI theme. While the largest names in the space tend to make headlines, we believe there are under-the-radar players in AI that represent some of the most compelling opportunities. An actively managed ETF like the iShares A.I. Innovation and Tech Active ETF (BAI), provides hand-picked exposure to companies enabling, developing, and deploying today's most advanced AI technologies.

Holdings as of 11/4/2025 and subject to change. There is no guarantee that the companies discussed remain in the fund. For a complete list of most recent holdings, click on the fund card below. This is not meant as a guarantee of any future result or experience. This information should not be relied upon as research, investment advice or a recommendation regarding the Funds or any security in particular. Specific companies or issuers are mentioned for educational purposes only and should not be deemed as a recommendation to buy or sell any securities.