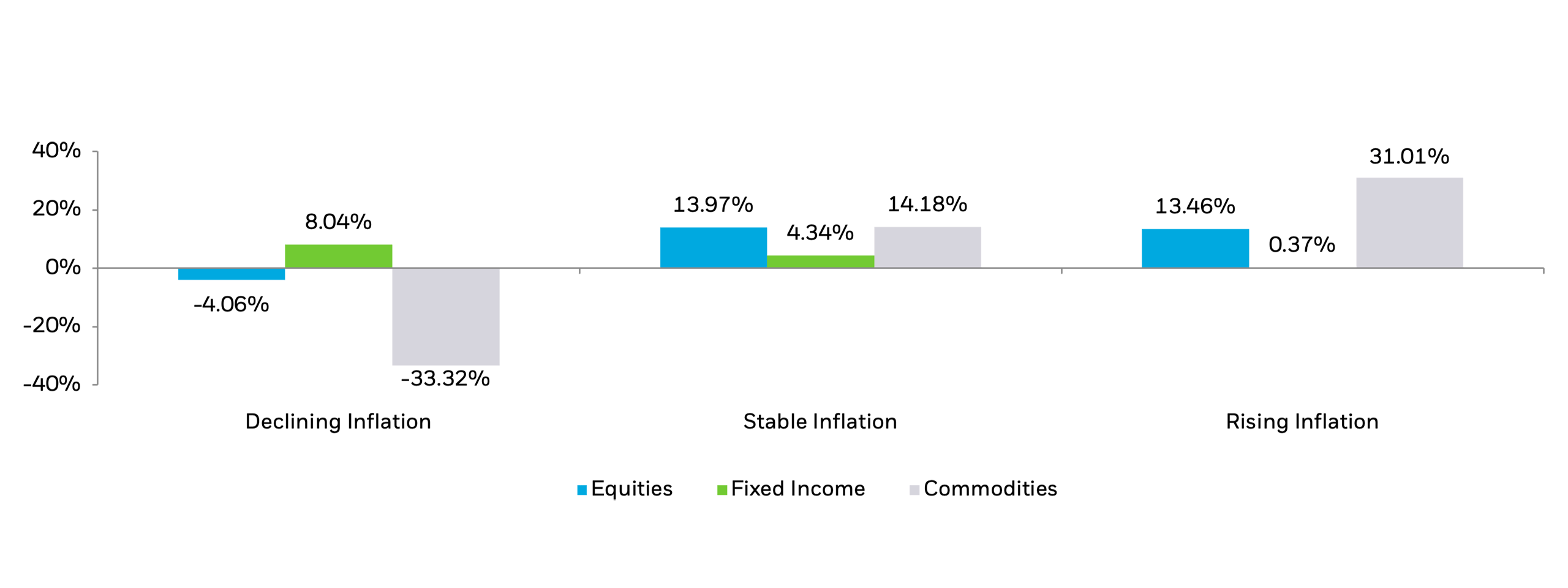

Asset class index performance during different inflation scenarios

Source: BlackRock Calculation, Bloomberg as of 11/30/2023. Inflation periods defined by QoQ Seasonally-adjusted CPI changes of more or less than 18bps, or 40%, from the median QoQ CPI change of 44bps. Inflationary periods measured between Oct 2000 and Nov 2023. Equities are proxied by the S&P 500 Index, Fixed Income is proxied by the Bloomberg US Aggregate Bond Index, Commodities proxied by the S&P GSCI Total Return Index. For illustrative and educational purposes. Not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Chart of index performance of equities, fixed income and commodities during different inflationary periods showing how commodities performance as an asset class varies widely in relation to equities and fixed income across periods of rising, stable, and declining inflation.