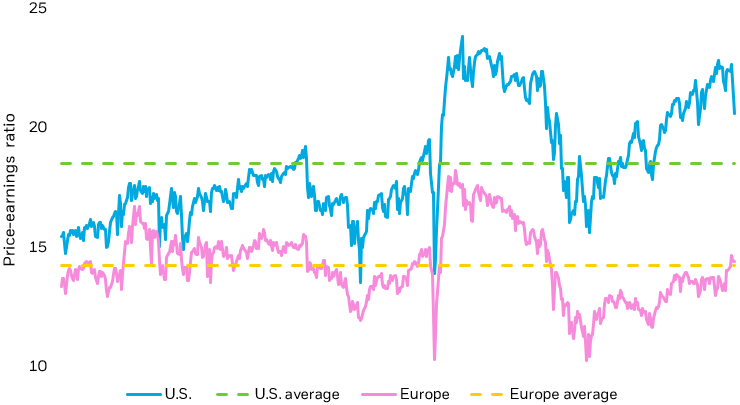

Many of the catalysts for Europe’s Q1 move remain in place and could support a resumption of positive momentum as tariff shocks fade. These include:

- The perception that a potential Ukraine peace deal may bring lower energy prices to Europe.

- Historic plans in Germany to unleash spending on defense and infrastructure amid U.S. policy changes and the broader mega force of geopolitical fragmentation.

- Muted inflation, potentially allowing for European Central Bank (ECB) interest rate cuts.

- Hopes that stimulus in China will boost the economy and benefit Europe’s exporting companies.

- Most important, in our view, robust earnings ― growing by more than 7% in the fourth quarter of 2024 versus the same period a year earlier.6

In all, we believe European stocks are supported by a unique set of tailwinds in 2025, although it’s important to be selective as not all sectors and companies may benefit equally.

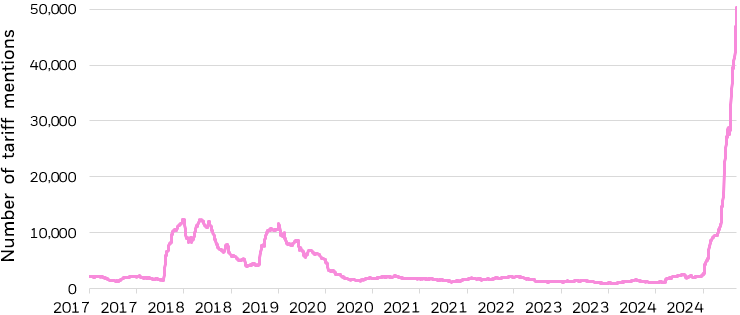

Risks remain. First, tariff machinations cloud the outlook and could hit Europe’s large auto sector especially hard. Second, a Ukraine peace deal may not actually bring much lower gas prices to Europe given the EU’s desire to move permanently away from Russian fossil fuels by 2030. And third, while Germany has the capacity to spend more money and boost growth, some other European countries are constrained by high debt levels.

Asia’s AI Ecosystem: China’s economic outlook remains foggy. U.S./China tariffs are key to watch. In addition, China’s property sector needs more fixing, consumers aren’t spending enough, society is aging fast, geopolitical and economic tensions have risen and fiscal reforms continue to underwhelm.

While all of this undermines short-term equity market performance, AI is about the long term. DeepSeek’s large language models advanced the conversation on AI, stressing efficiency in technology and capital deployment. The buildout to general purpose AI will still require massive investment over multiple years. In the short horizon, China’s AI-empowered tech companies could stimulate consumer and business demand in ways monetary and fiscal policies have not.

We see three reasons for this:

- First, these companies, particularly the internet commerce giants, have a pulse on people’s wants and incentives to spend.

- Second, both enterprises and individuals in China are known for their strong impulse to adopt new technology.

- Third, tenuous geopolitical and global trade dynamics compel policymakers to focus on domestic growth engines, and private enterprises appear optimally positioned. President Xi Jinping’s recent meetings with company executives could signal a new era of cooperation.

Our analysis finds that the pre-tariff surge in China-listed shares of diversified internet commerce giants with cloud services was well-grounded in fundamentals. An optimistic view could see the positive momentum broadening in the market. Yet caution and a selective approach is warranted as China’s economic story continues to evolve and geopolitical factors, including those related to U.S. policy, feature heavily.

Beyond China specifically, Asian countries are embracing the AI revolution, from the big infrastructure build to adoption via applications and automation. Japan, for example, has led in efforts to use technology to address societal problems such as the aging population and labor shortages.

Since Chat GPT came out at the end of 2022, correlations across the AI opportunity set have varied widely within Asia. They’ve also shown differentiation relative to their U.S. counterparts in the NASDAQ 100. Our calculations show correlations in the area of 64% for hardware and semiconductors and about 38% for application and physical AI.7

For investors looking forward to the long-term AI opportunity, we believe a global approach to investing in the theme could gain from Asia’s ample breadth, liquidity and potential for sector and currency diversification.

AI seemingly moves at two speeds: fast and faster, blurring the lines between buildout and adoption and fast-tracking productivity gains many anticipated could take years to realize. We believe Asia’s technology titans and intellectual capital are contributing to the time squeeze and, in the process, expanding potential investment opportunities.