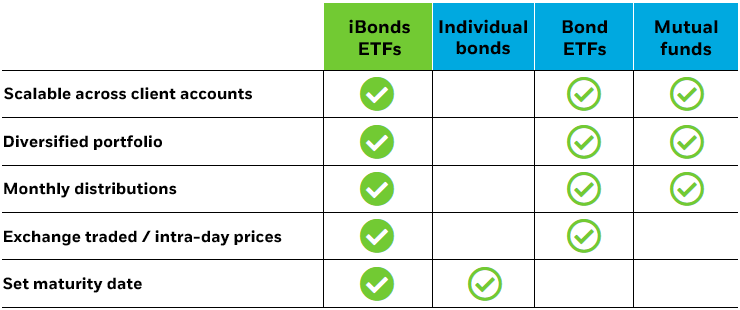

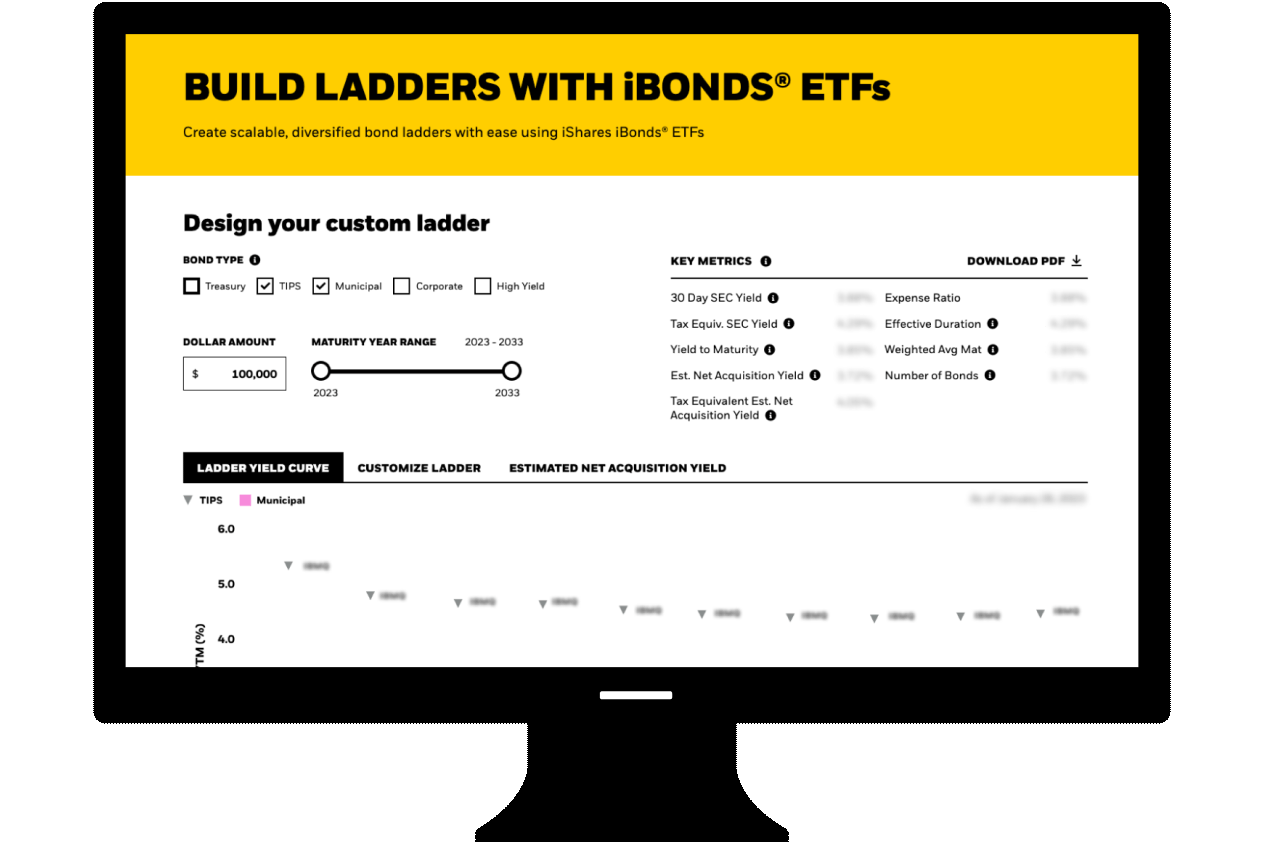

Put your bond ladder on autopilot

Introducing iShares iBonds Ladder ETFs

iBonds Ladder ETFs take convenience to the next level:

- Access a bond ladder with one ticker — iBonds Ladder ETFs seek to hold an equal weighted allocation to 5 iBonds ETFs with maturities in the 1–5 year range.

- Continuously rolled to maintain exposure — iBonds Ladder ETFs aim to rebalance every June, removing the need to manually reallocate your portfolio every year.