A. Summary

This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment. The Fund is passively managed and seeks to promote the following environmental and social characteristics by tracking the performance of the Bloomberg MSCI US Corporate High Yield Sustainable BB+ SRI Bond Index, its Benchmark Index: (1) exclusion of issuers deemed to be involved in certain activities considered to have negative environmental and/or social outcomes; (2) exclusion of issuers deemed to be involved in very severe ESG related controversies; (3) exclusion of issuers considered to be lagging industry peers in their high exposure and failure to manage significant ESG risks (based on an ESG rating); and (4) exposure to investments qualifying as sustainable investments.

While the Fund does not have as its objective a sustainable investment, it will have a minimum proportion of sustainable investments. BlackRock defines sustainable investments as investments in issuers or securities that contribute to an environmental or social objective, do not significantly harm any of those objectives and where investee companies follow good governance practices. By investing in a portfolio of securities that, as far as possible and practicable, consists of the component securities of the Fund’s Benchmark Index, a proportion of the Fund’s investments will qualify as sustainable investments.

The Fund’s investments qualifying as sustainable investments may be in: (1) fixed income securities which have been classified as “green bonds”; (2) issuers involved in activities deemed to contribute to positive environmental and/or social impacts; or (3) issuers which have committed to one or more active carbon emissions reduction target(s) approved by the Science Based Targets initiative (SBTi).

At each index rebalance, all investments qualifying as sustainable are screened against certain minimum environmental and social indicators. Where an investment has been identified as being associated with activities deemed to have highly negative environmental and social impacts, it shall not be eligible as a sustainable investment.

The investment policy of the Fund is to invest in a portfolio of securities that as far as possible and practicable consists of the component securities of the Benchmark Index and thereby comply with the ESG characteristics of its Benchmark Index (as further described in Section D. Investment strategy below). By investing in the constituents of its Benchmark Index, the Fund’s investment strategy enables it to comply with the ESG requirements of its Benchmark Index as determined by the index provider. The Fund takes into consideration principal adverse impacts on sustainability factors by tracking the Benchmark Index which incorporates certain ESG criteria in the selection of index constituents.

The Fund seeks to invest in a portfolio of securities that as far as possible and practicable consists of the component securities of the Benchmark Index. It is expected that at least 80% of the Fund's assets will be invested in either securities within the Benchmark Index or in securities that meet the ESG selection criteria of the Benchmark Index. The Fund does not currently commit to investing more than 0% of its assets in sustainable investments with an environmental objective aligned with the EU Taxonomy. The Fund does not currently commit to invest in fossil gas and/or nuclear energy related activities that comply with the EU Taxonomy.

The Fund seeks to track the performance of the Benchmark Index which incorporates certain ESG criteria in the selection of constituents, according to its methodology. BlackRock monitors the Fund’s adherence to the environmental and social characteristics which the Fund seeks to promote. The objective of the Fund is to track the performance of the Benchmark Index. The environmental and/or social characteristics of the Fund are embedded into the Benchmark Index methodology and the Fund is monitored in a manner that seeks to identify exceptions to the Fund’s sustainable commitments being met as at each rebalance.

BlackRock Portfolio Managers have access to research, data, tools, and analytics to integrate ESG insights into their investment process. ESG datasets are sourced from external third-party data providers and index providers, including but not limited to MSCI, Sustainalytics, Refinitiv, S&P and Clarity AI. BlackRock’s internal processes are focused on delivering high-quality standardised and consistent data to be used by investment professionals and for transparency and reporting purposes. Data, including ESG data, received through our existing interfaces, is processed through a series of quality control and completeness checks which seeks to ensure that data is high-quality data before being made available for use downstream within BlackRock systems and applications, such as Aladdin.

BlackRock applies a comprehensive due diligence process to evaluate provider offerings with highly targeted methodology reviews and coverage assessments based on the sustainable investment strategy (and the environmental and social characteristics or sustainable investment objective) of the product. Our process entails both qualitative and quantitative analysis to assess the suitability of data products in line with regulatory standards as applicable.

Sustainable investing and understanding of sustainability is evolving along with the data environment. Industry participants, including index providers face challenges in identifying a single metric or set of standardized metrics to provide a complete view on a company or an investment. ESG data sets are constantly changing and improving as disclosure standards, regulatory frameworks and industry practice evolve. There may be some circumstances where data is unavailable, incomplete, or inaccurate. Despite reasonable efforts, information may not always be available in which case an assessment will be made by the index provider based on their knowledge of the investment or industry. In certain cases, data may reflect actions that issuers may have taken only after the fact, and do not reflect all potential instances of significant harm.

