In its simplest form, a CLO holds a pool of potentially higher yielding and lower rated loans, where the priority of cash flows received from those loans, and therefore their risk, is allocated across a mix of investor’s risk and return profiles through a process called “tranching”. The most risk adverse investors typically invest in the first and highest rated tranche, receiving their cash first and are last to suffer from any losses. The last and lower rated tranches are allocated the earliest credit losses incurred by the loan pool and are only paid after all other promised cashflows, when available, are paid to the first ones. The first and most protected tranche is typically rated AAA by major rating agencies, with less protected tranches given lower ratings, from AA to B or below.

Securitization is common in fixed income markets, but not all tranche structures are the same. Given their name, CLOs are often confused with collateralized debt obligations (“CDOs”), or other structured securities often associated with the Global Financial Crisis (GFC). CLOs differ from CDOs in what they own, the diversification of the loan pool, structural features that protect investors, and their history. Notably, no AAA-rated CLO has ever defaulted.2 In fact, given how the typical CLO is structured, more than half of the underlying loans would need to default before the AAA-rated tranche would begin to experience losses.3

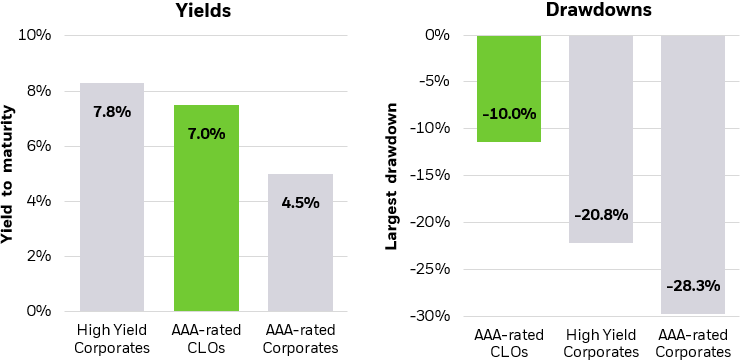

Today, CLOs have matured to a $1.2tn market globally, roughly the same size as the $1.2tn US High Yield bond market.4 As investors may allocate a portion of their portfolios to high yield bonds seeking potential income and return, CLOs could be a consideration as well.