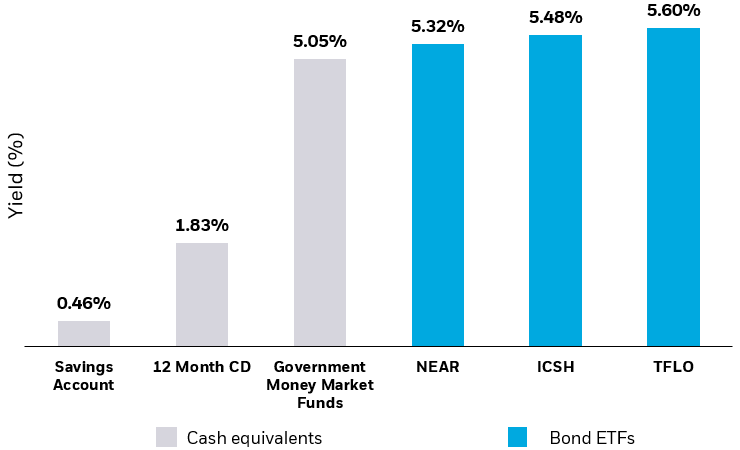

Looking to get more out of your cash? Consider short-term bonds, which are currently offering some of the highest yields in the past 15 years.1 Investors may be able to invest in short-term bonds with ETFs to potentially earn more income with cash they don’t need in the near future.

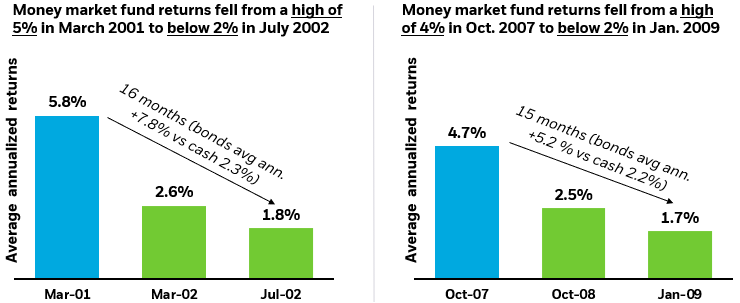

Americans are sitting on over $17.5 trillion in bank deposits with an additional $6 trillion in money market funds.2 An investment in fixed income funds is not equivalent to and involves risks not associated with an investment in cash or cash equivalents. That said, historically, longer term bonds have tended to outperform cash when interest rates are decreasing, as is expected to occur later this year if the Fed pivots to cutting rates.3