The Investment Manager carries out due diligence on the index providers and engages with them on an ongoing basis with regard to index methodologies including their assessment of good governance criteria set out by the SFDR which include sound management structures, employee relations, remuneration of staff and tax compliance at the level of investee companies.

The Investment Manager does not perform direct engagement with the companies / issuers within the Benchmark Index as part of the investment strategy of the Fund. The Investment Manager will engage directly with the index and data providers to ensure better analytics and stability in ESG metrics. Engagement with companies in which we invest our clients’ assets occurs at multiple levels within BlackRock. Where investment teams choose to leverage engagement, this can take a variety of forms but, in essence, the portfolio management team would seek to have regular and continuing dialogue with executives or board directors of engaged investee companies to advance sound governance and sustainable business practices targeted at the identified ESG characteristics and principal adverse indicators, as well as to understand the effectiveness of the company’s management and oversight of activities designed to address the identified ESG issues. Engagement also allows the portfolio management team to provide feedback on company practices and disclosures.

The Benchmark Index is designated as a reference benchmark to determine whether the Fund is aligned with the environmental and/or social characteristics that it promotes.

B. No sustainable investment objective

This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment.

While the Fund does not have as its objective a sustainable investment, it will have a minimum proportion of sustainable investments. By investing in a portfolio of fixed income securities that, as far as possible and practicable, consists of the component securities of the Fund’s Benchmark Index, a proportion of the Fund’s investments will qualify as sustainable investments.

The Fund’s investments qualifying as sustainable investments may be in: (1) fixed income securities which have been classified as “green bonds”; (2) issuers involved in activities deemed to contribute to positive environmental and/or social impacts; or (3) issuers which have committed to one or more active carbon emissions reduction target(s) approved by the Science Based Targets initiative (SBTi).

At each index rebalance, all investments qualifying as sustainable are assessed against certain minimum environmental and social indicators.

As part of the assessment, issuers are assessed on their involvement in activities deemed to have highly negative environmental and social impacts. Where an issuer has been identified as being involved in activities with highly negative environmental and social impacts, it shall not be eligible as a sustainable investment.

For bonds qualifying as green bonds, the assessment will be conducted at an issuance level based on the use of the proceeds of the bonds which must be formally and exclusively applied to promote climate or other environmental sustainability purposes. In addition, certain minimum safeguards and eligibility exclusions are incorporated in the selection of green bonds to avoid exposure to bonds associated with activities deemed to have highly negative environmental and societal impacts.

The mandatory indicators for adverse impacts on sustainability factors (as set out in the Regulatory Technical Standards (RTS) under the SFDR) are considered at each index rebalance through the assessment of the Fund’s investments qualifying as sustainable.

Following this assessment, the following investments in issuers shall not qualify as sustainable investments: (1) issuers deemed to be deriving at least 1% of their revenue from thermal coal which is significantly carbon intensive and a major contributor to greenhouse gas emissions (taking into account indicators relating to GHG emissions) (2) issuers that have been deemed to be involved in severe ESG related controversies (taking into account indicators relating to greenhouse gas emissions, biodiversity, water, waste and social and employee matters), and (3) issuers which are deemed to be lagging industry peers based on their high exposure and failure to manage significant ESG risks (taking into account indicators relating to greenhouse gas emissions, biodiversity, water, waste, unadjusted gender pay gap and board gender diversity).

In respect of green bonds, the indicators for adverse impacts on sustainability factors are taken into account at each index rebalance and are assessed at the issuance level based on an assessment of the use of proceeds of the bonds which must be formally and exclusively applied to promote climate or other environmental sustainability purposes. In addition, minimum safeguards and eligibility exclusions are applied in the selection of green bonds to ensure the proceeds of which are not applied to activities with highly negative environmental and social outcomes. This includes through the minimum safeguards and eligibility exclusions of bonds with the use of proceeds linked to thermal coal extraction and power generation, significant biodiversity loss and controversial weapons.

At each index rebalance, the Benchmark Index also excludes: (1) companies with a “red” MSCI ESG controversy flag which includes companies determined to be in violation of international and/or national standards (taking into account indicators concerning violations of United Nations Global Compact principles and OECD Guidelines for Multinational Enterprises), and (2) companies determined to have any tie to controversial weapons (taking into account indicators concerning ties to controversial weapons).

The Fund’s Benchmark Index excludes issuers with a “red” ESG controversy flag which excludes issuers which have been determined by the index provider to be in violation of the UN Guiding Principles on Business and Human Rights and OECD Guidelines for Multinational Enterprises. The Benchmark Index applies the above exclusionary criteria at each index rebalance.

