MAPPING A ROUTE TO RETIREMENT

Retirement may seem far away, but the earlier you start, the easier the journey can be. Ready to get started?

Consider the steps below to create a plan to help reach your retirement goals.

Preparing for retirement is among the most important journeys of your life. We’re committed to making investing for retirement easier and more affordable.

It's never too late to start saving for retirement! Rachel Aguirre, Head of U.S. iShares Product at BlackRock joins host Aaron Task to discuss ways you may navigate your financial journey, featuring practical advice on budgeting, investing, and growing your nest egg.

Retirement may seem far away, but the earlier you start, the easier the journey can be. Ready to get started?

Consider the steps below to create a plan to help reach your retirement goals.

Retirement is a number, not an age. Upon retirement, you will begin relying on savings and investments to cover all financial costs. Figuring out exactly how much you’ll need each year depends on your personal situation.

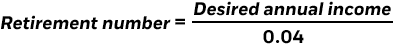

A common approach is the Rule of 4. This guideline suggests withdrawing 4% of your retirement savings in the first year of retirement and adjusting for inflation in each subsequent year. In order to translate annual spending in retirement into the amount of money you need to save for your nest egg, divide the annual desired income by 4% (or 0.04). Learn more in our retirement savings guide.

Your retirement savings goal may seem like a big number, but time and the power of compounding makes it easier to attain. Learn more about putting time on your side.

Saving for a large financial goal like retirement can be intimidating. Rather than worrying about the end result, consider implementing a consistent strategy that will put you on the path to your goal. Creating a budget can help set up a pattern of consistently saving and investing.

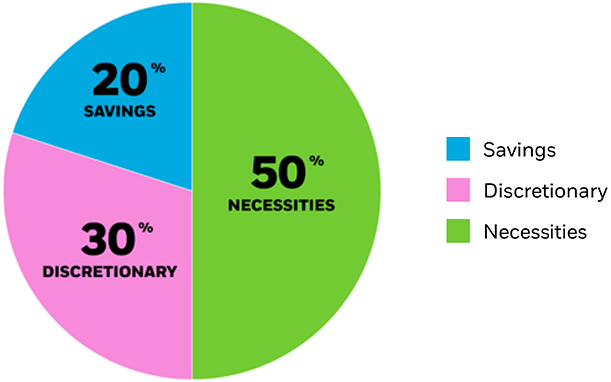

Don’t know where to start? Consider the 50/20/30 rule which suggests allocating 50% of income to necessities, 20% to savings, and 30% to discretionary spending. Once you have a budget in place, automating transfers into your investment account can help curb impulsive spending and keep you on the path to your financial goals.

Sample budget

Have more ambitious retirement goals and want to save more? Here are some strategies to help you accelerate your retirement plan.

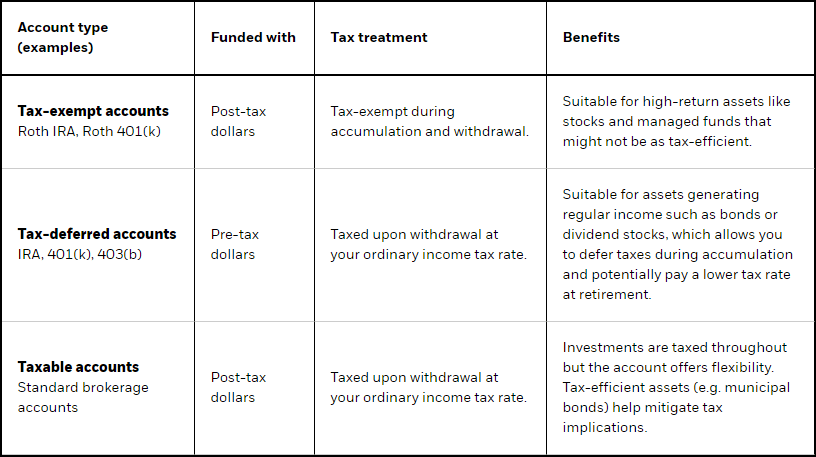

Overwhelmed by the options when it comes to investment accounts? Below is a summary of three common account types based on how they are taxed. After all, when you're planning for retirement, keeping an eye on what counts most — after-tax returns — is important.

Summary of three common account types based on how they are taxed

When it comes to investing for retirement, prioritizing tax advantaged accounts like 401(k)s and IRAs can help maximize total returns. Read our insight on how asset location can help minimize taxes and maximize returns to learn more about how to manage taxes on investments.

Once you have an investment account with automatic transfers, it’s time to select your investments. Each investment you make plays a role in helping you pursue your investment goals and all of your investments as a whole should work together to help your assets grow while keeping an eye on risk.

Looking for a simple solution? Target date ETFs adjust over time to transition from retirement investments to retirement income. Learn more.

If you prefer to select your own mix of investments, iShares Core ETFs make it easy to get started. Learn more.

Life has a way of throwing us curveballs and putting up detours when we least expect them, so your retirement plan needs to be as dynamic as the path you’re traveling. This checklist will help you determine if you’re steering a steady course toward retirement, or if you need to reassess your strategy.

Life events such as marriage, divorce, welcoming a new member to the family, or adult children coming back to the roost can significantly alter your financial goals. Any changes in your family’s makeup might require a fresh look at your savings strategy to ensure everyone's needs are met. More dependents could leave you with less income to contribute to your retirement savings each year so you may need to target more growth for longer in your portfolio (or work for longer).

Have you upgraded your home, streamlined, or finally paid-off that mortgage? If you have paid off the mortgage, your income needs in retirement may be lower than expected. Conversely, if you’ve upgraded or updated your home (and mortgage payments), you may need more income. Either way, a change in your housing may require a change in your retirement plan.

