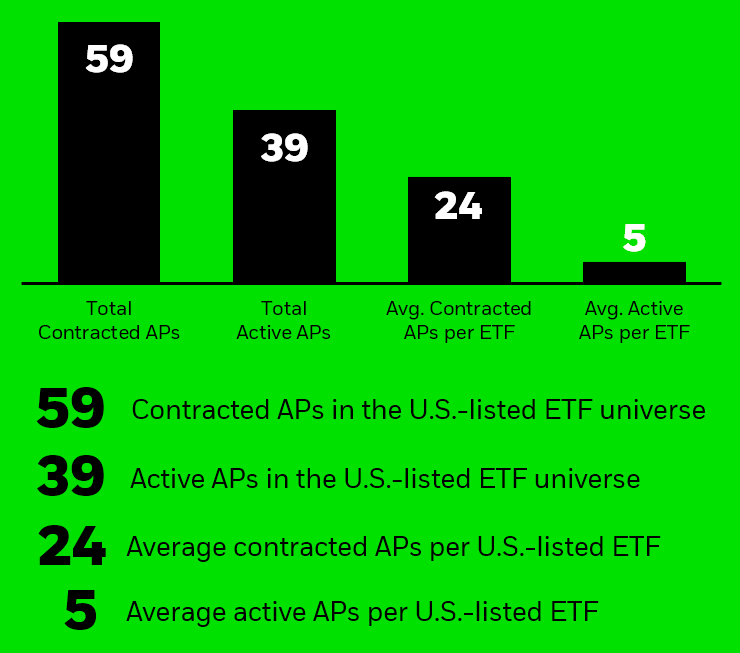

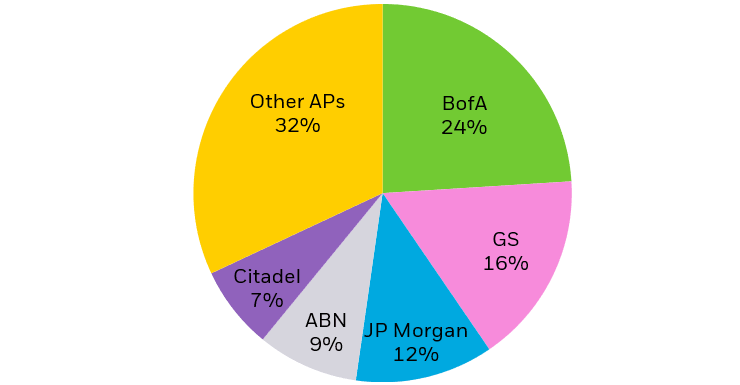

The rapid growth of exchange trade funds (ETFs) is supported by a robust, dynamic “ecosystem” made up of many players. Among the key contributors to smooth ETF operations are authorized participants (APs). These financial institutions work with ETF issuers to create and redeem shares in the primary market. To learn more about the role of authorized participants, see The authorized participant and market maker ecosystem.

This paper looks deeper into the U.S. ETF ecosystem to analyze the breadth and scope of the AP universe. It draws on data disclosed by fund companies annually, as required by the U.S. Securities and Exchange Commission (SEC).1