C. Environmental or social characteristics of the financial product

The Fund is passively managed and seeks to promote the following environmental and social characteristics by tracking the performance of theBloomberg MSCI US Corporate High Yield Sustainable BB+ SRI Bond Index, its Benchmark Index:

1. exclusion of issuers deemed to be involved in certain activities considered to have negative environmental and/or social outcomes;

2. exclusion of issuers deemed to be involved in very severe ESG related controversies;

3. exclusion of issuers considered to be lagging industry peers in their high exposure and failure to manage significant ESG risks (based on an ESG rating); and

4. exposure to investments qualifying as sustainable investments.

These environmental and social characteristics are incorporated through the selection of constituents in the Fund’s Benchmark Index at each index rebalance (as described below). The Benchmark Index excludes issuers based on their involvement in certain activities deemed to have negative environmental or social outcomes. Issuers are excluded from the Benchmark Index based on their involvement in the following business lines/activities (or related activities):

• alcohol

• tobacco

• gambling

• adult entertainment

• genetically modified organisms

• nuclear power

• nuclear weapons

• civilian firearms

• controversial weapons

• thermal coal

• unconventional oil and gas

• generation of thermal coal

• fossil fuel reserves

• weapons systems/components/support systems/services

• oil sands

The index provider defines what constitutes “involvement” in each restricted activity. This may be based on percentage of revenue, a defined total revenue threshold, or any connection to a restricted activity regardless of the amount of revenue received.

To be included in the Benchmark Index, securities must have an MSCI ESG rating and the rating must be BB or higher. An MSCI ESG rating is designed to measure an issuer's resilience to long-term industry material ESG risks and how well it manages ESG risks and opportunities relative to industry peers. The index provider may consider the following environmental themes when determining an issuer’s ESG score as part of the ESG rating methodology: climate change mitigation based on greenhouse gas emissions, waste and other emissions, land use and biodiversity. The index provider may also consider the following social themes when determining an issuer’s ESG score as part of the ESG rating methodology: access to basic services, community relations, data privacy and security, human capital, health and safety and product governance. The MSCI ESG rating methodology recognises that certain environmental and social issues are more material based on the type of activity that the issuer is involved in by weighting the issues differently in the scoring methodology. Those issuers with higher MSCI ESG scores are determined by the index provider to be those issuers that may be better positioned to manage future ESG-related challenges and risks compared to their industry peers.

The Benchmark Index also excludes issuers with a ‘red’ MSCI ESG controversy flag (based on an MSCI controversy score). An MSCI controversy score measures an issuer’s involvement (or alleged involvement) in serious controversies based on an assessment of an issuer’s operations and/or products which are deemed to have a negative ESG impact. An MSCI controversy score may consider involvement in adverse impact activities in relation to environmental issues such as biodiversity and land use, energy and climate change, water stress, toxic emissions and waste issues. An MSCI controversy score may also consider involvement in adverse impact activities in relation to social issues such as human rights, labour management relations, discrimination and workforce diversity.

For more information on where details of the methodology of the Benchmark Index can be found see see 'Section L - Designated reference benchmark.'

D. Investment strategy

The investment policy of the Fund is to invest in a portfolio of fixed income securities that as far as possible and practicable consists of the component securities of the Benchmark Index and thereby comply with the ESG characteristics of its Benchmark Index. The index methodology of its Benchmark Index is described above see 'Section C - Environmental or social characteristics of the fund.'

By investing in the constituents of its Benchmark Index, the Fund’s investment strategy enables it to comply with the ESG requirements of its Benchmark Index as determined by the index provider. In the event that any investments cease to comply, the Fund may continue to hold such investments only until such time as the relevant securities cease to form part of the Benchmark Index and it is possible and practicable (in the Investment Investment Manager's view) to liquidate the position.

The Fund may use optimisation techniques in order to achieve a similar return to the Benchmark Index which means that it is permitted to invest in securities that are not underlying constituents of the Benchmark Index where such securities provide similar performance (with matching risk profile) to certain securities that make up the Benchmark Index. If the Fund does so, its investment strategy is to invest only in issuers in the Benchmark Index or in issuers that meet the ESG requirements of the Benchmark Index at the time of purchase. If such securities cease to comply with the ESG requirements of the Benchmark Index, the Fund may hold such securities only until the next portfolio rebalance and when it is possible and practicable (in the Investment Investment Manager's view) to liquidate the position.

The strategy is implemented at each portfolio rebalance of the Fund, which follows the index rebalance of its Benchmark Index.

The binding elements of the investment strategy are that the Fund will invest in a portfolio of fixed income securities that as far as possible and practicable consists of the component securities of the Benchmark Index and thereby comply with the ESG characteristics of its Benchmark Index.

As the Fund is able to use optimisation techniques and may invest in securities that are not underlying constituents of the Benchmark Index, where it does so, its investment strategy is to invest only in issuers in the Benchmark Index or in issuers that meet the ESG requirements of the Benchmark Index at the time of purchase.

