IBMQ

iShares® iBonds® Dec 2028 Term Muni Bond ETF

-

Fees as stated in the prospectus

Expense Ratio: 0.18%

Overview

Performance

Performance

Growth of Hypothetical $10,000

Distributions

| Record Date | Ex-Date | Payable Date |

|---|

Premium/Discount

-

Returns

| 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|

| Total Return (%) | 2.53 | 4.05 | 0.48 | - | 2.01 |

| Market Price (%) | 2.48 | 4.16 | 0.47 | - | 2.04 |

| Benchmark (%) | 2.73 | 4.23 | 0.66 | - | 2.05 |

| After Tax Pre-Liq. (%) | 2.53 | 4.05 | 0.48 | - | 2.01 |

| After Tax Post-Liq. (%) | 2.48 | 3.62 | 0.76 | - | 1.93 |

| YTD | 1m | 3m | 6m | 1y | 3y | 5y | 10y | Incept. | |

|---|---|---|---|---|---|---|---|---|---|

| Total Return (%) | 3.47 | 0.15 | 1.41 | 2.59 | 2.53 | 12.64 | 2.44 | - | 13.73 |

| Market Price (%) | 3.50 | 0.16 | 1.52 | 2.63 | 2.48 | 13.01 | 2.36 | - | 13.93 |

| Benchmark (%) | 3.58 | 0.12 | 1.43 | 2.63 | 2.73 | 13.24 | 3.35 | - | 14.00 |

| After Tax Pre-Liq. (%) | 3.47 | 0.15 | 1.40 | 2.59 | 2.53 | 12.64 | 2.44 | - | 13.73 |

| After Tax Post-Liq. (%) | 2.73 | 0.17 | 1.08 | 2.03 | 2.48 | 11.27 | 3.86 | - | 13.17 |

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Total Return (%) | 6.78 | -0.23 | -6.77 | 3.97 | 0.75 |

