MARCH MADNESS FOR ETFs AS FLOWS BOUNCE BACK

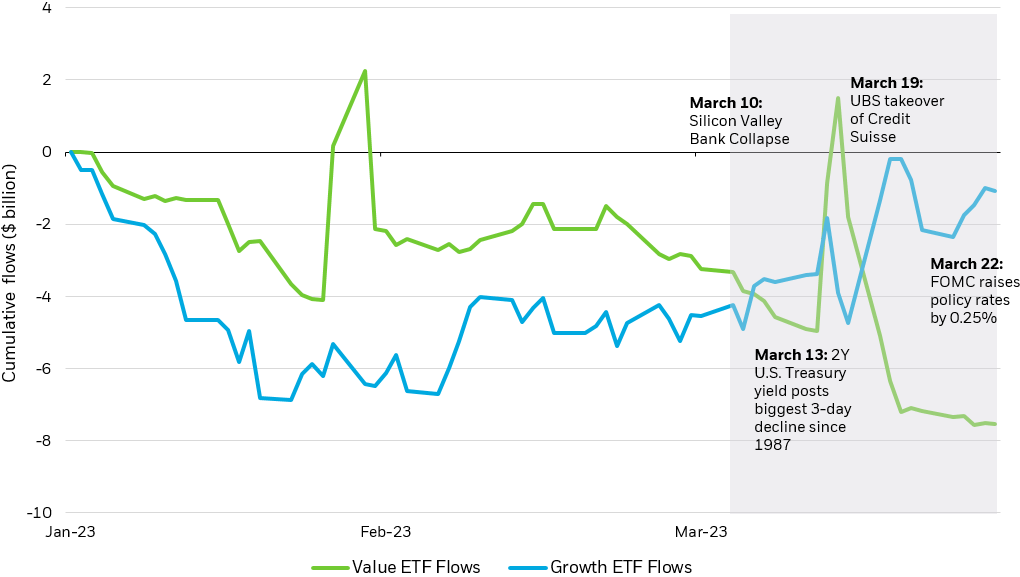

Trading volumes spiked in March on the heels of bank tumult in the U.S. and across the pond. Investors navigated extreme price action in both bond and stock markets as March registered some notable milestones: the 2-year U.S. Treasury yield experienced its largest one-day decline1, interest rate volatility reached its Global Financial Crisis level, and all four number one-seeds in the March Madness tournament were eliminated before the Elite Eight.