In the event that any investments cease to comply with the ESG requirements of the Benchmark Index, the Fund may continue to hold such investments only until such time as the relevant securities cease to form part of the Benchmark Index and/or it is possible and practicable (in the Investment Investment Manager's view) to liquidate the position.

Consideration of principal adverse impacts (PAIs) on sustainability factors

The Fund takes into consideration principal adverse impacts on sustainability factors by tracking the Benchmark Index which incorporates certain ESG criteria in the selection of index constituents. The Investment Investment Manager has determined that those principal adverse impacts (PAIs) listed below are considered as part of the selection criteria of the Benchmark Index at each index rebalance.

The Fund's annual report will include information on the principal adverse impacts on sustainability factors set out below:

• Share of investments in companies active in the fossil fuel sector.

• Share of investments in investee companies with sites/operations located in or near to biodiversity-sensitive areas where activities of those investee companies negatively affect those areas.

• Tonnes of emissions to water generated by investee companies per million EUR invested, expressed as a weighted average.

• Tonnes of hazardous waste generated by investee companies per million EUR invested, expressed as a weighted average.

• Share of investments in investee companies that have been involved in violations of the UNGC principles or OECD Guidelines for Multinational Enterprises.

• Share of investments in investee companies involved in the manufacture or selling of controversial weapons.

Good governance policy

Good governance checks are incorporated within the methodology of the Benchmark Index. At each index rebalance, the index provider excludes companies from the Benchmark Index based on an ESG controversy score (which measures an issuer’s involvement in ESG related controversies) which includes the exclusion of companies that are classified as violating United Nations Global Compact principles see 'Section C - Environmental or social characteristics of the fund.'

E. Proportion of Investments

The Fund seeks to invest in a portfolio of securities that as far as possible and practicable consists of the component securities of the Benchmark Index.

It is expected that at least 80% of the Fund's assets will be invested in either securities within the Benchmark Index or in securities that meet the ESG selection criteria of the Benchmark Index. As such, at each index rebalance, the portfolio of the Fund will be rebalanced in line with its Benchmark Index so that at least 80% of the Fund's assets will be aligned with the ESG characteristics of the Benchmark Index (this includes 10% of the Fund’s assets that are qualified as sustainable investments) (as determined at that rebalance).

In the event that any investments cease to comply with the ESG requirements of the Benchmark Index, the Fund may continue to hold such investments until such time as the relevant securities cease to form part of the Benchmark Index (or otherwise cease to meet the ESG selection criteria of the Benchmark Index) and it is possible and practicable (in the Investment Manager's view) to liquidate the position.

The assessment of the Fund's investments qualifying as sustainable is determined on or around each index rebalance, where the Fund's portfolio is rebalanced in line with its Benchmark Index. Where any investment ceases to qualify as a sustainable investment between index rebalances, the Fund's holdings in sustainable investments may fail below the minimum proportion of sustainable investments.

The Fund may invest up to 20% of its assets in other investments.

The Fund may use derivatives for investment purposes and for the purposes of efficient portfolio management in connection with the environmental or social characteristics promoted by the Fund. Where the Fund uses derivatives for promoting environmental or social characteristics, any ESG rating or analyses referenced above will apply to the underlying investment.

The Fund does not currently commit to investing more than 0% of its assets in sustainable investments with an environmental objective aligned with the EU Taxonomy. The Fund does not currently commit to invest in fossil gas and/or nuclear energy related activities that comply with the EU Taxonomy.

This Fund does not currently commit to investing more than 0% of its assets in investments in transitional and enabling activities within the meaning of the Taxonomy Regulation.

A minimum of 10% of the Fund’s assets will be invested in sustainable investments. These sustainable investments will be a mix of sustainable investments with either an environmental objective that is not committed to align with the EU Taxonomy or a social objective or a combination of the two. The combination of sustainable investments with an environmental or social objective may change over time depending on the activities of the issuers within the Benchmark Index. The assessment of the Fund’s investments qualifying as sustainable is determined on or around each index rebalance, where the Fund’s portfolio is rebalanced in line with its Benchmark Index.

Other holdings may include cash, money market funds and derivatives. Such investments may only be used for the purpose of efficient portfolio management, except for derivatives used for currency hedging for any currency hedged share class.

Any ESG rating or analyses applied by the index provider will apply only to the derivatives relating to individual issuers used by the Fund. Derivatives based on financial indices, interest rates, or foreign exchange instruments will not be considered against minimum environmental or social safeguards.

F. Monitoring of environmental or social characteristics

Ongoing product integrity monitoring

BlackRock monitors the Fund’s adherence to the environmental and social characteristics which the Fund seeks to promote. The objective of the Fund is to track the performance of the Benchmark Index. The environmental and/or social characteristics of the Fund are embedded into the Benchmark Index methodology and the Fund is monitored in a manner that seeks to identify exceptions to the Fund’s sustainable commitments being met as at each rebalance.

