Skip to content

Welcome to the BlackRock site for advisors

To reach a different BlackRock site directly, please update your user type.

Wealth isn’t just for the wealthy

A variety of hurdles keep people from taking control over their finances. This is why investment advisers can be key when facing these challenges. Investment education can complement your client conversations to achieve their investment goals.

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. You may not get back the amount originally invested.

Why aren’t more people making steps to invest?

Money is #1 cause of stress - ranking higher than physical, work and family. When people begin investing, they see immediate emotional benefits compared to non-investors. Investors are happier, more positive about their well-being and more fulfilled.

Even if there are some clear benefits to invest, only a third of the Europeans hold market-based investments. So why aren’t more people making steps to invest? Some of the responses we heard:

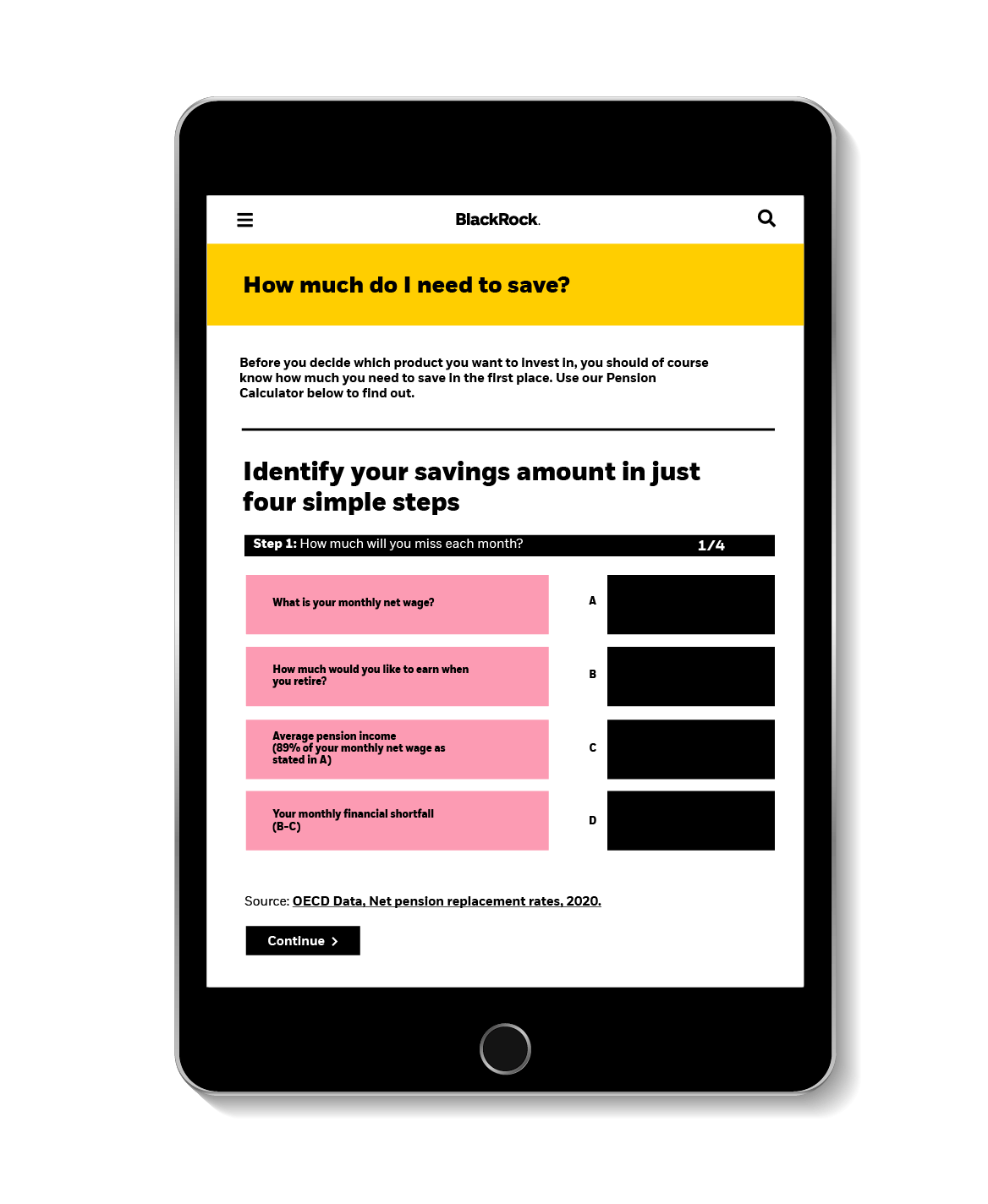

How far are you from achieving your goals?

Calculate your personal savings plan conveniently and easily. Quickly and easily check how much you need to set aside to achieve your financial goals. And then find the savings plan that’s right for you.

FAQ about ETFs and mutual funds

Other videos in the series

Find other videos below for more information about mutual funds and ETFs.

Other videos in the series

Find other videos below for more information about mutual funds and ETFs.

Help your clients achieve their goals today

Setting aside some money to invest in the future is the first step. Guide your client to begin investing now and educate them so that they can take the calculated risks necessary to get a desirable return on their investment.

Points to mention

01

Financial well-being

Improving your financial well-being can positively impact your emotional & physical health. Money ranks as #1 source of stress.

02

Learn the basics

Take the time to understand the basics of investing & get in touch with your financial advisor for guidance

03

Start now

The sooner you start investing, the closer you can come to achieving your life goals