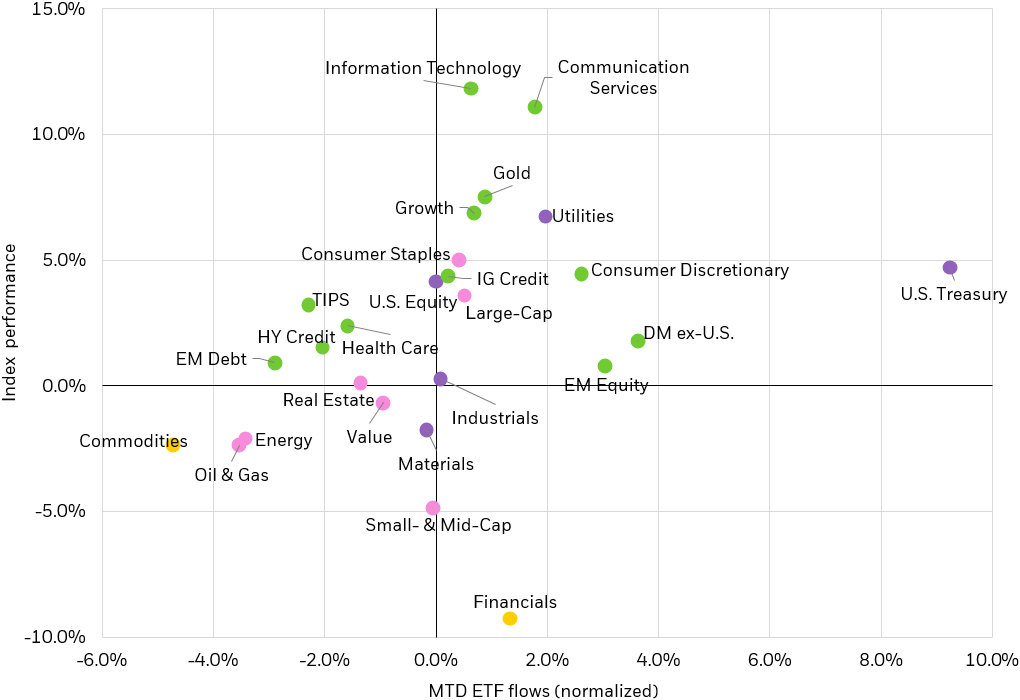

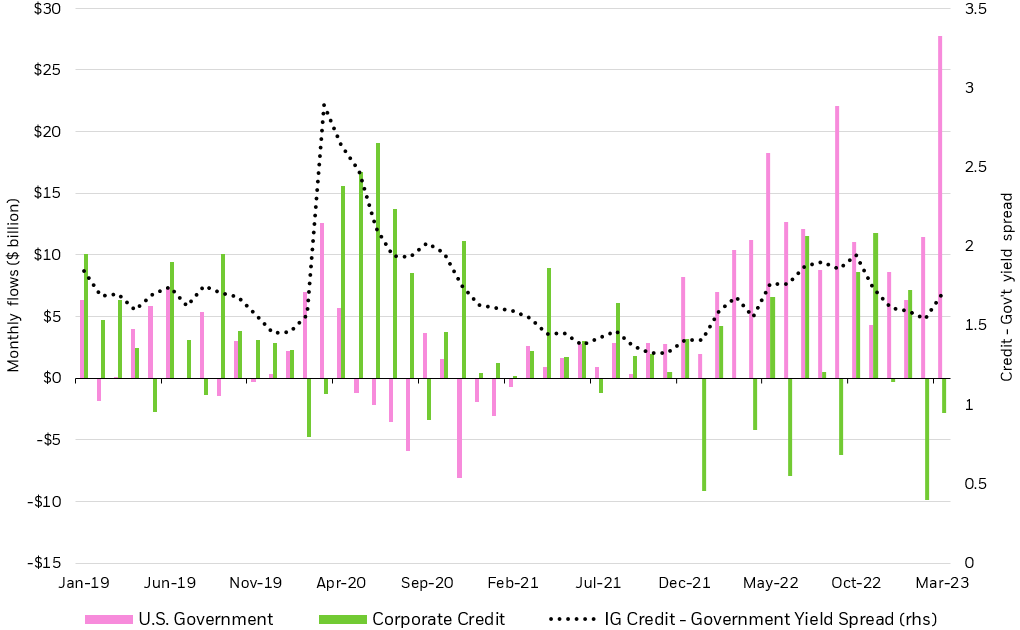

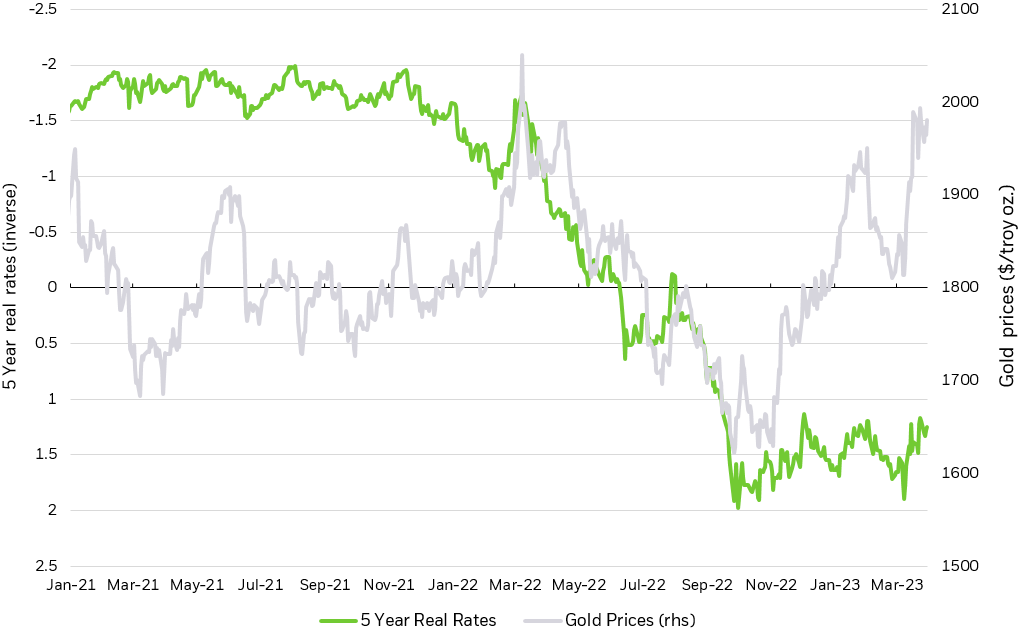

Bank sector volatility sent investors dashing to cash, and money market funds and short-dated Treasuries collected near-record inflows. The month’s FOMC meeting reset rate expectations, and growth equity ETFs emerged as popular exposures as the rate tightening campaign nears its end. Finally, investors turned to gold as a relative “safe-haven” allocation during March’s heightened volatility.