BlackRock monitors Fund and index-level data to track the Fund’s adherence to these characteristics as at each rebalance.

BlackRock also monitors the tracking error of the Fund and reports this to investors as part of the annual and semi-annual report and accounts. Information on the anticipated tracking error is also published in the Fund’s prospectus.

G. Methodologies

The Fund seeks to track the performance of the Benchmark Index which incorporates certain ESG criteria in the selection of constituents, according to its methodology (outlined above in Section C and detailed in section L).

Methodologies

In addition, the following methodologies are used to measure how the social or environmental characteristics promoted by the Fund are met:

The Benchmark Index uses MSCI ESG controversy data. For further information, https://www.msci.com/documents/10199/acbe7c8a-a4e4-49de-9cf8-5e957245b86b

The Benchmark Index uses MSCI ESG rating methodology. For further information, https://www.msci.com/our-solutions/esg-investing/esg-ratings

The Benchmark Index uses MSCI Business involvement and UNGC screens. For further information, https://www.msci.com/documents/1296102/1636401/MSCI_ESG_BIS_Research_Productsheet_April+2015.pdf/babff66f-d1d6-4308-b63d-57fb7c5ccfa9

The Benchmark Index uses additional screens. For further information, please see the index methodology.

Sustainable Investments Methodology

Sustainable investments are identified based on a four-part assessment:

(i) Economic activity contribution to environmental and/or social objectives;

(ii) Do no significant harm;

(iii) Meets minimum safeguards; and

(iv) Good governance (where relevant)

It is necessary for an investment to meet the four limbs of this test to be considered a “Sustainable Investment”. Sustainable Investments are subject to a robust oversight process to ensure that regulatory standards are met.

(i) Economic activity contribution to environmental and/or social objectives

Environmental and social objectives

BlackRock identifies Sustainable Investments which contribute to a range of environmental and / or social objectives which may include but are not limited to alternative and renewable energy, energy efficiency, pollution prevention or mitigation, reuse and recycling, health, nutrition, sanitation and education and the UN Sustainable Development Goals and other sustainability-related frameworks (together the “Environmental and Social Objectives”).

Economic activity assessment

An investment will be a Sustainable Investment (subject to it satisfying the other three limbs):

Business activity

• Where 20% or more of its revenue attributable to products and/or services is systematically mapped as contributing to Environmental and/or Social Objectives using third-party vendor data.

Business practices

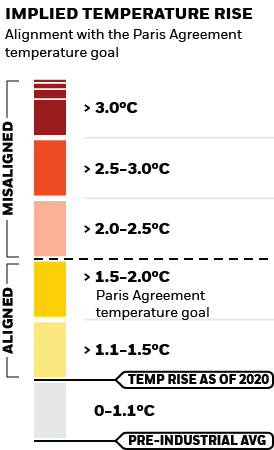

• Where the issuer has set a de-carbonisation target in accordance with the Science Based Targets initiatives (SBTi) as validated by third-party vendor data. The SBTi seeks to provide a clearly defined pathway for companies and financial institutions to reduce greenhouse gas (GHG) emissions to align with the goals of the Paris Agreement and help prevent the worst impacts of climate change.

Fixed income securities

• Where a fund invests in a use-of-proceeds bond, such use-of-proceed bond will be a Sustainable Investment where the use of proceeds substantially contributes to an Environmental and/or Social Objective as determined by fundamental assessment.

A fund’s Sustainable Investments may have any or all of the above Environmental and/or Social Objectives depending on the investment strategy of the fund. In identifying which underlying holdings are Sustainable Investments, BlackRock may have regard to the index provider’s assessment of sustainable investments, or any other exclusionary criteria incorporated within the fund’s benchmark index methodology.

(ii) Do no significant harm (DNSH)

At each index rebalance, all investments qualifying as sustainable are assessed against certain minimum environmental and social indicators. As part of the assessment, companies are assessed on their involvement in activities deemed to have highly negative environmental and social impacts. Where a company has been identified as being involved in activities with highly negative environmental and social impacts, it shall not be eligible as a sustainable investment.

Where a fund invests in use of proceeds bonds, such as green bonds, the assessment will be conducted at an issuance level based on the use of the proceeds of the bonds which must be formally and exclusively applied to promote climate or other environmental or social sustainability purposes. In addition, certain minimum safeguards and eligibility exclusions are incorporated in the selection of green bonds to avoid exposure to bonds associated with activities deemed to have highly negative environmental and societal impacts

The mandatory indicators for adverse impacts on sustainability factors (as set out in the Regulatory Technical Standards (RTS) under the SFDR) are considered at each index rebalance through the assessment of the Fund’s investments qualifying as sustainable.

