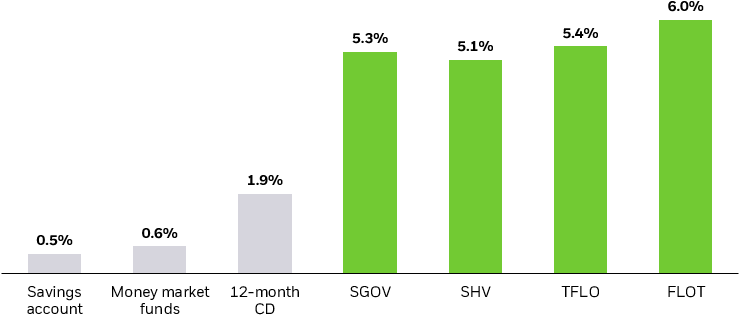

Source: BlackRock, FDIC, iMoneyNet, as of 8/31/2024. Govt Money Market Funds yield is the average 1-day simple net yield for government-only money market funds. Bond ETF yields are yield to maturity. This information must be preceded or accompanied by a prospectus for the iShares funds.

Performance data represents past performance and does not guarantee future results. Investment return and principal value will fluctuate with market conditions and may be lower or higher when you sell your shares. Current performance may differ from the performance shown. For a prospectus, standardized performance and most recent month end performance, click on the fund’s ticker symbol; SGOV, SHV, TFLO, FLOT.

“Money Market Fund” represents 2a-7 Money Market Funds and is calculated using the Weighted Average 7-Day Yield of the Morningstar “Money Market – Taxable” Category. “Savings Account” and “12 Month Bank CD” are the average APY rate of all FDIC-insured savings and 12-month bank CDs. iShares and BlackRock ETF yields represent the 30-Day SEC Yield. It’s important to note that there are material differences between Savings accounts, Money Market Funds, CDs and ETFs, including investment objectives, risks, fees, and expenses. CDs are fixed income investments that generally pay a set rate of interest over a fixed time period until maturity, whereupon the original principal is typically returned plus any interest earned. Early withdrawal from CDs may result in early withdrawal fees. Most savings accounts pay compound interest, meaning earnings are added to the balance to create a larger base on which future interest is paid. Most savings accounts allow you to add or withdraw money at any time without incurring a fee. Both Savings accounts and CDs principal investments are insured by the FDIC up to applicable FDIC limits, while ETFs are not FDIC insured and may lose value. Money Market funds typically seek to maintain a net asset value of $1.00 per share, but there is no guarantee they will do so and are not FDIC insured. Most ETFs seek to track an index, before fees and expenses. ETFs trade on exchanges intraday at market price, which may be greater or less than net asset value. Transactions in shares of ETFs may result in brokerage commissions and may generate tax consequences. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Short duration bond ETFs typically carry a higher degree of risk than the other cash alternatives and should not always be used as a substitute.

Chart description: Bar chart showing a comparison of yields currently available on various short-term products.