- It’s never too late to start saving for retirement but starting earlier is the best way to set yourself up for long-term success.

- Figuring out how much you’ll need to retire depends on your personal situation, but everyone needs to keep in mind that inflation will reduce your purchasing power over time.

- BlackRock offers the tools to simplify retirement investing with iShares® LifePath® Target Date ETFs.

How much do you need to retire? Start with this

Oct 19, 2023 CORE

KEY TAKEAWAYS

How much do you need to retire?

The answer depends on your individual circumstances, goals, where you plan to live and how you plan to spend time in retirement. But whether you’re spending time with family, traveling, or engaged in hobbies and intellectual pursuits, some retirement-planning truths apply to pretty much everyone:

- It’s never too late to get started, but the earlier you start planning and investing, the better chance you’ll have of meeting your retirement goals.

- Your retirement plan needs to get you through retirement, not just to it. This is especially important since retirement can last decades.

- Inflation will reduce your purchasing power over time.

Unfortunately, most Americans don’t feel confident about retirement. Only 56% of people investing for retirement through a workplace plan like a 401(k) feel they’re on track.1 The results are even worse for people without access to a workplace plan.

But don’t despair. The good news is we offer the tools to simplify retirement investing with iShares LifePath Target Date ETFs. These funds are a simple, comprehensive solution, with asset allocations that change to seek the right risk at the right time. And the funds come with the convenience, affordability, and accessibility of an ETF.

HOW MUCH DO YOU NEED TO RETIRE?

How much you need to retire depends a lot on timing. One of the first questions you’ll need to answer is:

When can I retire?

The standard answer is when you reach a certain age. But in reality, when you can retire partially depends on when you reach a level of savings that will last. While your spending needs could be lower in retirement compared to your working years, only 21% of those in our survey are “very confident” they will have enough.2

So how much should you have saved for retirement? To calculate your formula for success here are a few numbers to keep in mind.

- Know your income needs: According to the AARP, financial advisers generally recommend aiming to replace 70% - 85% of what you were earning while working3. For example, if you were making $60,000 during your final working year, target saving enough to replace at least $42,000 of annual income.

- Additional income: Also consider any additional income you may receive in retirement, such as Social Security. The average American’s Social Security benefit is about $1,825 a month.4 The annual Cost of Living Adjustment (COLA) has averaged 3.76% since 1975 and adjusts up or down based on 12-month changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers.5

- The Rule of 4:6 One approach to figuring out how much you’ll need is to plan on withdrawing 4% of your retirement savings in your first year of retirement and then in subsequent years, tack on an additional 2% to adjust for inflation. For example, if you have $1 million saved under this strategy, you would withdraw $40,000 during your first year in retirement. The second year, you would take out $40,800 (the original amount plus 2%) and then continue adding 2% in each subsequent year.

INVEST TO REACH YOUR GOALS

These may seem like big numbers. But time can be on your side to let the power of compounding work in your favor. Consider two individuals who are both 25 years old and want to retire at age 65. One investor saves $5,000 each year and puts it under his mattress, so in 40 years he could have $200,000. The other also puts aside $5,000 each year; but rather than keeping it in cash she invests that money and earns 7% annually. In 40-years her account could have over $1 Million.

Let your money earn more for you

Hypothetical example assuming a 7% return over 40 years, with an annual contribution of $5,000 per year. 7% is the weighted average annual return of a hypothetical portfolio composed of 60% weight to the S&P 500 Index and a 40% weight to the Bloomberg US Aggregate Bond Index for the 20-year time period ending 9/30/2023. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Bar chart showing the large difference in retirement income for someone who earned 7% return over 40 years vs. someone who kept all their money in cash.

It’s never too late to start saving, but getting an early start gives your assets time to grow and gives you time to ride out the market’s ups and downs.

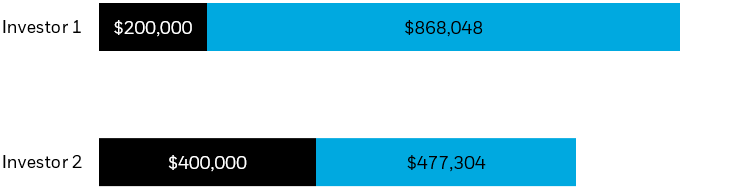

Let’s consider two more investors who both know the importance of investing to reach their retirement goals. One starts planning for retirement at 25 years old and invests $5,000/year for 40 years. Another doesn’t start investing until the age of 45 and contributes $20,000/year for 20 years. Although the second investor contributed twice the amount over the course of their savings, aka the accumulation phase, they still could have ended up with nearly $200,000 less in retirement because they missed out on the power of compounded investment returns.

Put time on your side

Hypothetical example assuming a 7% return over 40 years, with an annual contribution of $5,000 per year for 40 years for investor 1 and $20,000 per year for 20 years for investor 2. 7% is the weighted average annual return of a hypothetical portfolio composed of 60% weight to the S&P 500 Index and a 40% weight to the Bloomberg US Aggregate Bond Index for the 20-year time period ending 9/30/2023. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Bar graph showing how planning for retirement earlier in life can benefit from the power of compounding.

KEEP UP YOUR PURCHASING POWER

According to our survey, 86% of workplace savers are worried about inflation eroding their savings6. Those concerns are understandable, especially for investors close to retirement as inflation will decrease your purchasing power over time.

Let’s say you’re 25 years away from retirement and would like to have $40,000 for income replacement in your first year of retirement. For that $40,000 to have the same purchasing power that you have today, you would need to have about $66,000, assuming inflation grows 2% annually. The chart below shows a few different inflation scenarios and the income replacement amount you would need to have equivalent to $40,000 purchasing power.

| Annual inflation scenario | 2% | 3% | 4% |

|---|---|---|---|

| $40,000 equivalent in 25 years | $65,624 | $83,751 | $106,633 |

This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or informational purposes.

CONCLUSION

Getting started can feel overwhelming. But as with any journey, you need to take the first step: Get started saving as soon as you can and leverage the power of compounding over time to help grow your retirement portfolio. iShares is here to help take the guesswork out of planning for retirement. iShares LifePath Target Date ETFs can help make retirement investing easier, more affordable, and more accessible.