Picking individual stocks can be exciting. But it can also be difficult. It takes time to find the right companies. And even then, the initial excitement can quickly turn to fear if the stock you pick doesn’t perform well.

This is why investors may want to consider complementing their single stock allocations with a long-term investment strategy that aims to keep you on track to meet your future financial goals, regardless of the performance of a single stock.

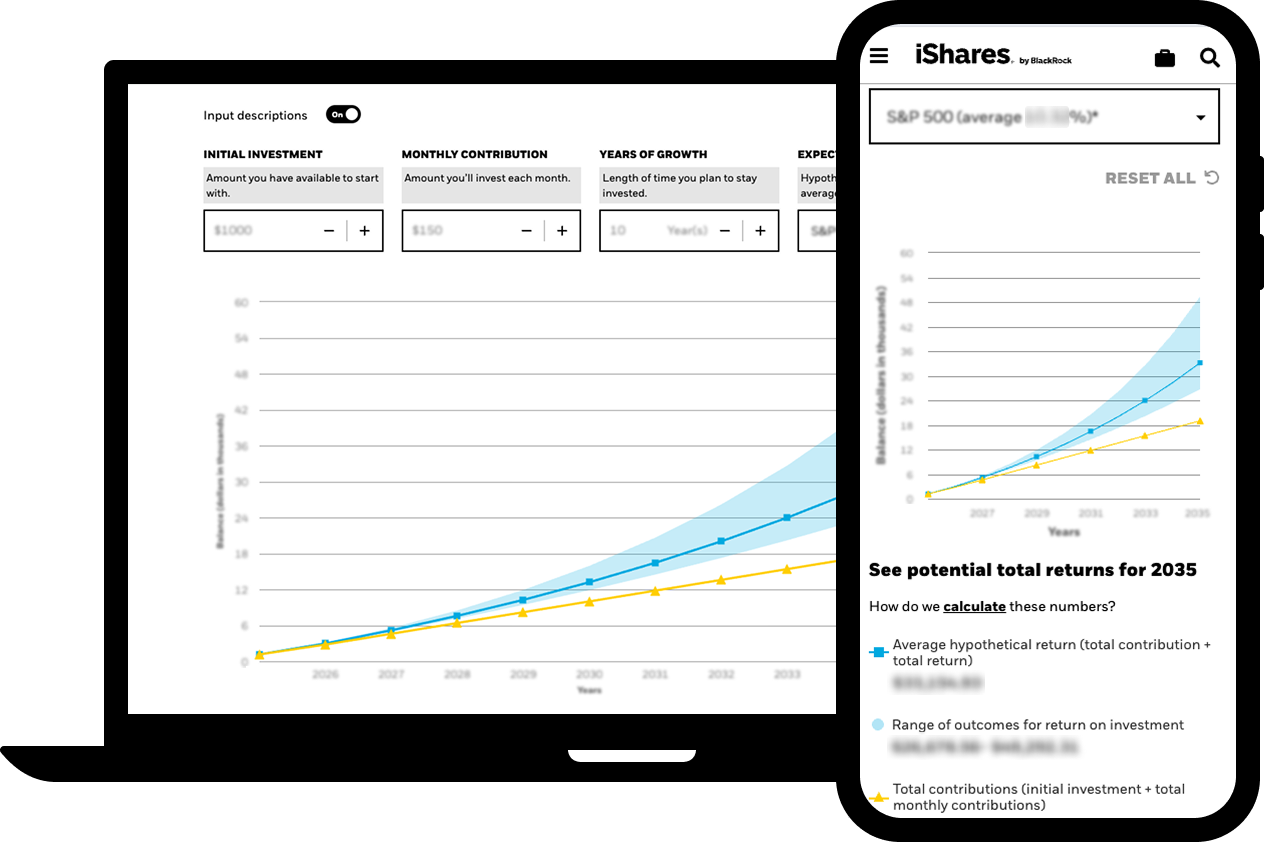

Exchange Trade Funds or ETFs can help you do just that.

The best part is — it can be as easy as choosing a playlist of songs.

When you want to listen to songs from a certain era or genre, it takes time and effort to research artists, pick individuals songs, buy those songs, and put it all together.

It’s much easier, quicker & cheaper to choose a curated playlist like “Today’s Top Hits” or “80s Rock”.

Like a playlist is a group of songs, an ETF is a diversified group of stocks that often seeks to track an index, like the S&P 500.

Whether you’re looking to invest in a particular sector, a specific geography, or theme, ETFs can give you exposure to companies that align with your views on the market, all while minimizing the risk of picking a single company that may ultimately not perform well.

And like playlists make it easier for people to listen to music they like, ETFs make it easier for people to get invested and stay invested.

1. They’re low cost — which can help you invest more of your hard-earned money.

2. They’re generally tax efficient — helping you keep more of what you earn.

3. And they’re transparent — Allowing you to see what you own and keep your asset allocation in check.

Whether you’re looking to build wealth, or to just save up for a vacation, iShares ETFs can make investing as easy as choosing a playlist of songs.

Get started today with iShares ETFs.

Visit www.iShares.com to view a prospectus, which includes investment objectives, risks, fees, expenses and other information that you should read and consider carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/developing markets and in concentrations of single countries. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and the general securities market. Small-capitalization companies may be less stable and more susceptible to adverse developments, and their securities may be more volatile and less liquid than larger capitalization companies.

Transactions in shares of ETFs may result in brokerage commissions and may generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Diversification and asset allocation may not protect against market risk or loss of principal.

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes and is subject to change.

The information on funds not managed by BlackRock or securities not distributed by BlackRock is provided for illustration only and should not be construed as an offer or solicitation from BlackRock to buy or sell any securities.

The iShares and BlackRock Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2022 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH1124U/S-4050664