Strategies with environmental, social and/or governance (ESG) objectives, themes, and related considerations as a primary means for selecting investments.

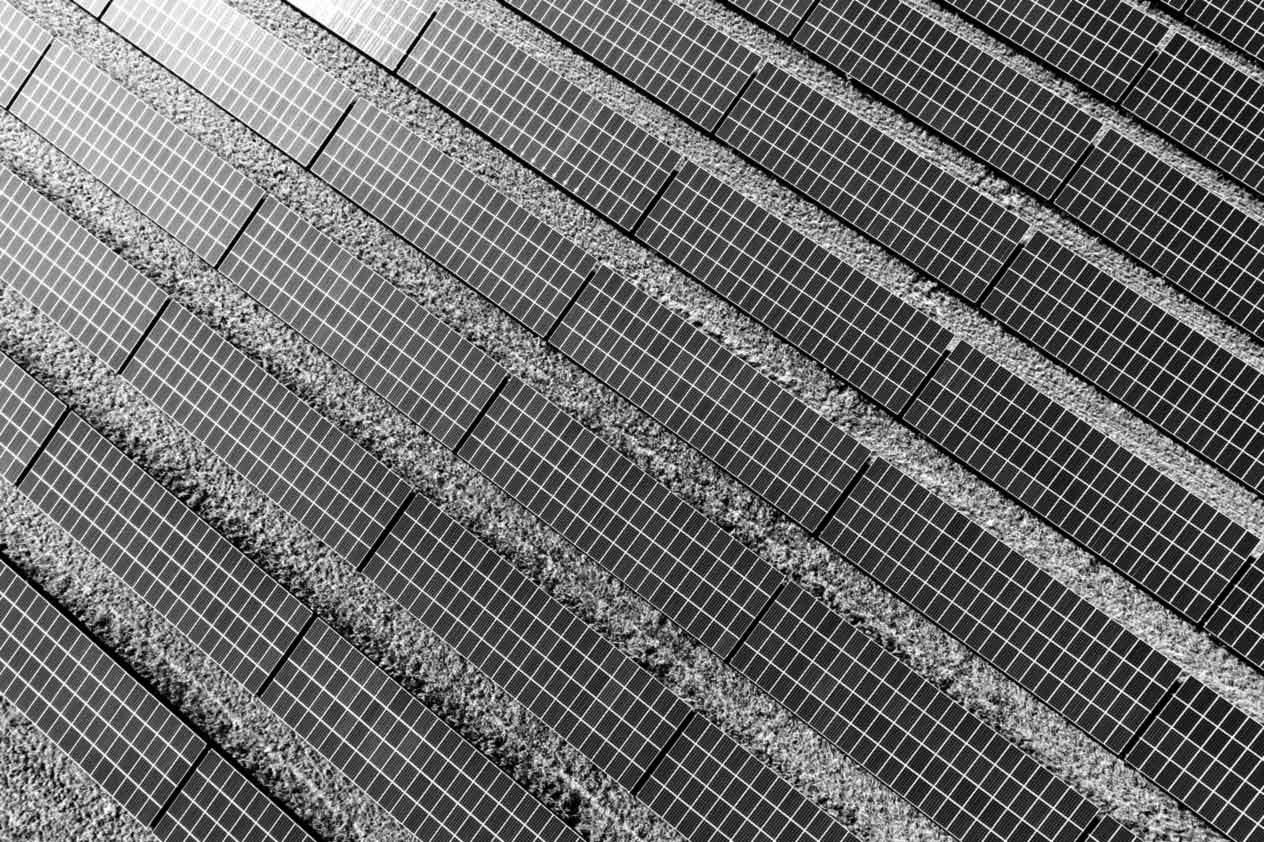

SUSTAINABLE INVESTING

Understand sustainable investing and how to build a portfolio that matches your investment goals.

SUSTAINABLE INVESTING 101

ENVIRONMENTAL

• Water use

• Land use

• Waste management

• Climate risk

SOCIAL

• Human capital

• Health & safety

• Product liability

• Data privacy

GOVERNANCE

• Accounting practices

• Ownership & control

• Board independence

• Ethics

For illustrative purposes only. This is not an exhaustive list of ESG considerations.

Investing sustainably can be simple. To get started, visit our starter kit page for guidance. If you are a financial professional, visit Advisor Center for an in-depth look at sustainable.

FIND A SUSTAINABLE FUND THAT ALIGNS WITH YOUR INVESTMENT GOALS

Select your primary investment goal, then explore the corresponding fund range.

SCREENED

Constrain investments by avoiding issuers or business activities with certain environmental, social and / or governance characteristics.

UPLIFT

Commitment to investments with improved environmental, social and / or governance characteristics versus a stated universe or benchmark.

THEMATIC

Targeted investments in issuers whose business models may not only benefit from but also may drive long-term sustainability outcomes.

IMPACT

Commitment to generate positive, measurable, and additional sustainability outcomes.

INSIGHTS

WHAT ARE THE INVESTMENT IMPLICATIONS OF U.S. TRANSITION POLICY?

The U.S. Inflation Reduction Act, passed in August 2022, contains a range of measures to spur the transition to a low-carbon economy. Learn what this may mean for you.

Investment stewardship

We engage with companies to inform our voting and promote sound corporate governance that is consistent with durable, long-term financial value creation for our clients.