| Market Price (%) | 6.93 | -0.26 | -6.77 | 4.02 | 0.71 |

| Benchmark (%) | 6.36 | 0.35 | -7.20 | 4.10 | 1.11 |

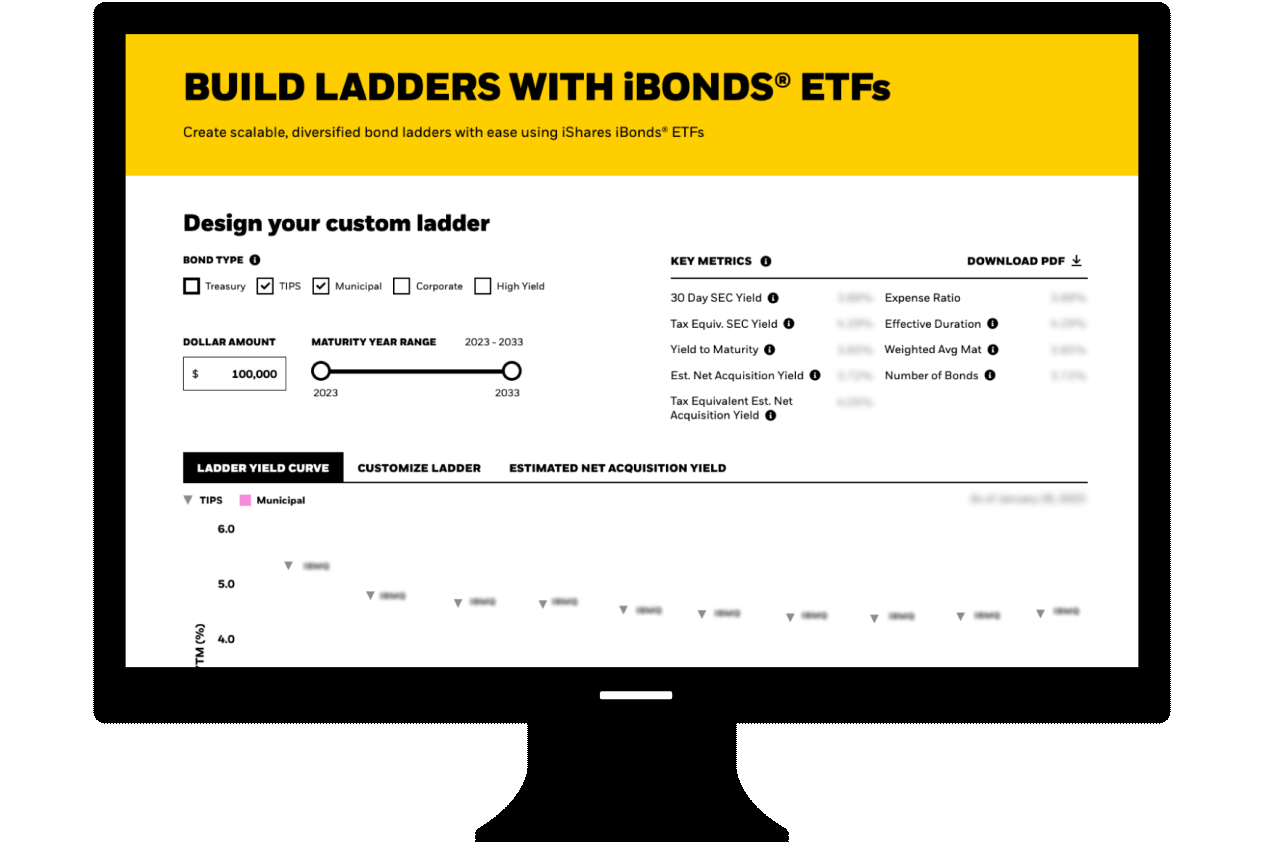

START BUILDING BETTER BOND LADDERS NOW

Financial professionals can test drive the iBonds ETFs suite with our fully customizable bond laddering tool.

Key Facts

Key Facts

Portfolio Characteristics

Portfolio Characteristics

Fees

Fees

| Management Fee | 0.18% |

| Acquired Fund Fees and Expenses | 0.00% |

| Other Expenses | 0.00% |

| Expense Ratio | 0.18% |

The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year. Amounts are rounded to the nearest basis point, which in some cases may be "0.00".

Ratings

Holdings

Holdings

| Issuer | Weight (%) |

|---|---|

| CALIFORNIA (STATE OF) | 3.15 |

| NEW YORK CITY TRANSITIONAL FIN AUTH | 1.89 |

| ILLINOIS (STATE OF) | 1.79 |

| NEW YORK CITY OF | 1.78 |

| CONNECTICUT (STATE OF) | 1.61 |

| Issuer | Weight (%) |

|---|---|

| WASHINGTON (STATE OF) | 1.54 |

| DORMITORY AUTHORITY OF STATE OF NEW YORK | 1.42 |

| METROPOLITAN TRANSPORTATION AUTHORITY | 1.39 |

| PENNSYLVANIA (COMMONWEALTH OF) | 1.26 |

| NEW JERSEY ECONOMIC DEVELOPMENT AUTHORITY | 1.08 |

| Name | Sector | Asset Class | Market Value | Weight (%) | Notional Value | Par Value | CUSIP | ISIN | SEDOL | Price | Location | Exchange | Currency | Duration | YTM (%) | FX Rate | Maturity | Coupon (%) | Mod. Duration | Yield to Call (%) | Yield to Worst (%) | Real Duration | Real YTM (%) | Market Currency | Accrual Date | Effective Date |

|---|

The values shown for “market value,” “weight,” and “notional value” (the “calculated values”) are based off of a price provided by a third-party pricing vendor for the portfolio holding and do not reflect the impact of systematic fair valuation (“the vendor price”). The vendor price is not necessarily the price at which the Fund values the portfolio holding for the purposes of determining its net asset value (the “valuation price”). Holdings data shown reflects the investment book of record, which may differ from the accounting book of record used for the purposes of determining the Net Assets of the Fund. Notional value represents the portfolio's exposures based on the economic value of investments and options are delta-adjusted. Additionally, where applicable, foreign currency exchange rates with respect to the portfolio holdings denominated in non-U.S. currencies for the valuation price will be generally determined as of the close of business on the New York Stock Exchange, whereas for the vendor price will be generally determined as of 4 p.m. London. The calculated values may have been different if the valuation price were to have been used to calculate such values. The vendor price is as of the most recent date for which a price is available and may not necessarily be as of the date shown above.

Please see the “Determination of Net Asset Value” section of each Fund’s prospectus for additional information on the Fund’s valuation policies and procedures.

Exposure Breakdowns

Exposure Breakdowns

% of Market Value

Estimated Net Acquisition Yield Calculator

Estimated Net Acquisition Yield Calculator

The ENA Yield metric does not include the impact of cash reinvestment rates (e.g., during the final year prior to maturity), potential losses arising from credit downgrades or defaults, or changes to the portfolio composition over time.

The Estimated Net Acquisition Yield is an annualized number. For periods less than one year, the yield adjustment will be magnified for a given change in price. This effect will increase as the fund approaches maturity.

READY TO INVEST?

READY TO INVEST?

There are many ways to access iShares ETFs. Learn how you can add them to your portfolio.

This fund does not seek to follow a sustainable, impact or ESG investment strategy. For more information regarding the fund's investment strategy, please see the fund's prospectus or, as applicable, shareholder report.