Following this assessment, the following investments shall not qualify as Sustainable Investments: (1) companies deemed to be deriving at least 1% of their revenue from thermal coal which is significantly carbon intensive and a major contributor to greenhouse gas emissions (taking into account indicators relating to GHG emissions) (2) companies that have been deemed to be involved in severe ESG related controversies (taking into account indicators relating to greenhouse gas emissions, biodiversity, water, waste and social and employee matters), and (3) companies which are deemed to be lagging industry peers based on their high exposure and failure to manage significant ESG risks (taking into account indicators relating to greenhouse gas emissions, biodiversity, water, waste, unadjusted gender pay gap and board gender diversity).

In addition, companies which are classified as violating or are at risk of violating commonly accepted international norms and standards, enshrined in the United Nations Global Compact (UNGC) Principles, the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises, the UN Guiding Principles on Business and Human Rights (UNGPs) and their underlying conventions shall not qualify as Sustainable Investments. Companies determined to have any tie to controversial weapons (taking into account indicators concerning ties to controversial weapons) shall not qualify as Sustainable Investments.

(iii) Meet minimum safeguards

Issuers which are classified as violating or are at risk of violating commonly accepted international norms and standards, enshrined in the UNGC Principles, the OECD Guidelines for Multinational Enterprises, the UNGPs and their underlying conventions shall not qualify as Sustainable Investments.

Good Governance

Good governance checks are incorporated within the methodology of the Benchmark Index. At each index rebalance, the index provider excludes companies from the Benchmark Index based on an ESG controversy score (which measures an issuer’s involvement in ESG related controversies) and excludes companies that are classified as violating UNGC principles.

H. Data sources and processing

Data Sources

BlackRock Portfolio Managers have access to research, data, tools, and analytics to integrate ESG insights into their investment process. Aladdin is the operating system that connects the data, people, and technology necessary to manage portfolios in real time, as well as the engine behind BlackRock’s ESG analytics and reporting capabilities. BlackRock’s Portfolio Managers use Aladdin to make investment decisions, monitor portfolios and to access index information that informs the investment process to attain ESG characteristics of the Fund.

ESG datasets are sourced from external third-party data providers and index providers, including but not limited to MSCI, Sustainalytics, Refinitiv, S&P and Clarity AI. These datasets may include headline ESG scores, carbon emissions data, business involvement metrics or controversies and have been incorporated into Aladdin tools that are available to Portfolio Managers and employed in BlackRock investment strategies. Such tools support the full investment process, from research, to portfolio construction and modelling, to reporting.

Measures taken to ensure Data Quality

BlackRock applies a comprehensive due diligence process to evaluate provider offerings with highly targeted methodology reviews and coverage assessments based on the sustainable investment strategy (and the environmental and social characteristics or sustainable investment objective) of the product. Our process entails both qualitative and quantitative analysis to assess the suitability of data products in line with regulatory standards as applicable.

We assess ESG providers and data across five core areas outlined below:

1. Data Collection: this includes but is not limited to assessing the data providers underlying data sources, technology used to capture data, process to identify misinformation and any use of machine learning or human data collection approaches. We will also consider planned improvements.

2.Data Coverage: our assessment includes but is not limited to the extent to which a data package provides coverage across our investible universe of issuers and asset classes. This will include consideration of the treatment of parent companies and their subsidiaries as well as use of estimated data or reported data.

3. Methodology: our assessment includes but is not limited consideration of the third-party providers methodologies employed, including considering the collection and calculation approaches, alignment to industry or regulatory standards or frameworks, materiality thresholds and their approach to data gaps.

4. Data Verification: our assessment will include but is not limited to the third-party providers approach to verification of data collected and quality assurance processes including their engagement with issuers.

5. Operations: we will assess a variety of aspects of a data vendors’ operations, including but not limited to their policies and procedures (including consideration of any conflicts of interest) the size and experience of their data research teams, their training programs, and their use of third-party outsourcers.

Additionally, BlackRock, actively participates in any relevant provider consultations regarding proposed changes to methodologies as it pertains to third party data sets or index methodologies and submits comprehensive feedback and recommendations to data provider technical teams. BlackRock often has ongoing engagement with ESG data providers including index providers to keep abreast of industry developments.

How data is processed

At BlackRock, our internal processes are focused on delivering high-quality standardised and consistent data to be used by investment professionals and for transparency and reporting purposes. Data, including ESG data, received through our existing interfaces, and then processed through a series of quality control and completeness checks which seeks to ensure that data is high-quality data before being made available for use downstream within BlackRock systems and applications, such as Aladdin. BlackRock’s integrated technology enables us to compile data about issuers and investments across a variety of environmental, social and governance metrics and a variety of data providers and make those available to investment teams and other support and control functions such as risk management.