Deciding to retire earlier or to extend your working years can create two major changes in your retirement strategy. First, your retirement date impacts how long you have to prepare for life after work and how long your money needs to last to support yourself. Ultimately, you may need to reassess how much to put into retirement savings every month. Second, a change in retirement date impacts the amount of risk you can take in your investments, and you may need to adjust the mix of stocks and bonds in your portfolio. Read about how iShares Target Date ETFs can help automate that process.

Life's about the journey, not just the destination. As your goals and aspirations evolve, so should your retirement plan. Maybe you've developed a taste for more adventurous (and expensive) hobbies like traveling to exotic locales; or maybe you’re happy to stay close to home and plant a garden or volunteer locally. Either way, reassess how you plan to spend time in retirement to ensure it aligns with your current investment strategy. This reflection might lead to adjustments in your retirement portfolio allocation if you determine you want to spend more or less in retirement.

Like unexpected storms, changes in your health can impact your retirement timeline and finances. If new healthcare needs arise, it may be time to do a retirement strategy check-up by reassessing your income needs in retirement and adjusting your regular investment contributions (and withdrawals) accordingly. Unexpected healthcare needs may require you to save more money or adjust your retirement portfolio allocation to target growth for longer.

Inflation will reduce your purchasing power over time and long-term changes in inflation can have a big impact on your financial needs in retirement. If you have significant time before retirement, you may be able to rely on investments like stocks and real estate which tend to move up and down with inflation. On the other hand, if you’re nearing retirement, you may need to adjust the amount you are investing or your target retirement date.

Explore ETFs that can help you keep pace with inflation.

If you are looking for a simpler option, check out Target Date ETFs that are designed to seek the right risk at the right time. These ETFs are managed by professionals who adjust the underlying fund holdings over time to navigate market changes such as inflation and volatility so that your investments reflect your goals, from saving for retirement to receiving retirement income. Learn more.

Remember, your path to retirement is unique and full of exciting detours and new horizons. Regularly assessing if your retirement strategy still fits your needs will help ensure that you reach the retirement you have been dreaming of.

Ready to start enjoying that retirement nest egg?

Gliding into retirement means transitioning from retirement saving to spending. Creating a lifetime of income from your retirement investments means taking a careful look at your budget and mix of investments. Employing tax management strategies; adjusting investments to balance income, growth and stability; and setting a regular cadence for reassessing investments can help increase your chances for a smooth retirement.

Need help finding investments to access income in retirement? Explore iShares ETFs that help provide income.

Start as early as possible and let compounding do to the heavy lifting of growing your investments — ideally, in your 20s or when you begin working. The earlier you start, the easier the journey.

The 50/20/30 rule suggests allocating 50% of income to necessities, 20% to savings, and 30% to discretionary spending. While this may be helpful for general budgeting purposes, consider adjusting the 20% savings portion to prioritize retirement contributions. It's a flexible guideline; so you can tailor it to fit your retirement goals and financial situation.

Figuring out how much you’ll need to retire depends on your personal situation, but it’s important for everyone to keep in mind that inflation will reduce your purchasing power over time.

Another approach is the Rule of 4: to figure out how much you’ll need, assume you can withdraw 4% of your retirement savings in the first year of retirement and adjust for inflation in subsequent years by tacking on an additional 2%. While this is not a foolproof plan, it can help provide a target to get started. In order to figure out how much money you need to retire, simply divide your target annual income in retirement by 4%. Read our insight, How much money do I need to retire, to learn more.

The $1,000 per month rule suggests that for every $1,000 you want to receive each month, you should ideally have around $240,000 saved up. This rule is based on the idea that if you retire at 65, withdrawing about 4% of your retirement savings annually can provide a steady income with low risk of running out of money over a 30-year retirement period.

The 4% rule is an approach to figure out how much you’ll need to retire. Assume you can withdraw 4% of your retirement savings in the first year of retirement and adjust for inflation in subsequent years. While this is not a foolproof plan, it can help provide a target to help you get started. In order to figure out how much money you need to retire, simply divide your target annual income in retirement by 4%. Read our insight, How much money do I need to retire, to learn more.

Nearly 40% of independent savers feel off-track for retirement1, not saving enough money to retire on their terms. Do you know how much money you need to retire? Check out our insight, How much money do I need to retire, to learn more.

Unexpected healthcare needs can impact finances and retirement plans and may require you to save more money or adjust your retirement portfolio allocation to target growth for longer. Is it time to reassess your retirement strategy?

Diversify your income sources, relying on one income source can impact your retirement strategy. Start saving for retirement as early as possible and let compounding do to the heavy lifting of growing your investments.

Deciding to retire earlier can impact your retirement strategy. Your retirement date impacts how long you have to prepare for life after work and how long your money needs to last to support yourself. Ultimately, you may need to reassess how much to put into retirement savings every month. Additionally, a change in retirement date impacts the amount of risk you can take in your investments, and you may need to adjust the mix of stocks and bonds in your portfolio. Read how iShares Target Date ETFs can help automate that process. If you prefer to select your own mix of investments, iShares Core ETFs make it easy to get started. Learn more.

Being too cautious or aggressive with investments impacts the size of your nest egg. Your retirement journey is unique, and you need to regularly adjust it to match your goals, from focusing on growth early on to prioritizing stability and income in retirement. Looking for a simple solution? Target date ETFs adjust overtime to transition from retirement investments to retirement income. Learn more. If you prefer to select your own mix of investments, iShares Core ETFs make it easy to get started. Learn more.

MARKET INSIGHTS

Stay in the know on iShares outlooks, insights and products.