Dividend strategies may help increase income potential because they focus on companies that have a history of paying out dividends, which are company profits distributed to shareholders.

Companies that pay dividends tend to be mature with stable earnings that can support dividend payouts. Because their rapid growth phase is often behind them, these companies tend to tilt more as value exposures and often trade at a discount to the broader market.3 That contrasts with the largest companies in many stock indexes today: growth companies pioneering new technology like AI are often more inclined to invest profits in new projects, rather than return to it directly to shareholders. Those tech companies tend to exhibit stronger growth and, as a result of those lofty expectations for the future, often trade at higher price-to-earnings multiples.

There are two main types of dividend strategies.

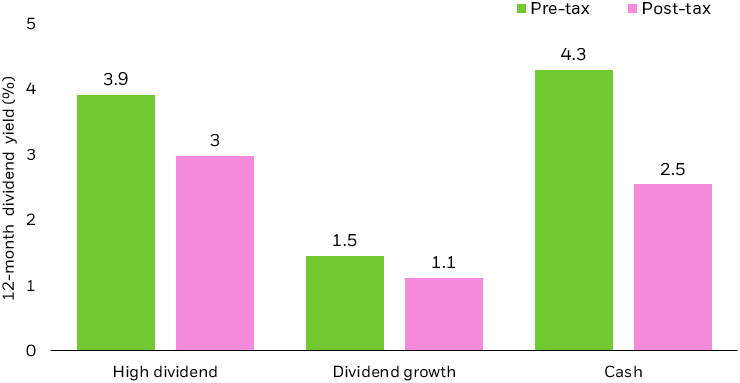

- Dividend growth: companies that have a sustained history of growing dividends.

- High dividends: companies that are screened for financial health and have a history of paying out relatively high dividends.

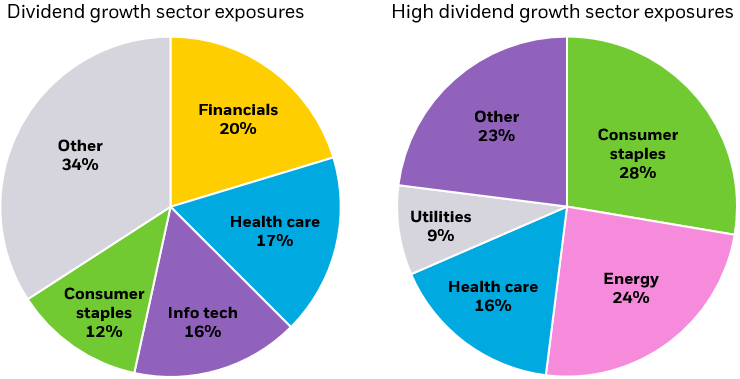

Dividend growth and high dividend strategies, while tilted to value, do differ in sector composition, so it’s important for investors to consider the context of their portfolio when choosing which dividend strategy to employ. For example, high dividend tends to tilt more defensive than dividend growth.

Both dividend stock strategies typically exhibit lower earnings volatility vs. the S&P 500, which can potentially provide portfolios with resiliency in the case of an AI-led sell-off.4 High dividend and dividend growth stocks have lower correlations to the tech sector than the S&P 500 and a 60% stocks/40% bonds portfolio.5