Hi everyone, I’m Gargi Pal Chaudhuri, here with another Macro Minute.

The Federal Reserve just cut interest rates by a quarter of a percent — the first move we’ve seen since December 2024. This was widely expected, and investors are now watching closely for additional cuts later this year.

Here are the key takeaways: Some key takeaways: the FOMC statement mentioned that "downside risks to employment has risen" and in the Summary of Economic projections, growth and inflation were both nudged higher this year and next. At the same time, medium-term unemployment rate projections moved lower. Together, we feel this suggests that labor market conditions — not inflation — were the main driver behind the Fed’s decision to cut rates.

In the press conference, Fed Chair Jerome Powell described this move as a “risk management” cut — meaning it’s preventative rather than reactive.

What does this mean for portfolios?

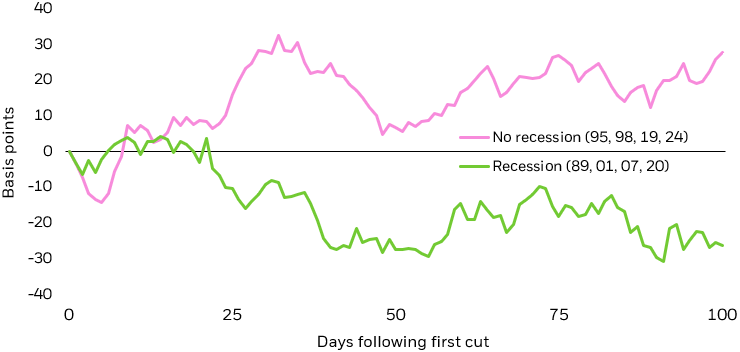

First, bonds. When the Fed begins an easing cycle, bonds in the middle of the curve — around three to seven years — often strike the right balance of income and protection if rates continue to move lower. Investors can consider options like the iShares 3–7 Year Treasury Bond ETF, or a diversified approach to maximize long-term income with the iShares Flexible Income Active ETF.

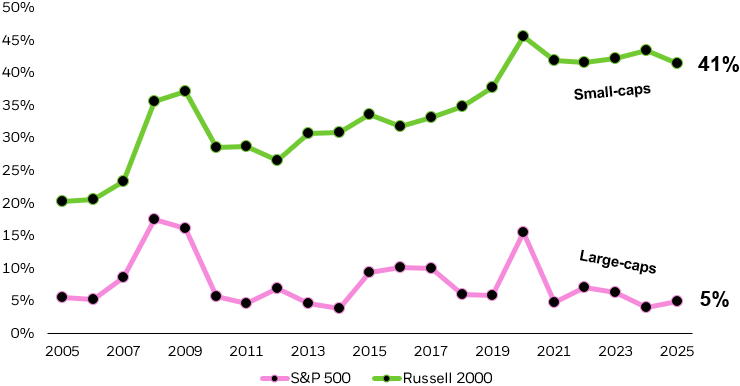

Second, U.S. stocks. Discount rates fall when the Fed cuts, which benefits growth stocks, especially in technology. A strategy that focuses on quality growth at reasonable prices, like the iShares MSCI Quality GARP ETF, can help target the areas most likely to benefit.

Third, international markets. Fed rate cuts often put downward pressure on the U.S. dollar, which can be a tailwind for international equities. Broad exposure through the iShares Core MSCI Total International Stock ETF allows investors to tap into those opportunities across developed and emerging markets.

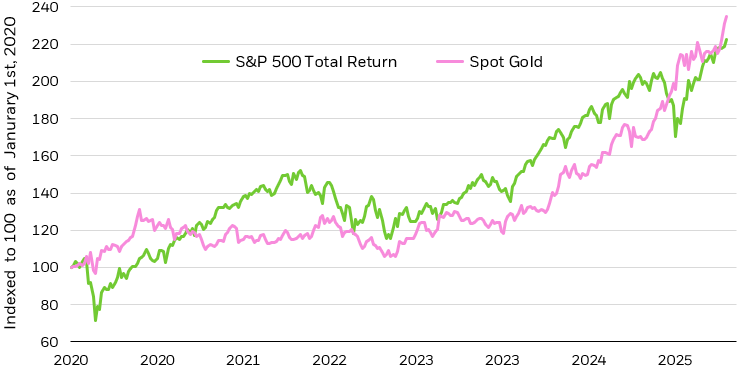

Finally, alternatives. Gold remains one of our preferred assets in this environment. Falling real rates and still-sticky inflation support its role in portfolios. On the far end of the risk spectrum, Bitcoin has also tended to perform well during past Fed easing cycles, though investors should treat it as a much higher-risk asset.

Thanks for watching, and head over to iShares.com to read our new article on what this easing cycle means for portfolios.

Disclosures:

Source: Quotations from the Federal Reserve September FOMC Meeting Press Conference on September 17, 2025. Views are subject to change.

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in the value of debt securities.

Credit risk refers to the possibility that the debt issuer will not be able to make principal and interest payments.

Actively managed funds do not seek to replicate the performance of a specified index, may have higher portfolio turnover, and may charge higher fees than index funds due to increased trading and research expenses.

There is no guarantee that an active fund will meet its investment objective.

Diversification and asset allocation may not protect against market risk or loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics ("factors"). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

The opinions expressed are as of the date indicated and may change as subsequent conditions vary.

The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents.

This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts.

There is no guarantee that any of these views will come to pass. Reliance upon information in this material is at the sole discretion of the viewer. This material contains general information only and does not take into account an individual's financial circumstances.

This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

This material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice.

Prepared by BlackRock Investments, LLC, member FINRA.

©2025 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, and the iShares Core Graphic are trademarks of BlackRock. Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH0925U/S-4828176