Combining U.S. and international investments can result in a better-diversified portfolio whose holdings don’t move in lockstep – so when some go up, others go down, and vice versa. The result: a potential reduction in the volatility (risk) of your total portfolio in the long-run.

iSHARES INTERNATIONAL ETFs

Precision exposures can help investors express views on region and country-specific markets. iShares has the industry's largest country ETF suite in the U.S., with 61 funds and $59B in AUM offering the potential for investors to target growth while also seeking portfolio diversification whatever their views are.1

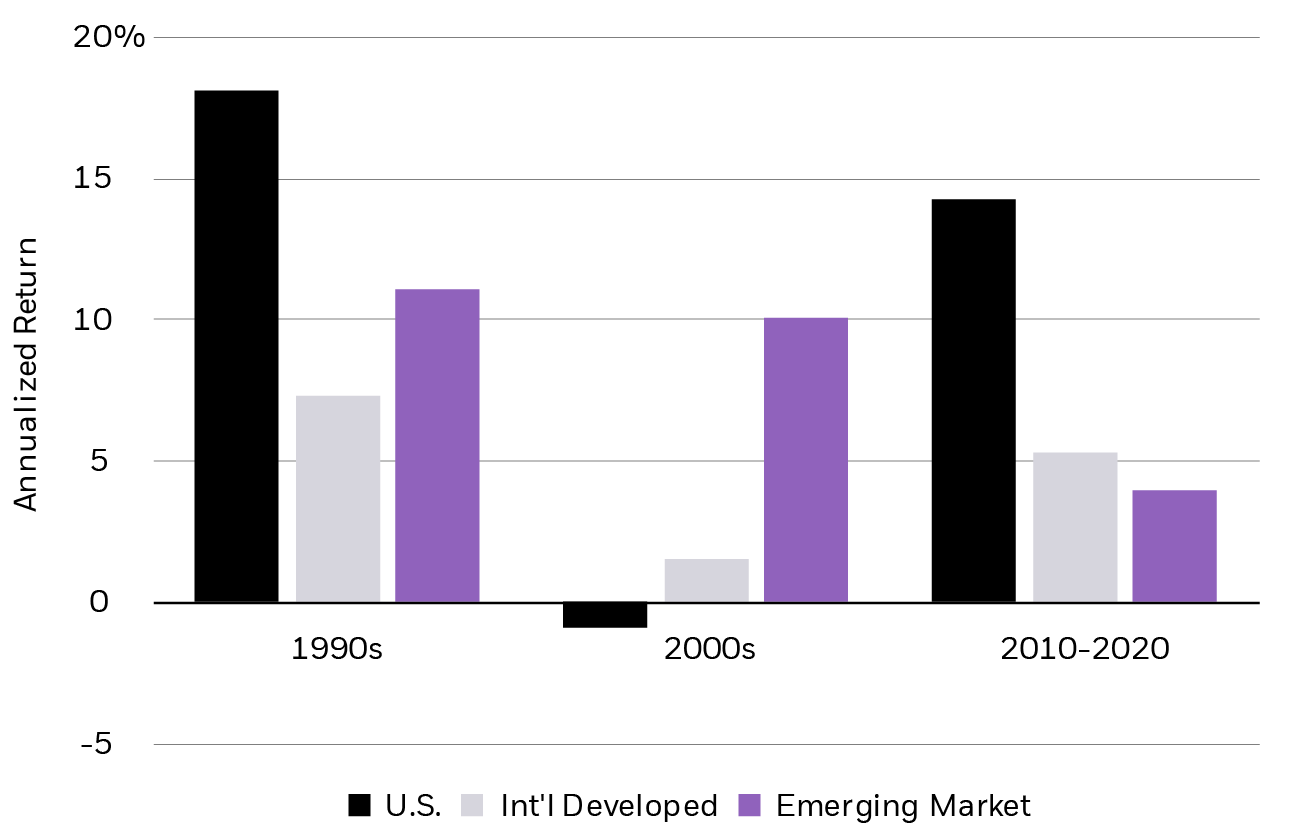

U.S. and international stocks have gone through cycles of relative outperformance

Source: Thomson Reuters, as of 10/27/2020. U.S. stocks represented by the S&P 500 Thomson Reuters; Int’l Developed stocks represented by MSCI EAFE + Canada Index (gross); Emerging Market stocks represented by MSCI Emerging Markets Index (gross). Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Access to growth

International economies—both developed and emerging—may offer faster rates of economic growth than the United States. The process of developing the physical, commercial and financial infrastructure of an emerging economy can help generate wealth and launch dynamic companies with significant growth potential. This may result in opportunities for enhanced long-term returns versus U.S. equity investments.

How to invest internationally

There are a number of considerations to take into account when thinking about adding international investments to your portfolio. Do you want to invest in a specific country or in a broader set? Do you want to invest in developed or emerging markets? However you want to invest internationally, iShares has many ETFs to consider.

BROAD EXPOSURE

Expand your global footprint using just a few funds with iShares’ international ETFs

Seek a broad spectrum of international growth

Offer investors diversification potential over the long-term

COUNTRY EXPOSURE

With 66 funds across 42 countries, iShares offers the world’s broadest range of country ETFs

Seek a broad spectrum of international growth

Offer investors diversification potential over the long-term