Use of Estimated Data

BlackRock strives to capture as much reported data from companies via 3rd party data providers as practicable, however, industry standards around disclosure frameworks are still evolving, particularly with respect to forward looking indicators. As a result, in certain cases we rely on estimated or proxy measures from data providers to cover our broad investible universe of issuers. Due to current challenges in the data landscape, while BlackRock relies on material amount of estimated data across our investible universe, the levels of which may vary from data set to data set, we seek to ensure that use of estimates is in line with regulatory guidance and that we have necessary documentation and transparency from data providers on their methodologies. BlackRock recognizes the importance in improving its data quality and data coverage and continues to evolve the data sets available to its investment professionals and other teams. Where required by local country-level regulations, funds may state explicit data coverage levels. BlackRock seeks to understand the use of estimated data in index methodologies and ensure that their approaches are robust and in line with applicable regulatory requirements and index methodologies.

I. Limitations to methodologies and data

Limitations to Methodology

Sustainable investing is an evolving space, both in terms of industry understanding but also the regulatory frameworks on both a regional and global basis. BlackRock continues to monitor developments in the EU's ongoing implementation of its framework for sustainable investing and its investment methodologies seeking to ensure alignment as the regulatory environment changes. As a result, BlackRock may update these disclosures, and the methodologies and sources of data used, at any time in the future as market practice evolves or further regulatory guidance becomes available.

Screening of a Benchmark Index against its ESG criteria is generally carried out by an index provider only at index rebalances. Companies which have previously met the screening criteria of a Benchmark Index and have therefore been included in the Benchmark Index and the Fund, may unexpectedly or suddenly be impacted by an event of serious controversy which negatively impacts their price and, hence, the performance of the Fund. Where these companies are existing constituents of the Benchmark Index, they will remain in the Benchmark Index and therefore continue to be held by the Fund until the next scheduled rebalancing (or periodic review) when the relevant company ceases to form part of the Benchmark Index and it is possible and practicable (in the Investment Manager’s view) to liquidate the position. A Fund tracking such Benchmark Index may therefore cease to meet the ESG criteria between index rebalances (or index periodic reviews) until the Benchmark Index is rebalanced back in line with its index criteria, at which point the Fund will also be rebalanced in line with its Benchmark Index. Similarly index methodologies that commit to investing in a minimum percentage of Sustainable Investments may also fall below that level in between rebalances but will be brought back into line at the point of rebalance (or as soon as practicable thereafter).

Limitations in relation to the data sources are noted below.

Limitations to Data

ESG data sets are constantly changing and improving as disclosure standards, regulatory frameworks and industry practice evolve. BlackRock continues to work with a broad range of market participants to improve data quality.

Whilst each ESG metric may come with its own individual limitations, data limitations may broadly be considered to include, but not be limited to:

• Lack of availability of certain ESG metrics due to differing reporting and disclosure standards impacting issuers, geographies, or sectors.

• Nascent statutory corporate reporting standards regarding sustainability leading to differences in the extent to which companies themselves can report against regulatory criteria and therefore some metric coverage levels may be low.

• Inconsistent use and levels of reported vs estimated ESG data across different data providers, taken at varied time periods which makes comparability a challenge.

• Estimated data by its nature may vary from realized figures due to the assumptions or hypothesis employed by data providers.

• Differing views or assessments of issuers due to differing provider methodologies or use of subjective criteria.

• Most corporate ESG reporting, and disclosure takes place on an annual basis and takes significant time to produce meaning that this data is produced on a lag relative to financial data. There may also be inconsistent data refresh frequencies across different data providers incorporating such data into their data sets.

• Coverage and applicability of data across asset classes and indicators may vary.

• Forward looking data, such as climate related targets may vary significantly from historic and current point in time metrics.

For more information about how metrics that are presented with sustainability indicators are calculated, please see the Fund's annual report.

Sustainable Investments and Environmental and Social criteria

Sustainable investing and understanding of sustainability is evolving along with the data environment. Industry participants, including index provider face challenges in identifying a single metric or set of standardized metrics to provide a complete view on a company or an investment. BlackRock has therefore established a framework to identify sustainable investments, taking into account the regulatory requirements and index provider methodologies.

BlackRock leverages third-party index provider methodologies and data in assessing whether investments cause significant harm and have good governance practices. There may be some circumstances where data is unavailable, incomplete, or inaccurate. Despite reasonable efforts, information may not always be available in which case an assessment will be made by the index provider based on their knowledge of the investment or industry. In certain cases, data may reflect actions that issuers may have taken only after the fact, and do not reflect all potential instances of significant harm.

