- Recent clinical trial success for the second significant, disease-modifying drug to treat Alzheimer’s is a critical milestone and a positive sign for the future of neuroscience.

- Technological advancements, particularly artificial intelligence (AI), are supercharging medical breakthroughs with smarter drug discovery, faster development, increased diagnostic accuracy, and higher industry output.

- Secular trends, such as aging demographics, medical technology innovation and faster approvals, plus cyclical factors, such as favorable valuations, may create attractive long-term opportunities in neuroscience and AI.

Finding investment opportunities in neuroscience and AI

Jun 08, 2023 Industry

KEY TAKEAWAYS

A CRITICAL MILESTONE FOR ALZHEIMER’S TREATMENTS

Since we published our neuroscience theme primer in August 2022, we have seen extraordinary advances in Alzheimer’s treatments. The experimental drug donanemab slowed cognitive decline in Alzheimer’s patients by 35% in a Phase 3 trial, potentially paving the way for U.S. approval.1 Following on the heels of comparable results for a similar antibody, lecanemab, the data bolsters the long-held — but once contested — hypothesis that preventing the accumulation of a protein called beta amyloid (“plaque”) in the brain could help the many millions afflicted with the disease. After almost 20 years without new Alzheimer’s drugs, we now have two with potential in just 12 months.

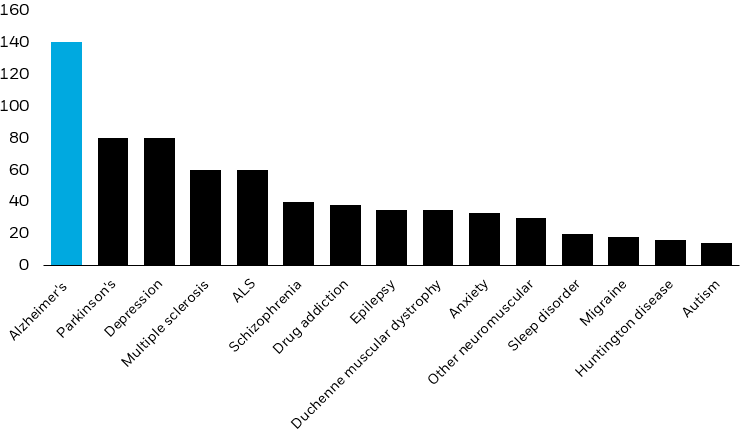

Beyond donanemab and lecanemab, there are a range of disease-modifying drugs in clinical development that could help address the significant unmet needs of those with dementia and other neurocognitive disorders. Neurology is expected to see the fourth-most drug spending across therapeutics, potentially reaching $151 billion by 2026.2 Neuroscience drugs already represent 11% of the global late-stage pipeline,3 and Alzheimer’s is the largest area of focus within neurology research.4

Neurology research is focused on Alzheimer’s

Number of products in neurology Phase I to regulatory submission pipeline in 2022 by disease

Source: IQVIA Pipeline Intelligence, Dec 2022; IQVIA Institute, Jan 2023.

Chart description: Column chart showing the number of products in neurology Phase I trials to the regulatory submission pipeline in 2022 by disease. The chart shows that neurology research is focused on Alzheimer's disease.

ARMING NEUROSCIENCE COMPANIES WITH AI

AI adoption in neuroscience is rapidly improving with progress across drug research & development (R&D), diagnostics and our understanding of the brain itself.

R&D capabilities, including smarter drug discovery and development, are being advanced by machine learning, large data sets and generative AI, which can have human-like conversations, create content, images and audio. Researchers can now use computing power to identify clinically meaningful patterns in data with efficient AI algorithms.5 These technologies have helped to shorten early drug development timelines. In fact, scientists might be able to develop drugs in one-tenth of the time.6

Diagnostic accuracy also continues to improve. A team at Massachusetts General Hospital used deep learning, a type of machine learning and AI that utilizes large amounts of data and complex algorithms, to train models that test for Alzheimer’s based on data from brain MRIs collected from patients with and without the disease. The model was tested on tens of thousands of routine brain scans and spotted disease risk with 90% accuracy.7

AI is even helping scientists better understand the inner workings of natural brains. Artificial neural networks (ANNs), while not designed to mimic human brains, are exhibiting similar “thinking.” For example, the interpretation of visual stimuli in the human brain builds up neuron by neuron — first distinguishing shapes, then colors and so on “until eventually, the brain decides whether it is looking at a car, a dog or banana...”, as described in an article published by The Economist.8 Surprising brain and machine learning researchers alike, AI is taking virtually the same approach when tasked with identifying visual cues. Similarities are also appearing in speech and language processing, as ANNs digest more data with ever greater processing power. This is a game changer for better understanding human brains and allowing the human brain to be directly linked to machines; for example, potentially returning eyesight or motor control to the handicapped.

A CASE FOR HEALTHCARE STOCKS

Erin Xie, head of the Health Sciences team in BlackRock's Active Equity Group emphasizes that “over the long-term, [we] are seeing secular drivers for the sector remain in place; firstly, aging demographics in both developed and developing countries and secondly, innovation in medical technology.” Her team is seeking opportunities in healthcare segments with attractive valuations, stable growth, and promising product pipelines for selective growth opportunities in biotech, pharmaceuticals, and medical devices.

Critical to all three of these areas, the approval process has become shorter for certain treatments and diagnostics with high unmet needs. In 2022, 65% of the U.S. Food and Drug Administration’s Center for Drug Evaluation and Research’s 37 novel drug approvals used one or more of these expedited programs.9

The current restrictive capital markets environment has negatively affected many smaller cap healthcare companies, often the purest players in areas like neuroscience, making it challenging for them to fund development in the short-term. This dynamic has brought down valuations and therefore created an attractive mergers and acquisitions (M&A) environment that has the potential to drive significant returns for acquirees and could present an attractive entry point for investors across the space.

CONCLUSION

The concurrent trends of groundbreaking medical innovation and AI advancements come together to create a strong, long-term case for neuroscience. And we believe that neuroscience may be well-positioned in the short-term given M&A dynamics and attractive valuations. Investors seeking exposure to advances in neuroscience and AI may want to consider looking to active and index ETFs to potentially capture the opportunity.