BlackRock undertakes thorough due diligence on index provider sustainable investment methodologies to ensure that they align with BlackRock’s views on Sustainable Investments.

J. Due Diligence

The Investment Manager carries out due diligence on the index providers and engages with them on an ongoing basis with regard to index methodologies including their assessment of good governance criteria set out by the SFDR which include sound management structures, employee relations, remuneration of staff and tax compliance at the level of investee companies.

K. Engagement Policies

The Fund

The Fund does not use engagement as a means of meeting its binding commitments to environmental or social characteristics or sustainable investment objectives. The Investment Manager does not perform direct engagement with the companies / issuers within the index but does engage directly with the index and data providers to ensure better analytics and stability in ESG metrics.

General

Engagement with companies in which we invest our clients’ assets occurs at multiple levels within BlackRock.

Where engagement is specifically identified by a particular portfolio management team as one of the means by which they seek to demonstrate a commitment to environment, social and governance issues within the context of SFDR, the methods by which the effectiveness of such engagement policy and the ways in which such an engagement policy may be adapted in the event that they do not achieve the desired impact (usually expressed as a reduction in specified principal adverse indicators) would be described in the prospectus and website disclosures particular to that fund.

Where investment teams chooses to leverage engagement, this can take a variety of forms but, in essence, the portfolio management team would seek to have regular and continuing dialogue with executives or board directors of engaged investee companies to advance sound governance and sustainable business practices targeted at the identified ESG characteristics and principal adverse indicators, as well as to understand the effectiveness of the company’s management and oversight of activities designed to address the identified ESG issues. Engagement also allows the portfolio management team to provide feedback on company practices and disclosures.

Where a relevant portfolio management team has concerns about a company’s approach to the identified ESG characteristics and/or principal adverse indicators, they may choose to explain their expectations to the company’s board or management and may signal through voting at general meetings that they have outstanding concerns, generally by voting against the re-election of directors they view as having responsibility for improvements in the identified ESG characteristics or principal adverse indicators.

Separate from the activities of any particular portfolio management team, at the highest level, as part of its fiduciary approach, BlackRock has determined that it is in the best long-term interest of its clients to promote sound corporate governance as an informed, engaged shareholder. At BlackRock, this is the responsibility of BlackRock Investment Stewardship. Principally through the work of BIS team, BlackRock meets the requirements in the Shareholder Rights Directive II (‘SRD II”) relating to engagement with public companies and other parties in the investment ecosystem. A copy of BlackRock’s SRD II engagement policy can be found at https://www.blackrock.com/corporate/literature/publication/blk-shareholder-rights-directiveii-engagement-policy-2022.pdf.

BlackRock’s approach to investment stewardship is outlined in the BIS Global Principles and market-level voting guidelines. The BIS Global Principles set out our stewardship philosophy and our views on corporate governance and sustainable business practices that support long-term value creation by companies. We recognize that accepted standards and norms of corporate governance differ between markets; however, we believe there are certain fundamental elements of governance practice that are intrinsic globally to a company’s ability to create long-term value. Our market-specific voting guidelines provide detail on how BIS implements the Global Principles – taking into consideration local market standards and norms – and inform our voting decisions in relation to specific ballot items for shareholder meetings. BlackRock’s overall approach to investment stewardship and engagement can be found at: https://www.blackrock.com/uk/professionals/solutions/shareholder-rights-directive and https://www.blackrock.com/corporate/about-us/investment-stewardship

In undertaking its engagement, BIS may focus on particular ESG themes, which are outlined in BlackRock’s voting priorities https://www.blackrock.com/corporate/literature/publication/blk-stewardship-priorities-final.pdf

L. Designated reference benchmark

This Fund seeks to achieve the environmental and social characteristics it promotes by tracking the performance of theBloomberg MSCI US Corporate High Yield Sustainable BB+ SRI Bond Index, its Benchmark Index, which incorporates the index provider’s ESG selection criteria.

At each index rebalance, the index provider applies the ESG selection criteria to exclude issuers that do not meet such ESG selection criteria.

At each index rebalance (or as soon as reasonably possible and practicable thereafter), the portfolio of the Fund is also rebalanced in line with its Benchmark Index.

As a result of the application of the ESG selection criteria of the Benchmark Index, the portfolio of the Fund is expected to be reduced compared to the Bloomberg US Corporate High Yield Total Return Index, a broad market index comprised of fixed income securities.

The methodology of the Fund’s Benchmark Index can be found on the index provider’s website at: https://www.bloomberg.com/

professional/product/indices/bloomberg-fixed-income-indices/#/ucits

Further details of the Fund's Benchmark Index (including its constituents) are also available on the index provider’s website at: https://www.bloombergindices.com/bloomberg-indices/